Bitcoin’s Ascent Tied to Federal Reserve Independence Concerns, Says Standard Chartered

The leading cryptocurrency is poised to appreciate if threats to the independence of the Federal Reserve persist. This conclusion was reached by Standard Chartered, as reported by The Block.

According to experts, in such a scenario, digital gold will serve as a decentralized hedge against traditional financial systems. The primary role of the asset is to protect against risks from the private sector, such as bank bankruptcies, as well as from the government, amid current concerns about the Federal Reserve’s independence.

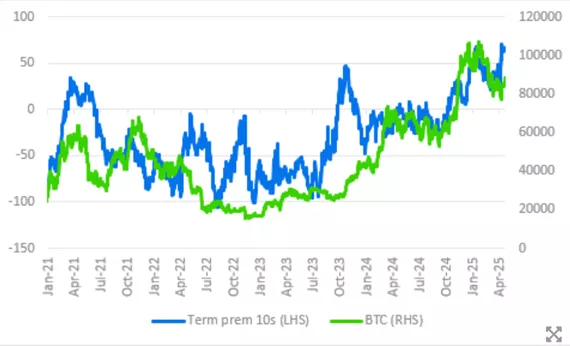

Analysts believe that bitcoin has historically shown a close correlation with the term premium on ten-year US government bonds, particularly since the beginning of 2024.

Recently, the leading cryptocurrency has been more responsive to the dynamics of tech stocks amid the “tariff war”, but it may catch up if concerns about the Federal Reserve’s independence do not dissipate.

“This could be the driver that allows it to reach an all-time high,” the review states.

Standard Chartered reaffirmed bitcoin’s target levels — $200,000 by the end of 2025 and $500,000 by the end of 2028.

Back in March, the bank’s analysts revised their Ethereum price forecast for 2025, lowering it from $10,000 to $4,000. Among the reasons cited was the growing influence of L2 solutions, particularly the Base platform.

Earlier, Standard Chartered estimated the capitalization of stablecoins at $2 trillion by 2028.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!