‘Blockchain for the people’ or a gift to venture capital?

What lies behind the Plasma project

Since the start of 2025, investment in stablecoin startups has exceeded $600 million. The GENIUS Act signed by Donald Trump has lowered regulatory risk and boosted demand for stablecoins; analysts now reckon the sector’s market capitalisation could reach $1 trillion by 2028.

Against this backdrop, on September 25 the team behind the stablecoin platform Plasma launched its mainnet with the XPL token. ForkLog examines how the platform aims to enable fast, free and anonymous handling of “money 2.0”.

The trillion-dollar hunt

Originally, the name Plasma was associated with a scaling protocol proposed in 2017 by Ethereum co-founder Vitalik Buterin. The current project, however, has little in common with that initiative.

Plasma is an EVM-compatible L1 blockchain designed for stablecoins. The developers aim to support high-speed payments and fee-free USDT transactions. The architecture envisages anonymous transfers and composition with the Bitcoin network to bolster security and to use BTC alongside USDT as gas. The testnet went live on July 15, 2025; mainnet launched on September 25.

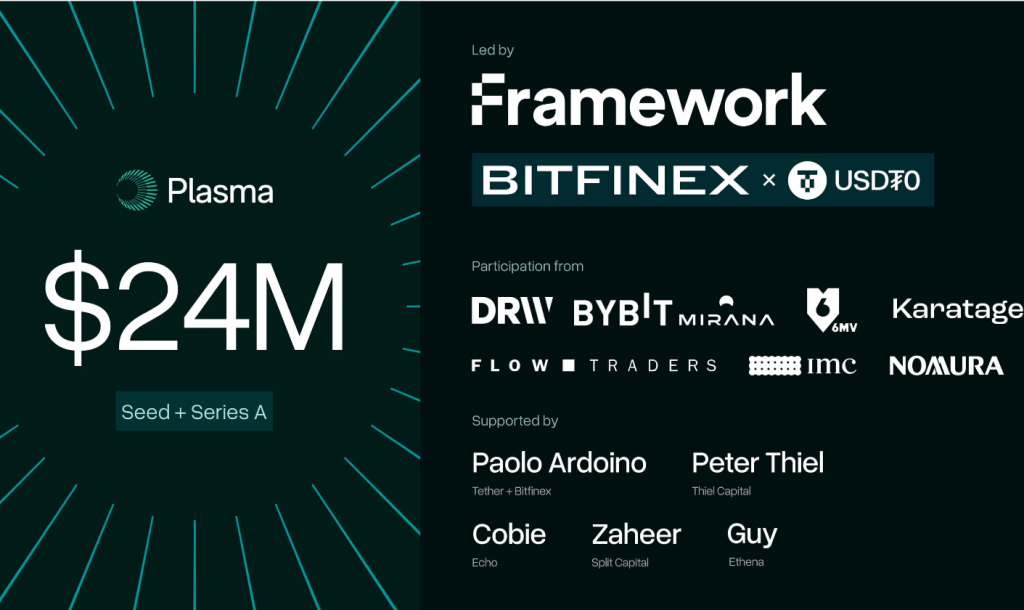

The startup attracted its first investment in October 2024, raising $3.5 million in a seed round led by Bitfinex with support from Plasma co-founder Christian Angermayer. Other participants included Anthos Capital, Split Capital, Karatage and Manifold Trading.

Its ties deepened further in February 2025, when the project raised $20.5 million in a Series A led by Framework Ventures. Additional backing came from Peter Thiel’s Founders Fund, Nomura, Flow Traders, Bybit, DRW/Cumberland and Tether CEO Paolo Ardoino.

On June 13, 2025, the blockchain project set a record for the speed of capital intake. The $500 million target was met in five minutes. After the team doubled the cap, deposits hit $1 billion in 30 minutes. Around 2,900 wallets participated; the median contribution was roughly $12,000.

On July 28, during the public sale of 1 billion XPL at $0.05 per token, the programme received $373 million in deposits versus the $50 million expected—7.5 times oversubscribed.

