Bitcoin tokenisation outpaces its issuance amid DeFi boom

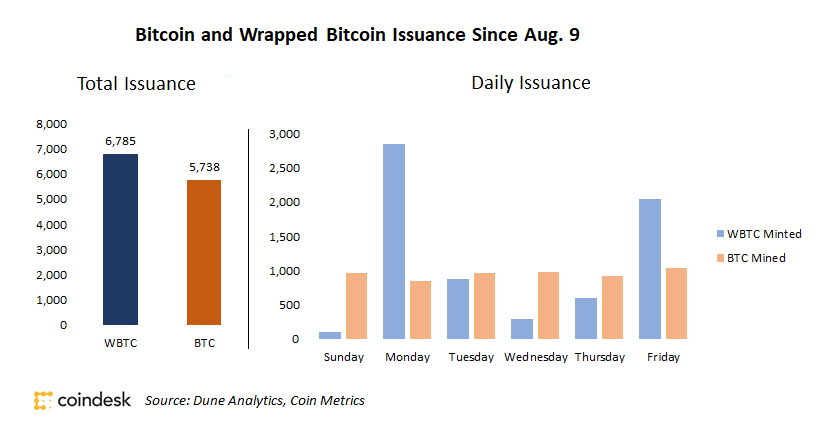

From 9 to 14 August, miners mined 5,738 bitcoins. In the same period, in the most popular form of tokenisation of the first cryptocurrency, Wrapped Bitcoin (WBTC), 6,785 coins were created.

WBTC has tokenised 1,043 coins more than were issued on the Bitcoin blockchain, according to Coindesk, citing Dune Analytics and CoinMetrics.

With a block reward of 6.25 BTC and a block time of 10 minutes, miners produce around 900 coins per day.

WBTC leads the market capitalisation among Bitcoin-on-Ethereum tokens. According to the BTC on Ethereum service, the market capitalisation of the bitcoin-backed token WBTC reached $346m. According to Dune Analytics, of 31,000 tokenised bitcoins, 75% have taken the form of this token.

According to DeFi Market Cap, WBTC sits in 11th place among DeFi tokens. DeFi Pulse puts it seventh by the value of locked assets.

Until mid-May, the volume of tokenised bitcoins was under 3,000 coins, but since then there has been a surge in their issuance. This was the consequence of growing interest in BTC among DeFi protocol users.

“WBTC is showing a solid ascent amid surging demand for Bitcoin in the DeFi space. I expect the trend to continue,” said Kyle Davies, co-founder of Three Arrows Capital.

In July, Three Arrows used BitGo’s services to tokenise the Bitcoin it holds. The crypto processing and custodian services provider has been actively involved in distributing WBTC since 2019.

According to Su Zhu, co-founder of Three Arrows Capital, over the course of a year WBTC will become a “first-class asset” for the DeFi ecosystem on a par with USDC and USDT.

Earlier, WBTC entered the list of 16 assets that could be listed on Coinbase, the largest US cryptocurrency exchange.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!