CME Bitcoin futures open interest hits $724 million

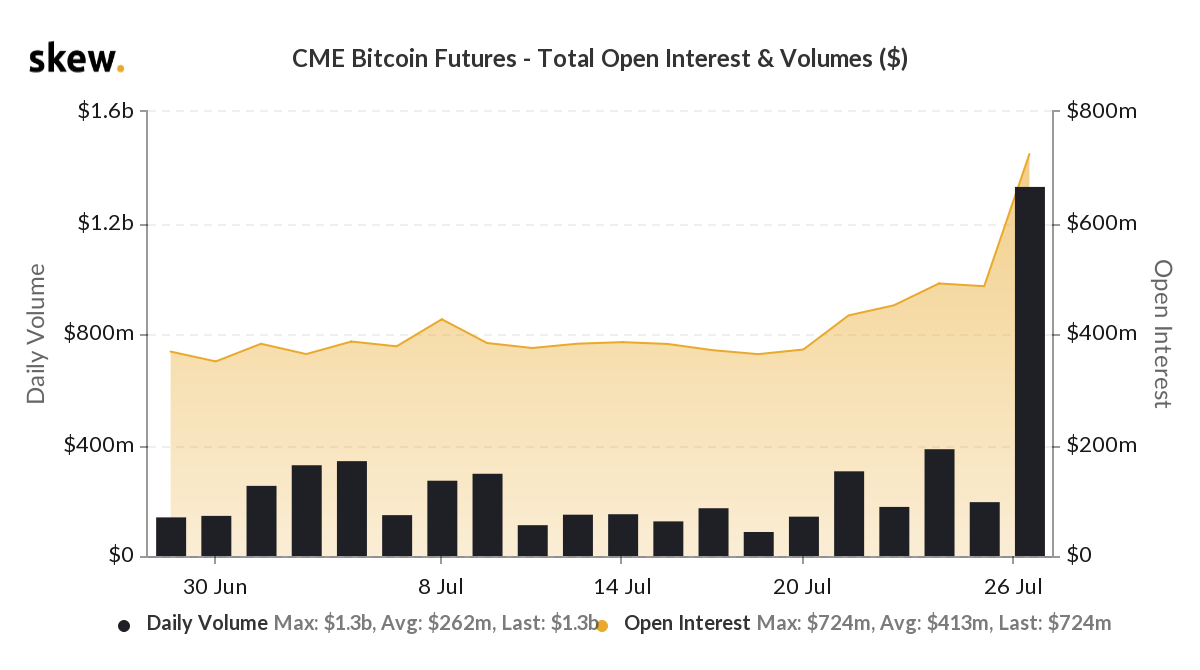

Against the backdrop of the bitcoin rally, open interest in CME futures on the regulated exchange reached $724 million.

According to data from analytics service skew, the jump in the indicator came amid a significant rise in trading volumes:

Trading volume in CME futures exceeded $1.3 billion. Previously, the indicator’s average hovered just under $300 million.

According to Arcane Research, the previous open interest (OI) peak on CME was recorded in May this year at $532 million.

Total OI on popular derivatives exchanges surpassed $5 billion, reaching the February highs.

Sources: Arcane Research, skew.

OI on the BitMEX exchange exceeded $1 billion, briefly pushing the exchange back into a leadership position. At the time of writing, the largest bitcoin-futures trading volume was on Huobi, while OKEx led in open interest.

“A sharp rise in open interest or the value of open positions in derivative contracts indicates that more money is flowing into the market, and traders expect Bitcoin volatility to rise in the near term,” explained The Block’s analysts.

The aggregate trading volume on the major futures exchanges nearly reached the all-time high set in early March this year.

Yesterday was second highest volume day in #bitcoin futures (short) history pic.twitter.com/7gQfrCiRwS

— skew (@skewdotcom) July 28, 2020

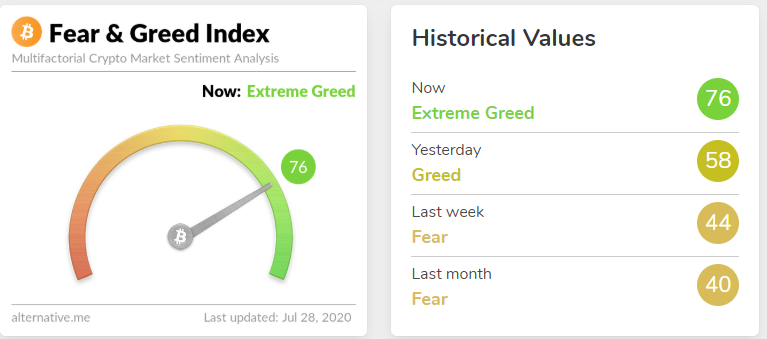

Against the backdrop of a marked uptick in spot and derivatives activity, the cryptocurrency “Fear and Greed Index” points to market overheating:

According to Arcane Research, the index last stood at such a high level in July 2019.

Earlier, ForkLog reported that miners were not rushing to sell bitcoins, despite the price rally.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!