Web3 researcher Vladimir Menaskop commented on the buzz around the launch and shared his view of Plasma’s potential impact. He hopes the industry will move away from zero-sum competition among incumbents:

“If we look at the stablecoin market, it has two basic problems: the centralisation of giants and the fragmentation of liquidity. So I personally favour synthesis: when every new token doesn’t siphon off money flows, but integrates into what already exists. That’s essentially how the whole DeFi market has evolved: first there were primitive DEX, then AMM, then more advanced ones, followed by DEXs with perpetual futures using liquidity pools. So there’s no direct fight, but there is improved cash flow thanks to ever more sophisticated mechanics and lower transaction costs.”

The Plasma team comprises specialists with experience in both crypto and traditional finance.

Co-founder and CEO Paul Fex previously co-founded Alloy, one of Tether’s institutional ventures. Fex oversees operations and technology, focusing on infrastructure for efficient and secure global stablecoin payments.

The second co-founder, investor Christian Angermayer, has close ties to Tether, Bitfinex and traditional finance. He organised early funding rounds, lending the project a reputation that attracted backers such as Peter Thiel.

“In 2024, stablecoin volume reached $32.8 trillion. That’s more than Visa. This is no longer a niche trend but the beginning of a new era of money. Plasma exists to enable this future as a blockchain purpose-built for ‘stable coins’. Our goal is simple: to become the global layer for settlement and issuance of digital dollars. That’s why the opportunity to earn trillions of dollars is real—and we plan to seize it,” the Plasma blog says.

A bridge to Bitcoin, anonymity and fee-free transactions

Plasma plays on the shortcomings of the sector’s leaders—Ethereum and TRON. It offers an alternative to high fees and frees users from holding gas tokens.

“None of these networks was built for the scale of stablecoin adoption we’re seeing now, or for the global financial shift it implies,” the Plasma team noted.

According to the technical documentation, the network’s architecture was designed from the outset for high performance with near-instant transactions.

Proof-of-Stake consensus underpins PlasmaBFT with a modified Fast HotStuff protocol. A similar approach is used by the Hyperliquid DEX. The execution layer is built on Reth, Ethereum’s modular Rust-based engine, enabling seamless interaction with the ecosystem of the second-largest cryptocurrency.

The native XPL token is used for staking, paying transaction fees, validator rewards and governance.

Plasma uses a dual node set: one for consensus, and another to process fee-free USDT transfers on a high-speed, low-cost lane. At first, the “economy” lane will be centralised, with participants distributed over time.

Thanks to a key partnership with the issuer of the USDT0 stablecoin, cross-chain USDT swaps across major networks are possible. LayerZero thus unifies liquidity previously siloed across blockchains and allows zero fees.

Free USDT transfers are effectively executed on a parallel block lane via USDT0, without overloading the network. Users can opt for speed and zero fees. Anti-spam rules—such as minimum balances and limits on send frequency—apply.

Users can pay fees with approved ERC‑20 tokens such as USDT or BTC, rather than a dedicated gas token like TRX on TRON. The protocol automatically swaps them into native XPL at the market rate.

Allbridge.io co-founder Andrii Velykyi sees the Plasma–USDT0 partnership as beneficial for Tether and draws parallels with USDC:

“I think Plasma is positioning itself in future as an analogue of what Circle does with its CCTP protocol. It’s a way to mint and burn stablecoins across networks without slippage and without having to maintain liquidity pools.”

An unconventional design choice is reliance on the Bitcoin blockchain. Plasma regularly stores a digest of its latest state directly on the network of the first cryptocurrency.

The promised anonymous transfers are not yet implemented. They are expected to conceal transaction details while allowing selective disclosure when needed for audits or regulatory compliance.

According to the technical documentation, the Bitcoin bridge and free transfers will not be available at mainnet launch. They will take time to develop.

Velykyi doubts Plasma will quickly go global or materially advance crypto adoption. He is also unsure the startup will significantly dent TRON:

“The question is how this will work, because today almost the entire OTC market is tied to USDT TRC‑20. Suppose they do offer some new technology—how quickly will users ‘roll over’ from the old familiar way to the new one, and what will be the drivers? If it’s anonymity and free transactions, which aren’t implemented yet—maybe. I don’t think Plasma will affect crypto adoption worldwide, honestly. It’s a niche product that too few in the market know about; mass adoption won’t come soon.”

