Bitcoin Tests $75,000 Amid Trump’s Tariff Turmoil

- Bitcoin’s decline could extend to $70,000 if global trade tensions escalate further.

- The ETH/BTC rate has fallen to its lowest since December 2019.

On the night of April 9, the price of the leading cryptocurrency dropped to its lowest since the start of the year, falling below $75,000. The catalyst was the implementation of President Donald Trump’s “liberating” tariffs.

Washington imposed tariffs of 10% and higher on foreign goods. For China, the rate reached 104% following Beijing’s refusal to “make a deal.”

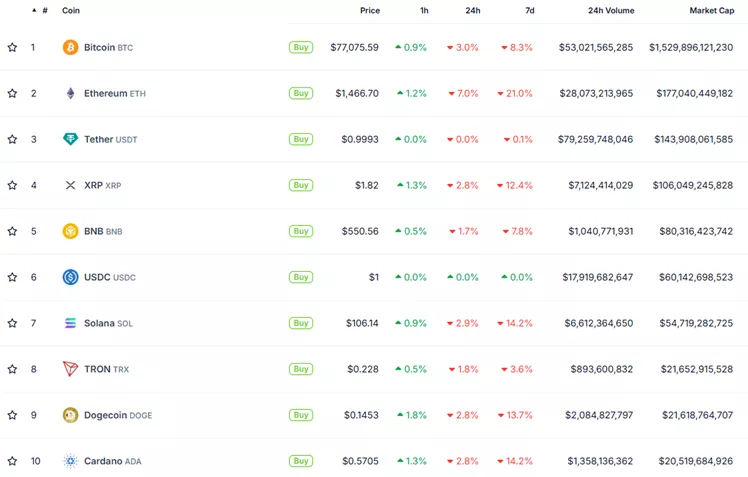

At the time of writing, the price had rebounded to $77,000. The daily rate of decline reduced to 3%.

Ethereum briefly dropped to its lowest since March 2023, below $1400, but recovered to $1466. Over the past day, the asset’s value corrected by 7%.

Among the top 10 cryptocurrencies by market capitalization, the negative revaluation was limited to 2.9%.

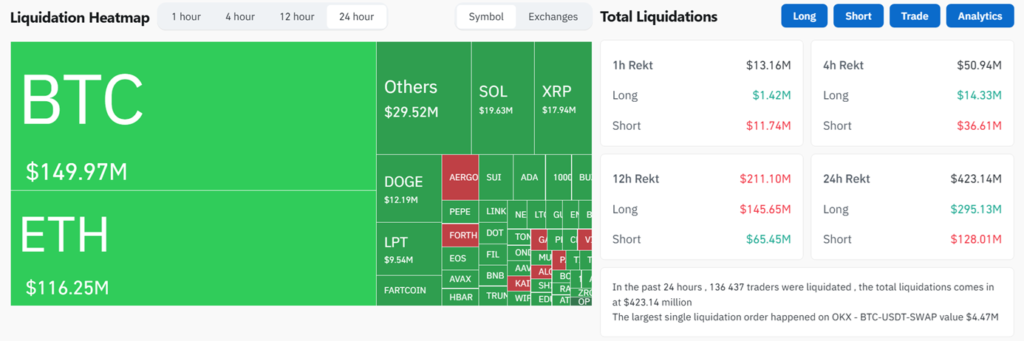

According to Coinglass, over the past 24 hours, more than 136,435 traders were liquidated, totaling $423.1 million.

Investors fear that the prolonged tariff war could weaken global trade, disrupt supply chains, and slow U.S. economic growth. This would exert additional pressure on American stock markets and bitcoin, which typically mirrors Wall Street’s fluctuations, noted CoinDesk.

In an interview, Bitget Research’s chief analyst Ryan Lee discussed the risks of digital gold prices falling to $70,000-75,000 if global trade tensions escalate.

“A prudent step now is to employ a dollar-cost averaging strategy. Going forward, attention should be paid to altcoins like Solana,” the expert suggested.

Lee remains optimistic about the longer-term outlook.

“If macroeconomic conditions stabilize or supportive cryptocurrency policies emerge, we could see bitcoin at $95,000-100,000 by the end of 2025 […]. While tariff wars have hit altcoins hard, the resilience of digital gold and its growing dominance indicate that the ecosystem’s fundamentals remain strong, bolstered by institutional adoption and the halving cycle,” he concluded.

Leading Swyftx analyst Pav Hundal assessed the cryptocurrency market’s decline since early February at $1.2 trillion.

“We have entered a new era of protectionism. The most concerning aspect is that we still lack clarity on where this will end. Now all eyes will be on how quickly the U.S. can forge new trade and non-trade deals,” he explained.

Bitcoin vs Ethereum

The ETH/BTC rate fell to 0.01855, a level last seen in December 2019.

According to analyst James Check, the second-largest cryptocurrency by market capitalization has outperformed bitcoin in only 15% of all trading days since its inception in mid-2015.

The ETH/BTC has now underperformed holding BTC for 85% of trading days…

A truly remarkable decline. pic.twitter.com/zsXpDWZSBi

— _Checkmate ??⚡☢️?️ (@_Checkmatey_) April 8, 2025

Ethereum showed superiority in its early years until mid-2017. There were two other brief periods in late 2019 and early 2020 when the ETH/BTC ratio favored the second-largest cryptocurrency by market capitalization.

CryptoQuant attributed the ETH/BTC decline to an unfavorable on-chain picture.

Bernstein described bitcoin’s resilience amid tariff turbulence as “impressive.”

Former BitMEX CEO Arthur Hayes stated that new U.S. tariffs could trigger a capital shift into digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!