Bitcoin slips to $82,000 as US trade tariffs loom

On March 31 the price of the leading cryptocurrency slipped below $82,000. On Binance it briefly fell to $81,329.

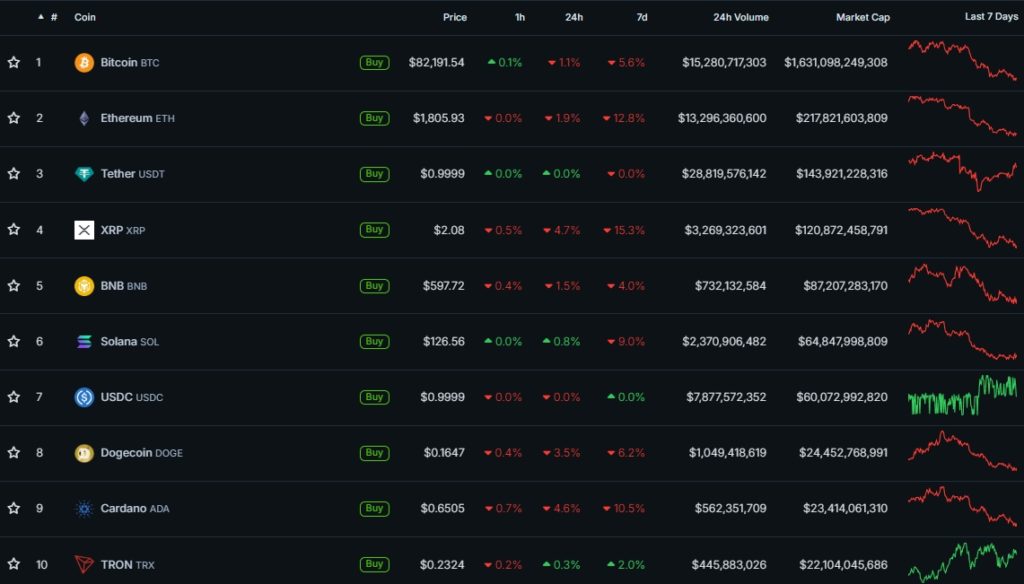

After a bounce, the asset is trading around $82,200. It is down 1.1% over the past 24 hours. Leading altcoins fell more sharply.

Total crypto market capitalisation fell 3.2% to $2.75 trillion.

Futures on US equities also turned lower. Derivatives on the S&P 500 fell 0.7%, and on the Nasdaq 100 by 0.8%.

Equities all down -1% to open the week.

Happy Liberation Week! pic.twitter.com/hoz5QJa6hi

— Spencer Hakimian (@SpencerHakimian) March 30, 2025

The Trump factor

Traders’ confidence is ebbing as April 2—dubbed “Liberation Day” by US president Donald Trump—approaches. The president has announced a 25% tariff from that date on imports of cars, pharmaceuticals and other items for a wide range of countries.

Reports a week ago of a possible softening of the US administration’s stance on tariffs sent bitcoin above $87,000. Mr Trump’s tougher rhetoric has weighed on demand for risk assets, with the first cryptocurrency increasingly associated with them. Spot gold—one of the main haven assets—on March 31 hit a record high of $3,122.

Analysts at Goldman Sachs raised the probability of a US recession within 12 months from 20% to 35%.

“The increase in the previous estimate reflects lower growth rates, the recent sharp deterioration in household and business confidence, and statements by White House officials indicating a greater willingness to tolerate short-term economic weakness in order to implement their policy,” the bank’s specialists explained.

Daily bitcoin trading volumes on exchanges have fallen to $36 billion, 70% below the $126 billion peak recorded in November 2024, according to The Block.

The total value of BTC on trading venues has also declined from $24.4 billion at the start of March to $8.6 billion. The value transferred on-chain each day has fallen by roughly half.

Technical analysts tilt to optimism

Earlier, QCP Capital questioned the strength of bitcoin’s $80,000 support.

Economist Timothy Peterson, author of “Metcalfe’s Law as a Model for Bitcoin’s Value”, struck a more upbeat tone.

Every Bitcoin Bear Market Since 2015

Since 2015 there have been 10 Bitcoin bear markets, defined as a 20% decline from ATH. About one every year, these are common.

Of those, only 4 have been worse than this one in terms of duration: 2018, ’21, ’22, ’24.

In terms of… pic.twitter.com/ywVw8InId0

— Timothy Peterson (@nsquaredvalue) March 22, 2025

“Judging solely by base adoption value, bitcoin is unlikely to fall below $50,000. From a price-dynamics perspective it will be hard-pressed to break even $80,000, especially given that central banks are leaning toward easier monetary policy,” the expert said.

By his estimate, the current bear market will last 90 days from ATH, with a 20–40% rise from mid-April.

Profitz Academy founder Merlijn Enkelar noted that bitcoin’s chart has formed a double top, repeating the 2023 pattern.

Just like in 2023, $BTC is repeating the same setup.

Double Top. Bear Trap. PARABOLIC MOVE.

Don’t let the bears shake you out this time! pic.twitter.com/LNuoey7cc5

— Merlijn The Trader (@MerlijnTrader) March 29, 2025

A parabolic move higher should follow this bear trap, he predicted.

Crypto trader Ted Pillows argues that the first cryptocurrency is in a Wyckoff re-accumulation phase, implying sideways trading in a tight range after a prolonged downtrend.

$BTC is currently in the Wyckoff re-accumulation phase.

The drop below $85K is pure manipulation to scare last standing bulls.

Once BTC goes above $92K, bears will get rekt. pic.twitter.com/QpRTJjO6SF

— Ted (@TedPillows) March 30, 2025

He called the dip below $85,000 the result of “pure manipulation” aimed at “scaring the last standing bulls”.

“As soon as BTC exceeds $92,000, the bears will be defeated,” Pillows said.

Capriole Investments founder Charles Edwards, based on the Bitcoin Macro Index, suggested that bitcoin may be entering a decline phase.

CryptoQuant specialists noted worrying signals for digital gold across four indicators. On March 31 one of the analytics firm’s verified authors confirmed that MVRV does not yet point to a bottom.

Earlier, Real Vision’s chief analyst Jamie Coutts forecast bitcoin to rise to $123,000 by June.

Several experts at Wall Street firms have also mooted a rally in the asset in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!