Bitwise CIO Explains Bitcoin’s Lag Behind Gold

The expert believes cryptocurrency will follow the path of precious metals.

The current parabolic rise of gold serves as a model for the next phase of the leading cryptocurrency’s movement, according to Matt Hougan, Chief Investment Officer at Bitwise. He shared his insights on the matter.

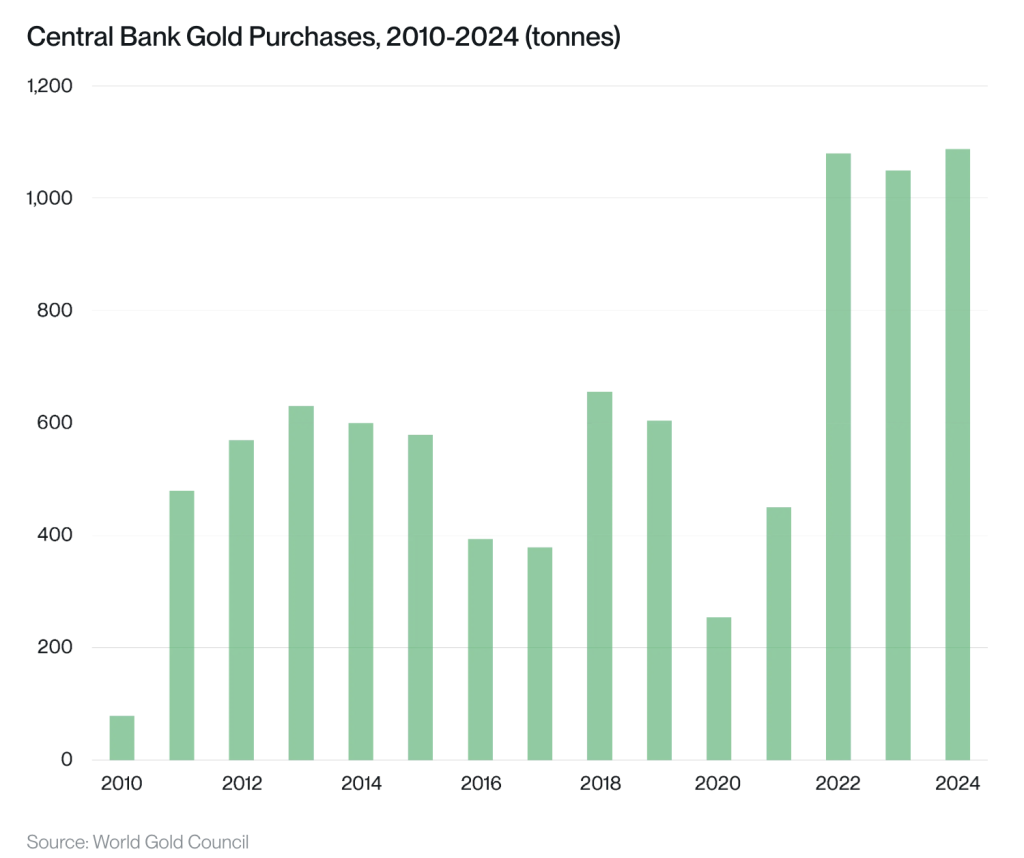

Hougan’s analysis is based on the structural differences between the two markets. Since 2022, central banks have become the dominant buyers of precious metals. Their consistent purchases have been the main catalyst for the asset’s 57% rally since the beginning of 2025.

Bitcoin does not enjoy comparable demand. Primarily, the cryptocurrency’s price support has come from spot ETFs and corporate treasuries. Hougan believes this fundamental difference explains why gold is rising while the flagship of the crypto market consolidates.

However, the mechanism is the same: when a large, stable buyer entered the gold market in 2022, many price-sensitive investors began to take profits. Their sales initially restrained the growth, and only after this pool of sellers was exhausted did the rally begin.

“The logic is simple. Price-sensitive market participants sold into the growing demand from central banks. When their potential was exhausted, prices surged,” he explained.

Hougan believes a similar scenario is possible for Bitcoin as the available supply for sale diminishes.

Since their inception, exchange-traded funds based on digital gold have accumulated over 1.5 million BTC—several times more than the coins mined by miners in the same period. The expert emphasized that this gap should have already pushed the cryptocurrency’s price, but it is currently held back by sellers.

If purchases by ETFs and corporations continue at the current pace, and the available supply for sale shrinks further, Bitcoin will break out of its narrow range and surge upward, noted the Bitwise investment director.

“Gold has shown the scenario, but not the exact timing,” he concluded.

At the time of writing, the leading cryptocurrency is trading around $108,100, having decreased by 0.4% over the past day.

Earlier, CryptoQuant analyst Burak Kesmeci noted a decrease in selling pressure in the digital gold market.

How Far to the Peak?

CryptoQuant contributor CoinCare analyzed the NVT indicator for Bitcoin, which assesses the ratio between the cryptocurrency’s capitalization and the volume of transactions in its network.

In the previous two market cycles, the metric accurately identified the moments of reaching price peaks, the expert noted.

Are We Still Far from Cycle Top According to the NVT Golden Cross?

“In the past two market cycles, this indicator has accurately marked the cycle tops… Although the current cycle appears more prolonged compared to previous ones, it continues to unfold.” – By CoinCare pic.twitter.com/OxH60HjWhZ

— CryptoQuant.com (@cryptoquant_com) October 22, 2025

When the indicator is in the negative zone, it indicates the asset is undervalued relative to network activity—a sign of a healthy base for growth. Exceeding a value of 3, on the other hand, signals an overheated market.

“What is important for bears: we are still very far from the peak. Although the current cycle seems more prolonged compared to previous ones, it continues to develop steadily,” emphasized CoinCare.

Previously, the creator of the S2F model and analyst PlanB stated that fundamental indicators point to continued growth in the crypto market, despite recent corrections.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!