Circle and Binance Collaborate to Promote USDC

Circle and Binance have forged a strategic partnership to expand the global reach of the USDC stablecoin.

BREAKING NEWS: Circle and Binance have entered into a strategic partnership that will accelerate global USDC and crypto adoption. The world’s largest exchange and crypto super app and the world’s largest trusted and compliant dollar stablecoin operator are coming together to… pic.twitter.com/WO8w4rv3NZ

— Jeremy Allaire — jda.eth / jdallaire.sol (@jerallaire) December 11, 2024

“The world’s largest crypto exchange and super app is joining forces with a trusted and regulated stablecoin operator to work on the next phase of crypto adoption,” said Circle co-founder and CEO Jeremy Allaire.

As part of the collaboration, Binance will enhance user access to USDC through its products and services. The exchange will also include the “stablecoin” in its corporate treasury assets.

Circle will provide the platform with “liquidity, a range of technologies, and other tools.”

“We will also join forces to work on products and partnerships that will promote the use of stablecoins and crypto infrastructure in everyday financial activities and commerce worldwide,” Allaire added.

In February 2023, the New York State Department of Financial Services (NYDFS) prohibited the infrastructure company Paxos from issuing the Binance-branded stablecoin BUSD.

The SEC also raised concerns regarding the asset, considering its offering as an investment contract. Circle supported the exchange on the coin’s status. In July 2024, the regulator concluded its investigation.

According to media reports, NYDFS’s concerns about BUSD arose after Circle complained about the stablecoin’s reserve management quality. Other experts had previously pointed out these shortcomings in the backing mechanism.

In 2023, Binance supported the launch of the FDUSD, a dollar-pegged “stablecoin” by Hong Kong-based First Digital Labs.

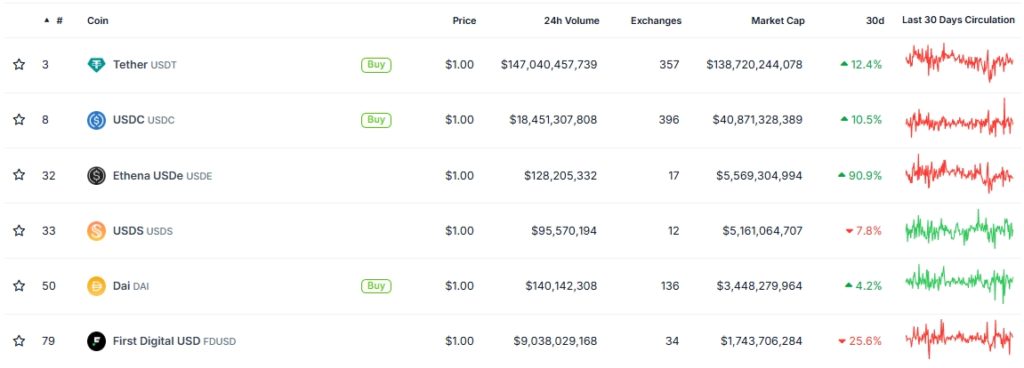

The asset’s capitalization stands at $1.74 billion, while USDC’s is $40.8 billion. Tether’s USDT dominates the stablecoin segment with a figure of $138.7 billion.

On December 10, the combined market value of stablecoins surpassed $200 billion.

Analysts at Bernstein have forecasted a rise in capitalization to $2.8 trillion within the next five years.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!