Circle Seeks U.S. Trust Bank License

Circle has submitted an application to the U.S. Office of the Comptroller of the Currency for a national trust bank license, according to Reuters.

This new status would allow the firm to act as a custodian for its own reserves and hold crypto assets on behalf of institutional clients. However, the license would not permit the acceptance of cash deposits or the issuance of loans.

“Circle has long aimed to achieve the highest standards of trust, transparency, governance, and compliance. Becoming a public company is a significant part of that. Becoming a national trust company is the continuation,” said the company’s CEO Jeremy Allaire in an interview with journalists.

According to him, the new structure will manage Circle’s reserves in USDC, although some of these will still be held in major banks.

The company will also focus on providing custodial services for assets such as stocks and bonds, which are represented as tokenized tokens on blockchains.

“[…] if we succeed in obtaining approval as a national trust, it will provide us with a foundation upon which the world’s leading institutions can confidently build,” Allaire added.

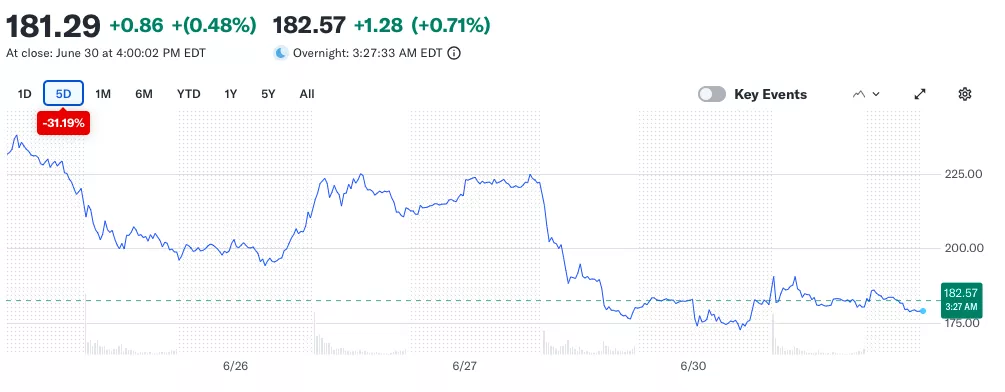

At the time of writing, CRCL shares are valued at $181. Over the past trading week, the asset has lost about 30%.

In June, Circle’s head predicted an imminent stablecoin revolution. In his view, developers have yet to realize the potential of programmable money.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!