Circle and Tether split over US stablecoin regulation

Circle and Tether executives have set out their views on US stablecoin regulation. The debate has prompted suspicions in the community that one of the firms is lobbying for its own interests in government circles.

Building a regulatory framework for cryptocurrencies, including stablecoins, was one of US president Donald Trump’s campaign pledges.

Work on stablecoin rules sits on the agenda of the working group on digital-asset markets led by “crypto czar” David Sacks. He has said it will be one of the priorities for the body.

At the start of February, Senator Bill Hagerty proposed a regime to oversee stablecoin issuers, splitting supervision between state agencies and the Fed and the OCC at the Treasury. In the House of Representatives, congressmen French Hill and Bryan Steil introduced their own bill.

Circle

USDC issuer Circle’s co-founder Jeremy Allaire said in an interview with Bloomberg that dollar stablecoin issuers should be required to register in the United States.

“This should not be a free pass. Right? Where you can just ignore the laws of the country and do whatever you want, wherever, and sell into the United States,” he said.

The New York-based Circle chief said the issue is “about consumer protection and financial integrity”.

“Whether you are an offshore company or based in Hong Kong, if you want to offer your dollar stablecoin in the United States, you need to register in the country, just as we do everywhere,” Allaire stressed.

He did not name any specific firms.

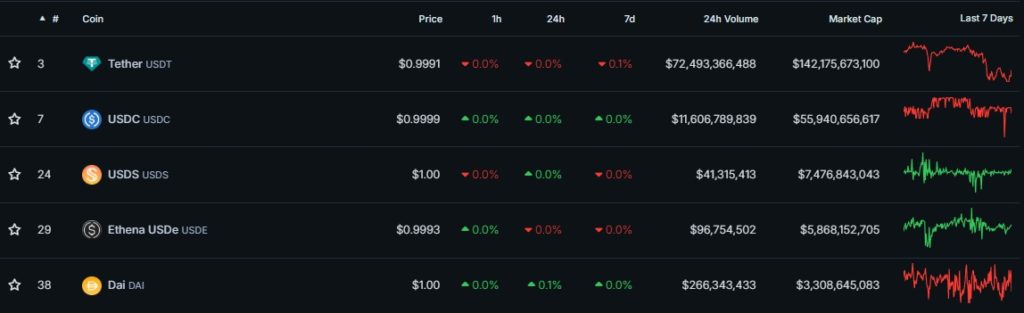

USDC ranks second by market capitalisation in the segment. At $55.9bn, it trails only USDT at $142.2bn.

The company behind USDT, Tether, was based in Hong Kong. In January, the firm announced it was moving its headquarters to El Salvador.

Tether

Even before Allaire’s interview was published, Tether CEO Paolo Ardoino suggested that competitors are pushing US stablecoin legislation in their own interests. He did not say whom he had in mind.

USDt is the most successful tool for US Dollar hegemony and distribution across emerging markets.

Tether built, over the last decade, the widest physical and digital distribution network, spacing from thousands of kiosks in Africa and South America to digital remittances… https://t.co/KD2oUzemT8

— Paolo Ardoino ? (@paoloardoino) February 25, 2025

“USDT is the most successful instrument for dollar hegemony and its distribution across emerging markets,” the executive wrote.

Ardoino said that Tether has built “the widest distribution network” in Africa and South America. The platform offers payments, remittances and financial instruments for institutions.

According to him, 400m people worldwide use USDT, contributing to the US economy. He added that the company holds more than $115bn of US Treasuries, making it the 18th-largest bondholder.

“While our competitors’ business model should be to build a better product and an even wider distribution network, their real goal is ‘to kill Tether’. Every business or political meeting they have ends with that intention,” the company head said, citing information he receives from various sources.

His post was a response to a message from Framework Ventures co-founder Vance Spencer.

Community reaction

According to Spencer, US authorities plan to shut centralized international stablecoin issuers out of the Treasury market.

I don’t comment directly on regulation much but I would like to flag an emerging regulatory battle that is happening in D.C.

The soon-to-be revealed stablecoin markup apparently has requirements to shut off access to the treasury market to centralized international stablecoin…

— Vance Spencer (@pythianism) February 24, 2025

“This is an egregious attempt at regulatory capture by US players undertaken at the expense of national interests. Please explain to me how cutting off access to hundreds of billions of dollars of demand for Treasuries helps us preserve dollar hegemony globally or solve our debt problem,” the investor wrote.

In his view, the largest dollar stablecoins today are issued abroad, and that is where demand is concentrated. Those conditions will persist, and it is in America’s interest to allow as broad a set of issuers as possible to prosper.

Electric Capital co-founder Avichal Garg disagreed with Spencer.

I have spoken with the people drafting — the goal is not to shut out foreign buyers of treasuries.

The goal is to prevent foreign issuers that have low standards for backing collateral from claiming to be safe/secure and rugging people.

Which is very fair. If you aren’t…

— Avichal — Electric ϟ Capital (@avichal) February 24, 2025

“I have spoken with the people drafting the bill. The goal is not to push away foreign buyers of Treasuries. The aim is to prevent foreign issuers with low standards for collateral backing from claiming that their obligations are safe and secure,” he explained.

Castle Island Ventures general partner Nic Carter called such an approach “odd”. He noted it would make the US Treasury market officially “two-tier”, with foreign holders potentially “at risk” at any moment—even though they own 30% of outstanding bonds worth about $8trn.

The proposed policy would signal to the market that the Treasury market is officially two tier, with foreign holders potentially being rugged at any moment. Except, 30% of USTs ($8T) are held by foreigners. The US government literally cannot afford to lose this holder base.…

— nic carter (@nic__carter) February 25, 2025

“The US government literally cannot afford to lose this holder base. Capitulating to the lobbyists of a single stablecoin organisation would throw the system into disarray—akin to the seizure of Russian reserves in 2022, only with much less moral justification,” Carter stressed.

In February, the US Senate approved Howard Lutnick as commerce secretary. He previously served as CEO and president of Cantor Fitzgerald—the custodian of USDT’s reserves and a possible owner of a stake in Tether.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!