BitMine Expands Ethereum Holdings to $13.7 Billion

BitMine Immersion boosts Ethereum reserves to 3.3 million ETH, valued at $13.7 billion.

BitMine Immersion, a company managing Ethereum reserves, has increased its holdings to 3.3 million ETH, valued at approximately $13.7 billion.

🧵

BitMine provided its latest holdings update for Oct 27, 2025:

$14.2 billion in total crypto + “moonshots”:

— 3,313,069 ETH at $4,164 per ETH (Bloomberg)

— 192 Bitcoin (BTC)

— $88 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

-…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 27, 2025

Since October 20, the firm acquired 77,055 ETH worth approximately $319 million. BitMine’s total reserves in cryptocurrency and cash have reached $14.2 billion.

The company’s portfolio also includes 192 BTC ($22.2 million), an $88 million stake in Eightco, and $305 million. The company’s share constitutes nearly 2.8% of the total circulating supply of Ethereum, which amounts to about 120.7 million ETH.

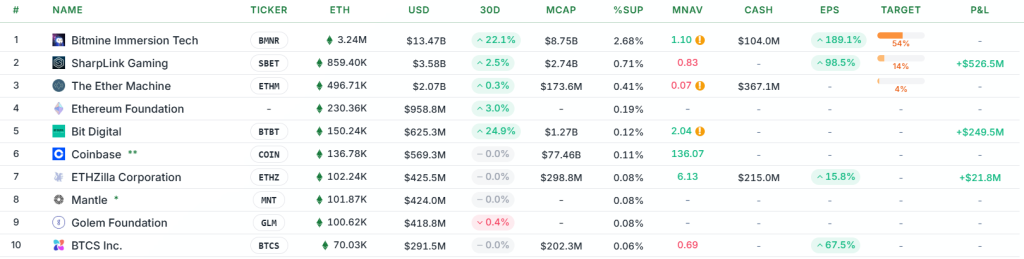

BitMine is the largest corporate holder of Ethereum, followed by SharpLink and The Ether Machine.

BitMine aims to acquire 5% of the total supply of the second-largest cryptocurrency by market capitalization, equivalent to approximately 6.04 million coins.

Bitcoin Reserves

Strategy acquired 390 BTC for $43.4 million, with an average price of about $111,053.

Strategy has acquired 390 BTC for ~$43.4 million at ~$111,053 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/26/2025, we hodl 640,808 $BTC acquired for ~$47.44 billion at ~$74,032 per bitcoin. $MSTR $STRC $STRK $STRF $STRDhttps://t.co/Ipb8nYX4w4

— Strategy (@Strategy) October 27, 2025

The company now holds 640,808 BTC with a total value of $47.44 billion at an average acquisition rate of $74,032. The investment yield since the beginning of 2025 has been 26%.

Meanwhile, South Korean Bitplanet reported its purchase of the leading cryptocurrency. The company acquired 92.67 BTC for $10.9 million at an average price of $117,647.

For the past month, @Bitplanet_KR has been quietly building the most reliable and compliant Bitcoin treasury infrastructure in Korea — culminating in becoming the first public company to purchase Bitcoin directly through a licensed domestic crypto exchange. As of October 26,… pic.twitter.com/hEmpvh9fUL

— Bitplanet Inc. (@Bitplanet_KR) October 26, 2025

Bitplanet became the first public company in South Korea to buy Bitcoin directly through a licensed local crypto exchange. Company representatives stated they would continue daily purchases of the asset through regulated channels. The company’s goal is to become the leading institutional Bitcoin holder in the country.

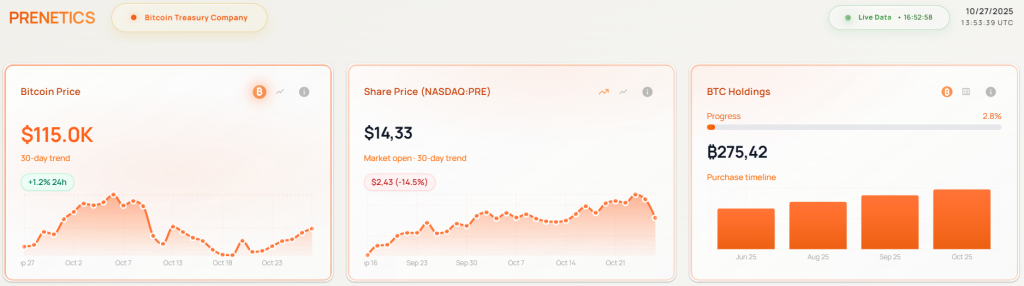

The medical company Prenetics, backed by David Beckham, raised about $48 million through a public securities offering. The firm plans to allocate the funds to two main areas. The first is the global expansion of the wellness brand IM8. The second is to bolster its treasury with the leading cryptocurrency.

According to Prenetics CEO Danny Yeung, the company plans to purchase 1 BTC daily. The five-year goal is to reach $1 billion in annual revenue and accumulate digital gold of equivalent value.

As of writing, the Hong Kong-based company holds 275.42 BTC.

On October 16, BitMine increased its reserves by 104,336 ETH valued at $417 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!