BlackRock’s Bitcoin Holdings Surpass $17 Billion

The volume of bitcoins acquired by BlackRock’s Shares Bitcoin Trust (IBIT) has increased to 245,951 BTC (~$17.47 billion) after 11 weeks of trading, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) holds 143,720 BTC ($10.21 billion), according to data from BuyBitcoinWorldwide.

In third place among competitors, the GBTC — ARK 21Shares Bitcoin ETF (ARKB) — has increased its holdings to 41,353 BTC ($2.94 billion).

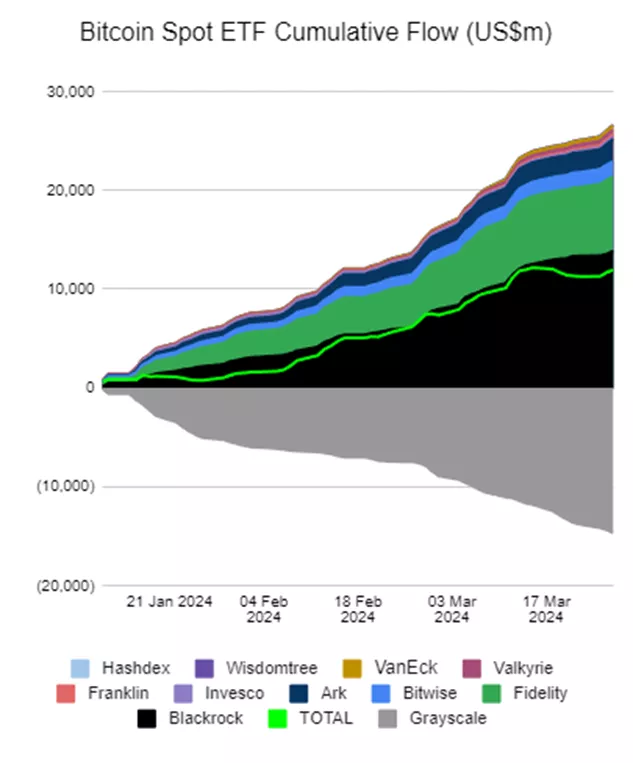

Grayscale’s exchange-traded fund still holds 342,607 BTC (~$24.34 billion). At its peak, the figure was 619,000 BTC.

IBIT has surpassed MicroStrategy (214,296 BTC) and the US government (207,189 BTC) in the ranking of the largest holders of digital gold. The ETF segment as a whole now accounts for 4.82% of the first cryptocurrency’s issuance.

On March 27, BlackRock CEO Larry Fink admitted he was “pleasantly surprised” by the hype surrounding bitcoin ETFs.

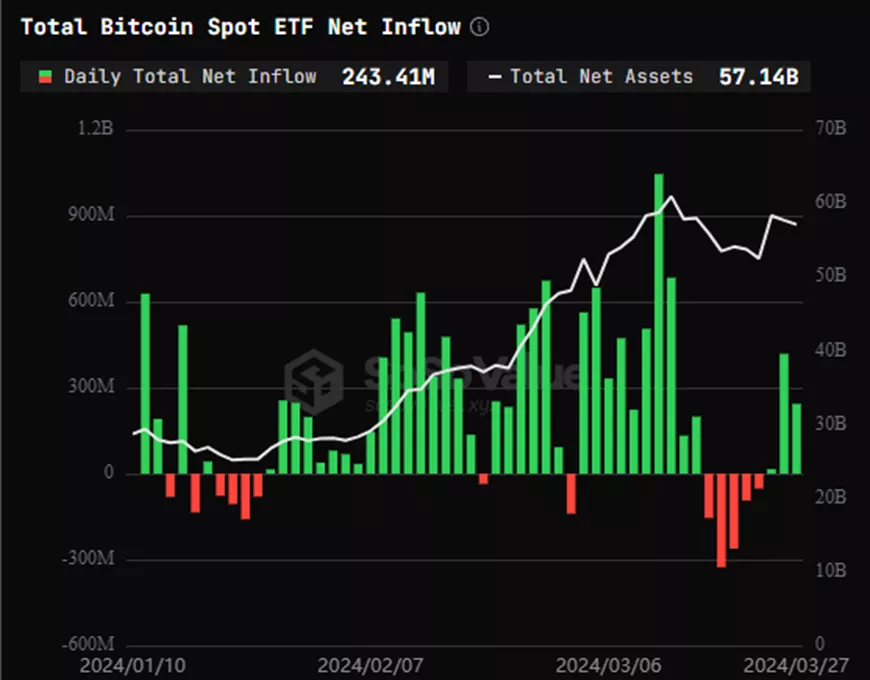

According to SoSoValue, on March 27 the net inflow into the segment was $243.3 million. Since January 10, the figure has reached $11.94 billion. The AUM of products has increased to $57.14 billion.

Earlier, market maker GSR reduced the probability of approval for Ethereum-based spot exchange-traded funds in May to 20%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!