CCAF finds Bitcoin miners increasingly using cleaner energy

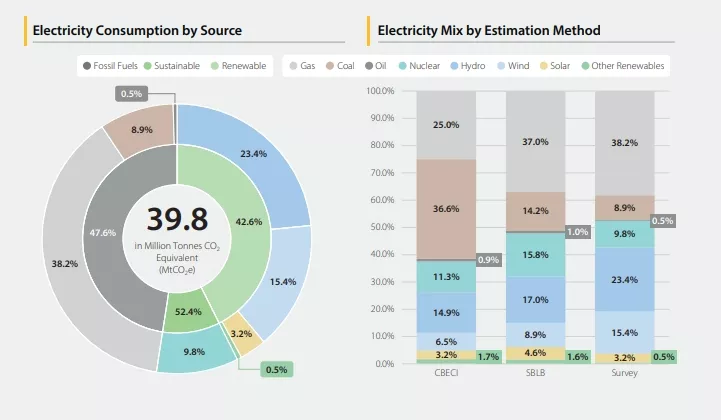

The share of sustainable energy in Bitcoin mining has reached 52.4%, up from 37.6% in 2022, according to a report by the Cambridge Centre for Alternative Finance (CCAF).

Of that, 42.6% comes from renewables and 9.8% from nuclear. The share of natural gas rose from 25% to 38.2%, while coal fell from 36.6% to 8.9%.

The researchers surveyed 49 mining firms controlling about 48% of the network’s hashrate. Respondents are headquartered in 17 jurisdictions and run mining operations in 23 countries.

The authors note that the sample’s tilt towards North America—75.4% of observed activity was in the United States—may skew results. Even so, CCAF argues the findings broadly reflect industry trends and pressures.

According to the survey, miners’ biggest concerns are:

- rising energy prices (57%). Miners pay an average tariff of $0.045 per kWh, and these costs account for over 80% of operating expenses;

- unfavourable regulation (47%);

- adverse moves in the Bitcoin price (40%).

As primary risk-management strategies, respondents cited:

- diversifying into other lines (64%), chiefly high-performance computing and artificial intelligence;

- hedging power costs (60%);

- broadening the geographic footprint of data centres (55%).

The biggest obstacles to expansion are the limited capacity of suitable sites for large-scale mining (47%) and delays in ASIC-miner deliveries (45%).

In the same vein, industry participants also pointed to a lack of access to debt financing (40%) and equity capital (36%).

Meanwhile, 41% of the companies surveyed are publicly listed.

Hashrate growth owes to more efficient ASICs

The researchers estimate Bitcoin miners’ annual electricity consumption at 138 TWh. Since January 2021, that figure is up 111%, while hashrate has jumped 455%.

The gap reflects improving hardware efficiency that accelerated in the ASIC era. By end-2024, the global fleet averaged 23.7 J/TH.

Latest-generation models already deliver 12 J/TH, with chips rated at 10 J/TH slated for 2025, the authors note.

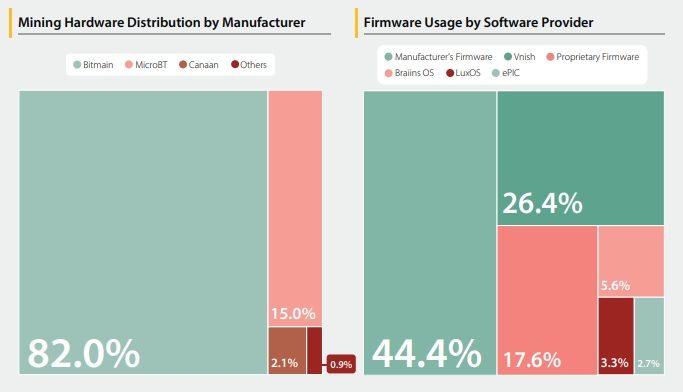

They describe the market for new miners as an oligopoly. By their estimates, Bitmain (82%), MicroBT (15%) and Canaan (2.1%) almost entirely control it. The firmware segment is more fragmented.

Data: CCAF.

CoinShares estimates that by end-2024 Canaan had dropped out of that trio. Its place was taken by Bitdeer of former Bitmain CEO Jihan Wu, with a 7% share, the same as MicroBT.

Environmental harm is contested

CCAF calculates mining-related annual CO₂ emissions at 39.8 million tonnes—about 0.08% of the global total and roughly Slovakia’s level. Most survey participants said they take steps to offset their climate impact.

They add roughly 2,300 tonnes of electronic waste from retired miners in 2024. Companies said a significant share of used equipment is resold on the secondary market or recycled.

In an April study, researchers at the Harvard T.H. Chan School of Public Health accused bitcoin mining of adding to airborne particulate pollution.

They found that even when equipment is connected solely to clean sources, overall electricity demand rises. Reserve capacity—owing to technological constraints, typically gas and coal—then responds. As a result, harmful emissions increase, often in regions far from the data centres.

In comments to The Block, mining-sustainability expert Daniel Batten called the methodology “deeply flawed”. In his view, the conclusions were tailored so that Bitcoin mining “would look bad”.

“This paper is a throwback to an earlier generation of academic work that used imperfect methodologies and cherry-picked data — an approach that Sai and Vranken debunked in 2023. Policymakers and regulators should not take it seriously,” Batten said.

The Digital Asset Research Institute also rebutted the findings of the Harvard scholars. It highlighted:

- excessive reliance on non-scientific sources (mostly news reports);

- ignoring major energy trackers;

- methodological gaps;

- misattribution of emissions;

- selective use of data and other inaccuracies.

In the US Senate, lawmakers introduced a bill setting regional emissions limits for cryptocurrency-mining facilities and AI-serving data centres.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!