BlackRock buys stakes in Marathon Digital Holdings and Riot Blockchain

The international investment company BlackRock, Inc., managing more than $8.7 trillion in assets, acquired stakes in Nasdaq-listed mining firms Marathon Digital Holdings and Riot Blockchain.

According to the 13F form dated June 30, 2021, BlackRock acquired 6.71% of Marathon Digital Holdings’ shares (about $207 million) and 6.61% of Riot Blockchain (about $175 million). The total value of its positions stood at $382.96 million.

According to ETF.com, among exchange-traded funds, the BlackRock-owned iShares Russell 2000 ETF is the largest holder of Marathon Digital Holdings (MARA) and Riot Blockchain (RIOT) securities — it holds about 2.14 million MARA and 1.9 million RIOT. The iShares Russell 2000 Value ETF ranks third in the same categories.

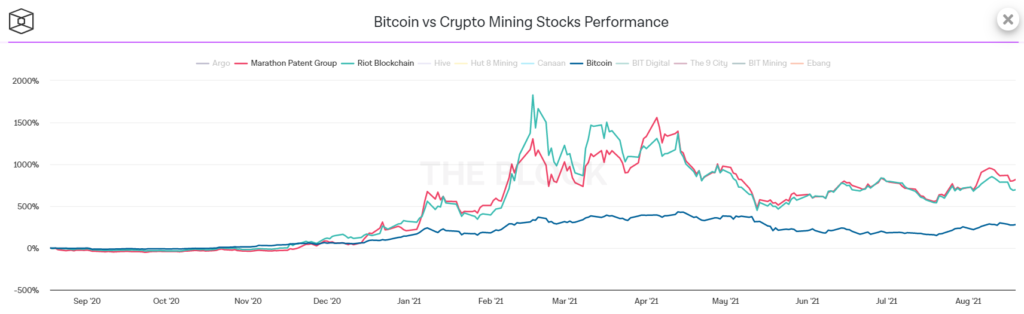

Over the past year, Marathon Digital Holdings’ shares have risen by more than 800% and are now trading near $31.80. Over the same period, Riot Blockchain’s shares have surged 704%, to $32. By comparison, the price of Bitcoin over 12 months has risen 300%.

Earlier, Fidelity Investments, which manages assets of $10.4 trillion, invested in Marathon Digital Holdings. It acquired 7.4% of the miner’s shares.

In April, BlackRock added to the BlackRock Global Allocation Fund portfolio Bitcoin futures traded on the Chicago Mercantile Exchange.

In May, the organization is studying cryptocurrencies for hedging market cycles.

Subscribe to ForkLog news on VK.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!