BlackRock CEO Warns Bitcoin Poses Threat to Dollar’s Dominance

The status of the US dollar as the world’s reserve currency is under threat, according to BlackRock CEO Larry Fink in his annual letter to investors.

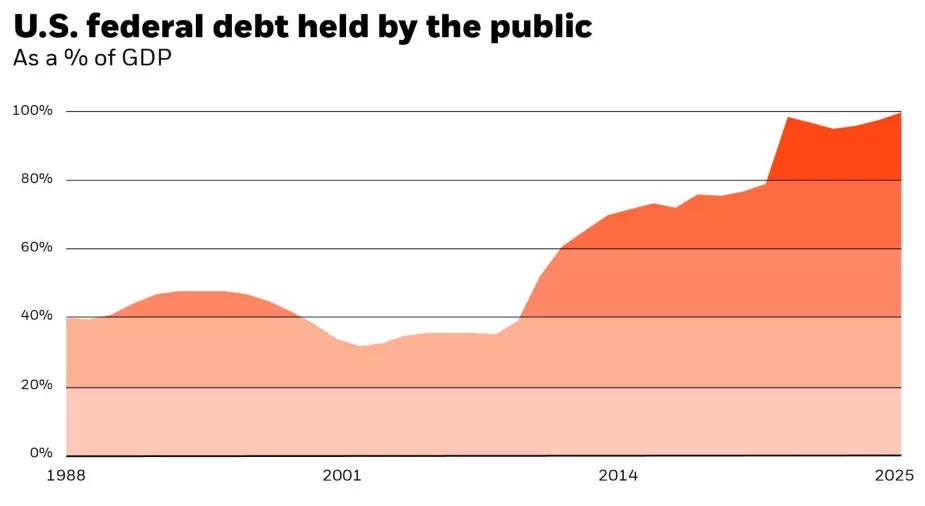

He stated that the uncontrolled growth of US debt and budget deficit could lead to a loss of this position in favor of digital assets like Bitcoin.

The US national debt has been increasing three times faster than the GDP since the debt clock was launched in Times Square in 1989, the expert noted.

In 2024, US government spending on debt servicing exceeded $952 billion, surpassing defense expenditures. If the situation remains unchanged, by 2030 mandatory government payments and interest expenses will fully consume federal revenues, leading to a perpetual deficit.

Despite the risks, decentralized financial systems offer markets speed, transparency, and accessibility, Fink emphasized. However, increased trust in Bitcoin could weaken the dollar’s position, undermining the US’s economic advantage.

The BlackRock CEO also discussed the prospect of asset tokenization. He compared the technology to the transition from paper letters to email. Through tokenization, stocks, bonds, and real estate can be digitized, making investments more accessible, speeding up transactions, and eliminating delays between purchase and settlement.

According to Fink, the technology simplifies asset ownership, enables fractional shares, and broadens access to high-yield investments. This could revolutionize financial markets by expanding the presence of less affluent investors.

Back in January 22, the head of BlackRock outlined a condition under which Bitcoin could reach $700,000. For this to happen, investors of all categories—from private to institutional—must allocate 2% to 5% of their portfolios to the leading cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!