BlackRock and Vanguard sell $5.4bn of MSTR shares

Wall Street cut Strategy (MSTR) holdings by $5.38bn through Q3, per CryptoSlate.

From the first to the third quarter, investors pared positions in Strategy (MSTR) by $5.38bn—from $36.32bn to $30.94bn, CryptoSlate reports.

In percentage terms, the decline was about 14.8% of the total value of institutional holdings in the company.

The biggest asset managers—Capital International, Vanguard, BlackRock and Fidelity—each cut investments by around $1bn. The move was broad-based across key market participants, not confined to a few names.

Wall street dumped the fuck out of Strategy in Q3 😂 pic.twitter.com/dNWFx6tvTt

— Sani | TimechainIndex.com (@SaniExp) November 14, 2025

The reason was not a fall in bitcoin’s price—then it was trading steadily around $95,000 and, in early October, set a new all-time high above $126,000. MSTR traded sideways around $175.

Reporters suggested that the sale of Strategy shares stemmed from deliberate, active trimming by large investors.

They argued the shift marks a key milestone in access to the first cryptocurrency: a move from experimental workarounds to mature institutional solutions.

For years, Strategy was Wall Street’s main way to make relatively safe, indirect bitcoin investments. That approach went mainstream.

The advent of spot exchange-traded funds and the development of regulated solutions for storing digital assets have changed everything: portfolios of TradFi giants can now gain direct exposure to the flagship of the crypto market without resorting to compromise equity proxies.

Strategy’s premium falls below 1

On 17 November, the company of Michael Saylor saw its mNAV plunge below 1 for the first time since early 2024.

A lower reading means the firm’s market value is less than its bitcoin holdings minus liabilities. That points to a high share of debt financing.

At the time of writing, the multiple stands at 1.16.

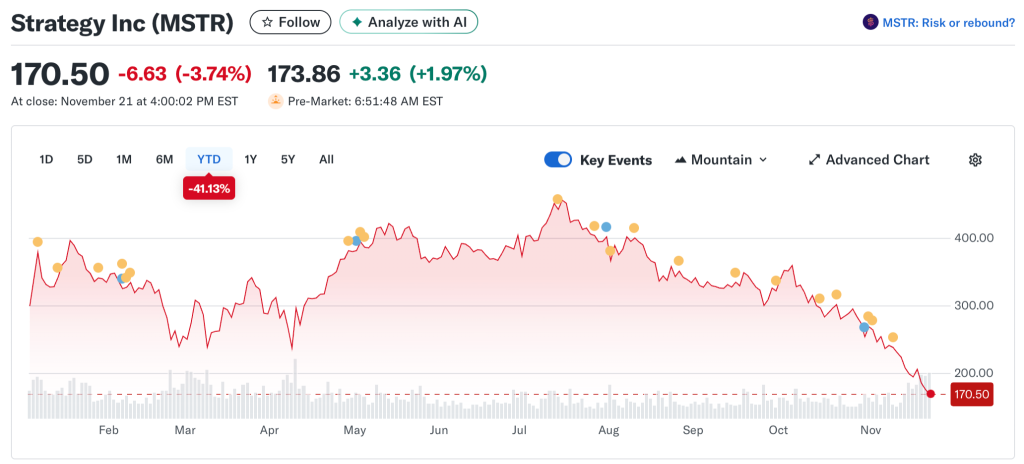

Investors reckon that for a treasury-focused company a sustainable mNAV level is 2 or higher. Since the start of the year, Strategy’s shares have fallen by more than 40%—from $379 to about $170.

According to BitBo, the firm holds 649,870 BTC worth $56bn. The average purchase price is $66,384.

At the time of writing, the leading cryptocurrency trades around $86,300, down 9.9% on the week.

In total, 170 public companies have adopted an accumulation strategy. Most of them have an mNAV around 1.

Ethereum treasuries buy the dip

At present, 68 companies carry the second-largest cryptocurrency on their balance sheets. Amid declines in the asset and the market more broadly, firms booked significant losses.

The Ethereum portfolio of the largest holder—BitMine—has shrunk by nearly $4bn. According to analysts, the company loses $1,000 on each ETH it buys, yet continues to accumulate coins.

On 23 November the firm acquired 21,537 ETH for $59.1m, and on the 24th a further 28,625 ETH worth $82.1m, Lookonchain noted.

Tom Lee(@fundstrat)’s #Bitmine just bought another 28,625 $ETH($82.11M).https://t.co/F6dECpuvcehttps://t.co/PzMN7EecRW pic.twitter.com/55tlnA1MEs

— Lookonchain (@lookonchain) November 24, 2025

BitMine manages 3.5m ETH worth $9.9bn. It is followed by SharpLink Gaming (850,400 ETH worth $2.4bn) and The Ether Machine (496,710 ETH worth $1.3bn).

At the time of writing, Ethereum trades around $2,800, down 12.4% over the week.

Earlier, BitMine chairman Tom Lee said the crypto-treasuries segment was a burst bubble.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!