In the second quarter of 2022, the cryptocurrency exchange FTX could have provided a “large financial bailout” to Alameda Research, which ultimately led to serious consequences. This was the conclusion of Lucas Nuzzi, head of R&D at Coin Metrics.

1/ I found evidence that FTX might have provided a massive bailout for Alameda in Q2 which now came back to haunt them.

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇 pic.twitter.com/DtCyPspME0

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

“Forty days ago, 173 million FTT worth over $4 billion became active. A rabbit hole appeared,” he wrote.

According to the expert, on September 28 there was the largest daily movement of the FTX utility token in its history — for more than $8.6 billion. After analysis, Nuzzi found that the recipient of $4.19 billion worth of FTT was linked to Alameda Research.

5/ Here’s what I think happened:

— Alameda blew up in Q2 along with 3AC+ others.

— It ONLY survived because it was able to secure funding from FTX using as “collateral” the 172M FTT that was guaranteed to vest 4 months later.Once vested, all tokens were sent back as repayment.

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

“After the transfer, all tokens were sent back as repayment,” the thread notes.

Nuzzi added that the potential Alameda crash in May would have led to the liquidation of all FTT issued in September. However, the scenario implemented in Q2 reinforced FTX’s image as a solvent and responsible organisation, which helped push up the token’s price, the expert noted.

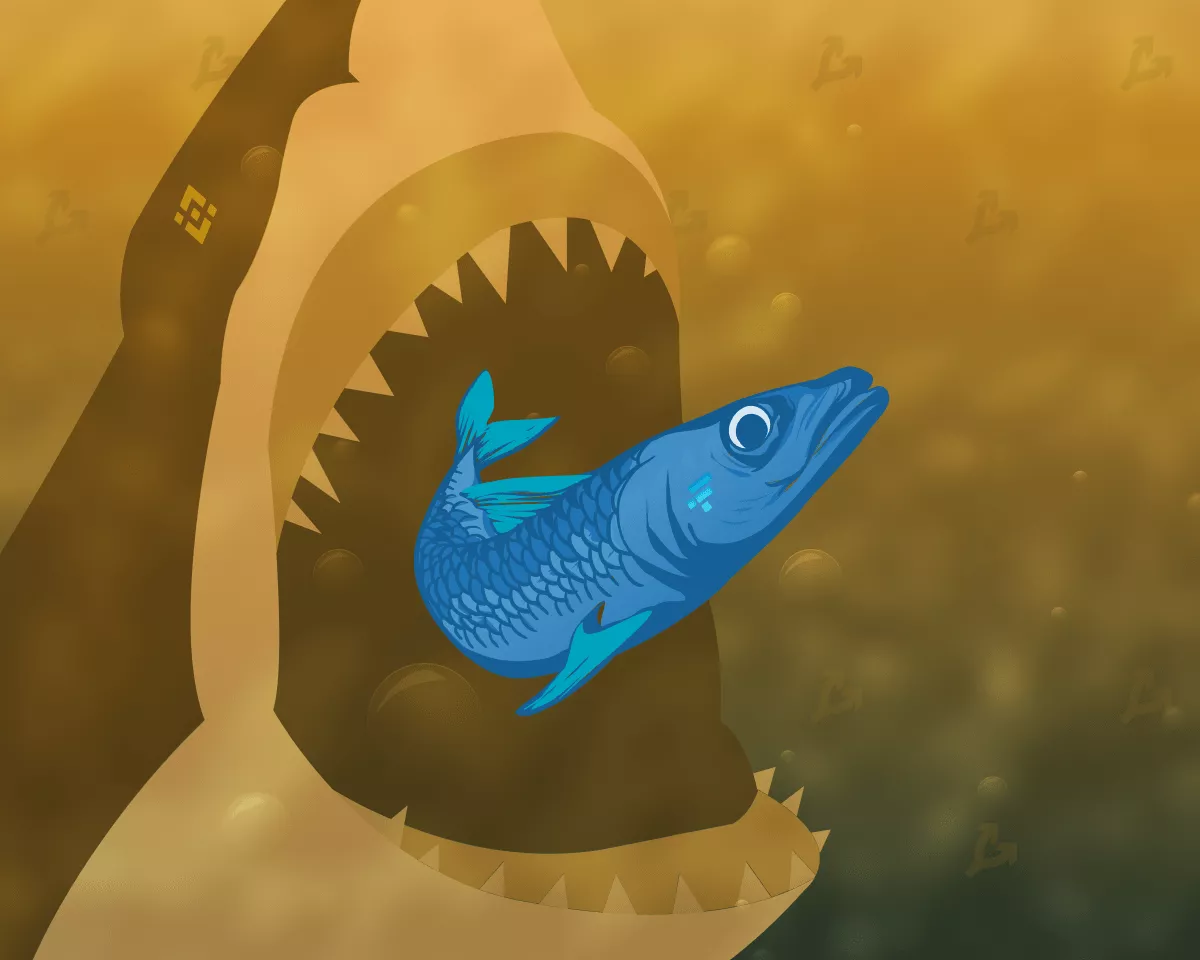

“There is a possibility that people from Binance knew about this arrangement between FTX and Alameda. An opportunity arose. As large holders of FTT, they could start deliberately tanking that market to force FTX to face a liquidity crunch,” Nuzzi said.

9/ Here’s where I think it gets crazier.

There is a chance the folks from Binance knew about this arrangement between FTX and Alameda.

An opportunity emerged.

As large holders of FTT, they could start deliberately tanking that market to force FTX to face a liquidity crunch.

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

The expert emphasised that the published thread is his personal view on what happened, based on on-chain research.

Earlier, on November 6, Binance CEO Changpeng Zhao stated his intention to dispose of FTT. Assets together with BUSD, totaling around $2.1 billion, were the result of the company’s exit from its portfolio investment in the platform Sam Bankman-Fried.

Then Zhao noted that the decision was not aimed at a competitor but was the result of “recent disclosures”. It is presumed he meant CoinDesk’s investigation, which revealed details of Alameda Research’s balance sheet, closely tied to FTX.

On November 8, FTT fell by almost 30% amid concerns about the platform’s financial resilience. On the same day, Bankman-Fried and Zhao announced a strategic partnership aimed at resolving the liquidity crisis. It also envisages a possible takeover of FTX by the Binance exchange.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.