Bloomberg: Bitcoin eyes $50,000

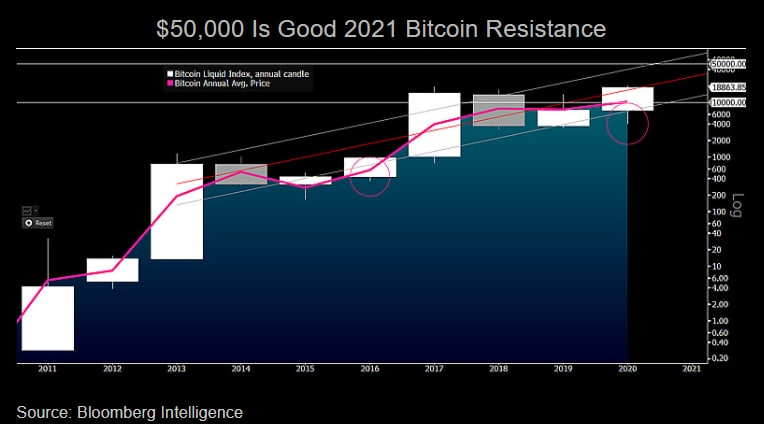

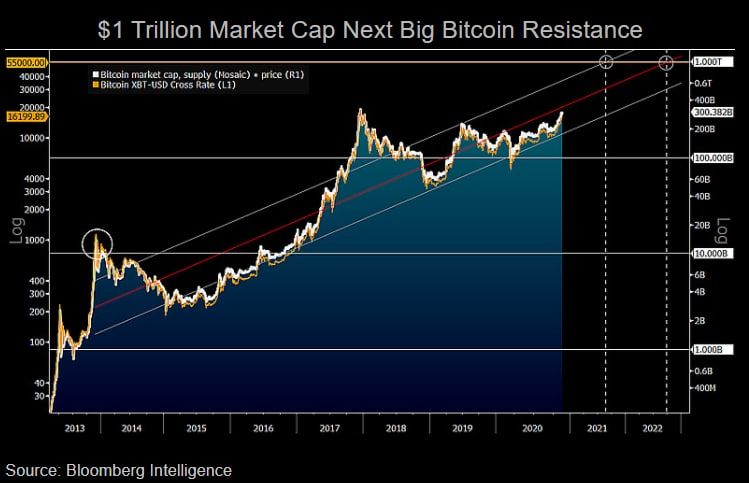

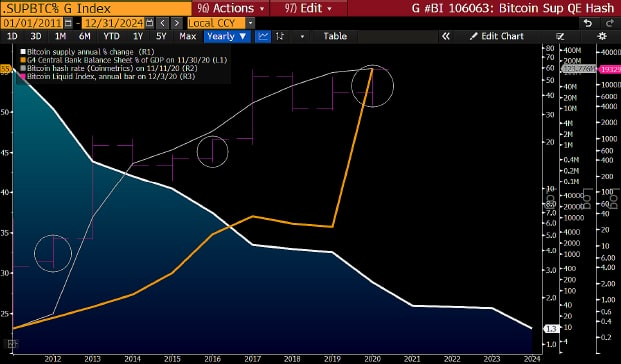

The price range for the first cryptocurrency could be between $10,000 and $50,000, and its market capitalization could rise to $1 trillion. In Bloomberg’s view, Bitcoin’s new records will be driven by unprecedented pace of quantitative easing and a rising debt-to-GDP ratio, as well as lower post-halving issuance rates.

Experts say that the current consolidation in the $19,000–$20,000 range could extend over the coming months, but the uptrend will resume. The analysts’ optimism rests on fundamental shifts relative to the 2017 situation.

Over the past three years, open interest in CME Bitcoin futures has grown to $1 billion, the daily issuance of digital gold has fallen from 1,800 to 900 coins, and the value of assets in the GBTC trust of Grayscale Investments has surged from $200 million to $10 billion.

Analysts say Bitcoin’s market capitalization of $1 trillion is only a matter of time. The corridor of values around the regression line they built suggests this could occur in 2021-2022.

Among other factors, analysts note a decline in Bitcoin’s volatility. The 180-day volatility gauge has in recent days stood at around 1.8 times that of gold.

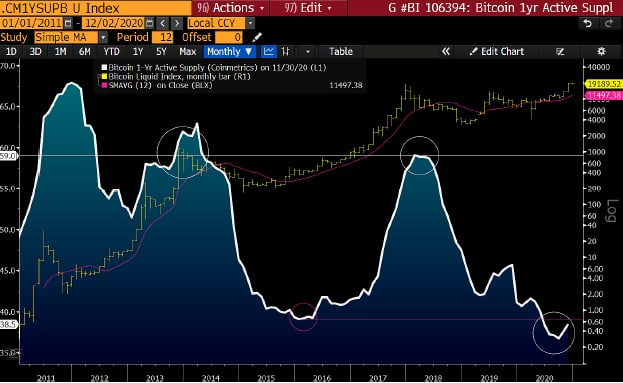

In the report, there is also mention of a decline in the active supply of Bitcoin. Based on Coin Metrics data, experts noted that the share of on-chain coins transferred over the past year fell to 40% of total supply. In 2013 and 2017, when prices formed notable peaks, this figure stood at 60%.

In conclusion, the experts presented a chart showing simultaneous growth in hash rate and Bitcoin price against the backdrop of rising balance-to-GDP ratios among central banks worldwide (highlighted in yellow). A white downward line marks the slowdown in the rate of issuance of the cryptocurrency.

Crypto December 2020 Outlook by ForkLog on Scribd

Earlier, the aggregate short position of leveraged traders in Bitcoin futures on CME reached record levels.

Earlier, CryptoQuant’s Ki Young Ju predicted, that the return of Bitcoin whales to selling would delay a breach of the psychological $20,000 level until year-end.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!