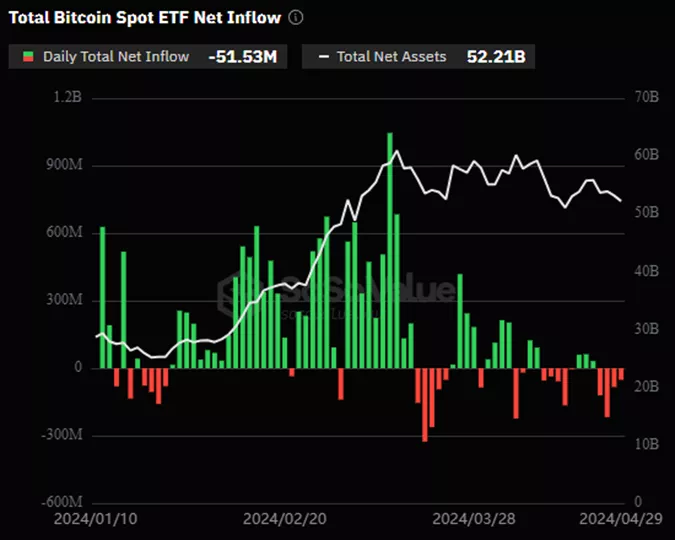

Bitcoin Spot ETF Outflows Persist for Fourth Consecutive Day

On April 29, the net outflow from spot Bitcoin ETFs amounted to $51.5 million, marking the fourth consecutive day of this negative trend.

According to SoSoValue, the total net outflow of Bitcoin spot ETF yesterday, April 29, was $51.5316 million. GrayscaleETF GBTC had a single-day net outflow of $24.6607 million. ARKB had a single-day net outflow of $31.34 million, surpassing GBTC. The BlackRock ETF IBIT has had… pic.twitter.com/RAgU7Al9m3

— Wu Blockchain (@WuBlockchain) April 30, 2024

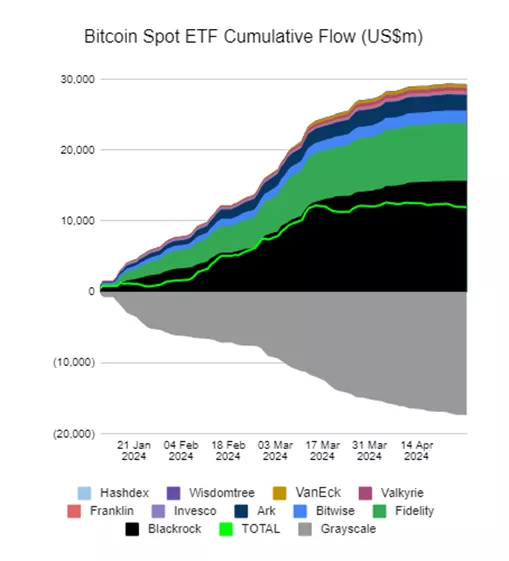

Since the approval of these products on January 11, investors have collectively invested $11.94 billion in these instruments. April has seen a mixed flow dynamic.

In BlackRock’s IBIT, there have been no inflows or outflows recorded over the past four trading days.

On April 29, the net outflow from Grayscale’s GBTC slowed to $24.66 million, while outflows from ARKB by Ark Invest and 21Shares increased to $31.34 million.

On April 30, trading officially commenced on the Hong Kong Stock Exchange for six spot ETFs based on Bitcoin and Ethereum.

According to Bloomberg analyst Rebecca Sin, inflows into this category of products could reach $1 billion within two years.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!