At the end of August, the TRON community voted to reduce transfer fees—likely a response to rising competition in stablecoins.

At mainnet launch, Plasma’s stablecoin TVL exceeded $2 billion. The funds were allocated across DeFi protocols.

USDT will not be the only stablecoin available on Plasma. The network plans to go live with integrations from major players including Aave, Maker, Curve and Ethena.

Behind the curtain

XPL drew industry attention even before it entered free circulation.

On August 27, the XPL/USD contract on Hyperliquid surged 2.5 times to about $1.8, triggering mass liquidations. On other venues, including Binance, the price stayed around $0.55. On-chain analyst MLM suggested that a wallet linked to TRON founder Justin Sun was behind the large buys.

The flurry of investment drew mixed reactions.

Many complained retail users were all but shut out. Roughly 70% of the $1 billion in deposits ended up with the top 100 wallets.

Velykyi agreed that the team may have let whales in to ease negotiations later:

“If ‘big money’ came in, they still wanted to profit—they weren’t donating. And they can profit by selling to retail users who, say, weren’t let in. But for the amount they raised, will there actually be enough buyers in the market? That’s the question I’d like to see answered, but there isn’t one.”

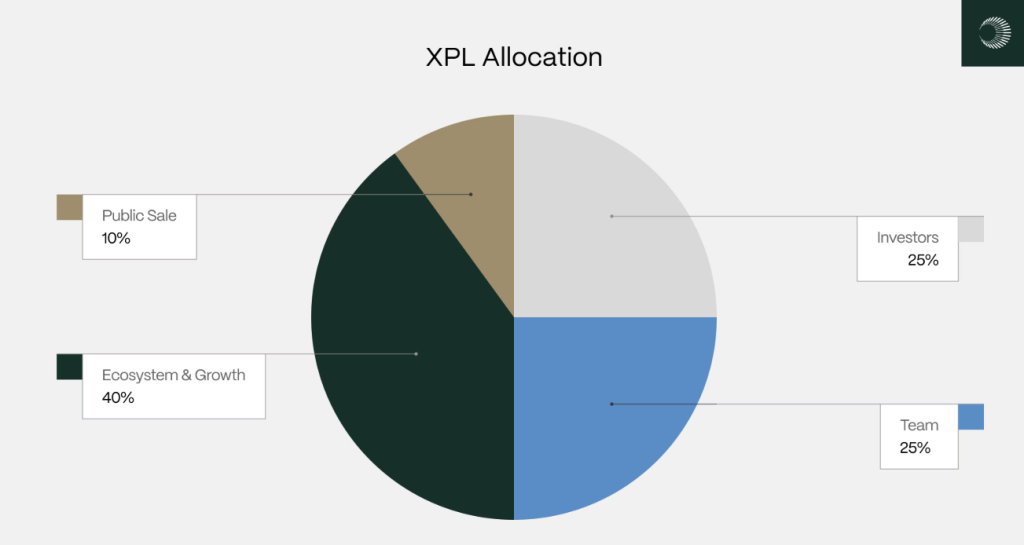

Total XPL supply is 10,000,000,000 tokens. Inflation starts at 5% annually and tapers to 3% over time, partially offset by burning transaction fees.

XPL token distribution. Source: Plasma.

The Plasma team says it complies with regulation. It has published a MiCA Whitepaper detailing compliance with the EU Regulation.

Menaskop flags a growing trend that runs counter to Web3’s original ideas. He urges readers to study genuinely decentralised cases, analyse projects and invest in tokens—rather than merely chasing APR on USDT. In his view, this helps avoid increasingly frequent fund freezes by custodial crypto platforms like Tether. Plasma is no exception.

“Let me remind you that bitcoin was created as an alternative to banks, not to please them. And the main security risk is that instead of grasping the basics—‘Your keys, your money’; ‘Non-custodial is the essence, not a bonus’—the user gets account abstraction, access to thousands of tokenised stocks in the RWA zone, and a USD wallet under the ‘crypto’ sauce.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!