Bitcoin’s Rebound May Be a ‘Bull Trap’, Experts Warn

The recent recovery of Bitcoin’s price to a two-week high may prove short-lived amid overall market uncertainty, according to Bloomberg.

The lack of upward momentum, low trading volumes, and macroeconomic tensions create conditions for a ‘bull trap’, experts consulted by the agency believe.

“Investors need to be cautious in this environment: the market remains fragile and easily manipulated. Retail activity is low, volumes are small, and even the so-called ‘smart money’ stays on the sidelines. Those with the real power to move the market are not doing so — and there are good reasons for that,” noted Kirill Kretov from CoinPanel.

Investor sentiment is reflected in the funding rate of perpetual Bitcoin futures. In a bull market, the metric is positive, but even after the cryptocurrency’s rebound above $87,000, the values remain in the negative zone. This indicates that traders are unwilling to pay a premium for opening long positions.

Another sign of market uncertainty is the borrowing cost of stablecoins like USDT from Tether and USDC from Circle. On the lending platform Aave, rates have dropped to around 4%.

According to Strahinja Savic, Head of Data and Analytics at FRNT Financial, this reflects a decrease in appetite for leverage and other strategies requiring credit.

Moreover, seasoned Bitcoin holders continue to maintain their positions in hopes of higher prices for exit. According to Kretov, this creates a ‘dead weight’ on the market, making it less susceptible to volatility. Price fluctuations may ‘wash out’ retail investors, but for major players to open new positions, a ‘real crash’ is needed, where even long-term cryptocurrency holders capitulate.

“Until that happens, rallies even after uncertainty is lifted pose a danger. They can draw in hasty long positions only to sharply reverse — a classic bull trap in low liquidity conditions,” he said.

SignalPlus partner Augustin Fan believes that all eyes are currently on US President Donald Trump’s plans to introduce trade tariffs on April 2. In anticipation of this potential catalyst, a gradual recovery is expected to continue until the end of the month, he suggested.

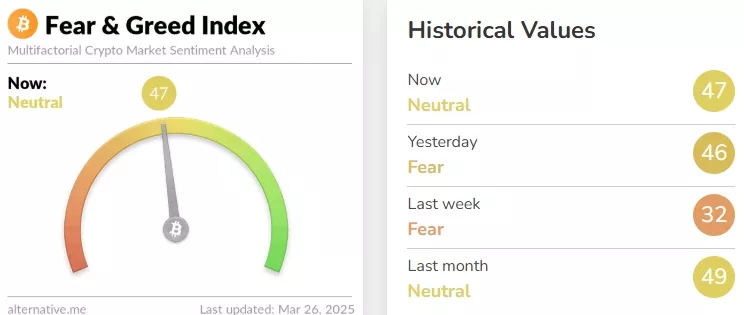

The cryptocurrency fear and greed index has risen from 32 to 47 since last week, moving into the neutral zone.

Analysts at QCP Capital noted “cautious optimism” driven by the resumption of inflows into spot Bitcoin ETFs. The potential increase in trade tariffs on April 2 could pressure risk assets, raising concerns about the near-term prospects of the crypto market, they added.

Meanwhile, the company specialists pointed to an unexpected potential driver for Bitcoin prices — GameStop decided to convert part of its cash reserves into digital gold. Given the company’s ‘meme’ status among retail investors, this could spark speculative interest in cryptocurrency, experts believe.

4/ Gamestop ( $GME ) just added $BTC to its treasury.

Not the first corporate to do so, but its meme status could reignite retail speculation. Remember 2021? Retail coordination has the power to challenge institutions.

— QCP (@QCPgroup) March 26, 2025

CryptoQuant founder and CEO Ki Young Ju earlier stated that individual investors are unlikely to enter the market, as most have already invested in Bitcoin through exchange-traded funds.

As reported in previous analyses, Santiment analysts concluded that many community members are confident in the continued growth of the cryptocurrency market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!