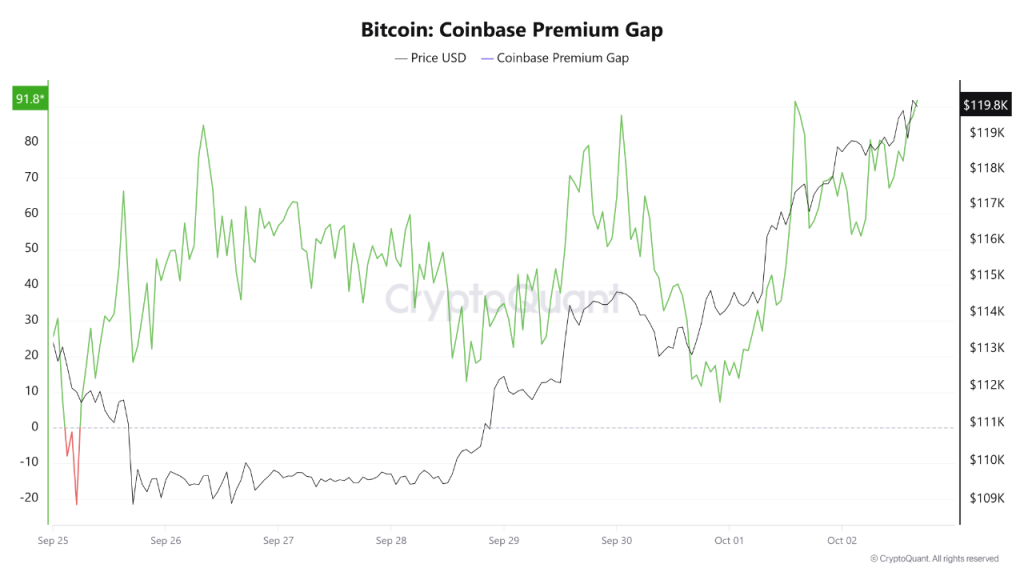

Coinbase premium hints at a looming bitcoin record high

US investor activity coincided with renewed inflows into ETFs

Amid the first cryptocurrency’s rally to $121,000, the Coinbase premium reached 91.86. CryptoQuant analyst Burak Kesmeci called it a signal that bitcoin could soon set a new all-time high.

“On the hourly timeframe, the price difference on Coinbase has risen to $91.86. This means American investors are buying the asset on the exchange at a rate $91.86 higher than on Binance. Such a strong positive signal from the US may indicate a potential move toward ATH,” he wrote.

At the time of writing, the digital gold is trading around $120,400, up 1% over the past 24 hours.

According to CoinGecko, the leading cryptocurrency is 3% shy of a new record.

ETFs

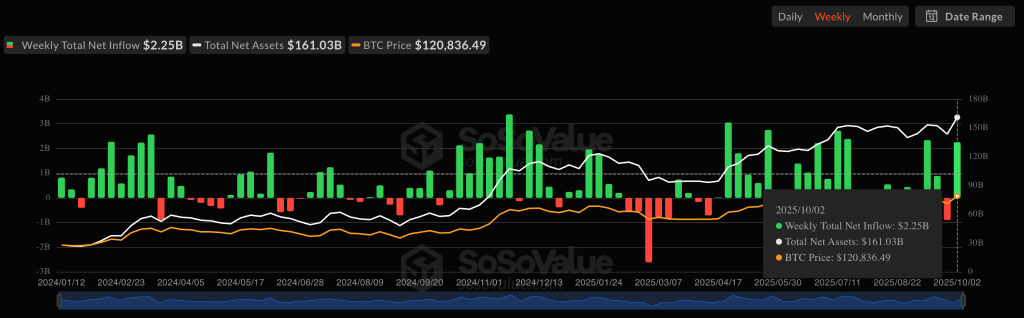

US investor activity has coincided with steady inflows into spot bitcoin ETFs. From 29 September to 2 October, more than $2.2bn flowed into the products — the highest since mid last month.

Cumulative inflows since launch in January 2024 have neared $60bn. The largest fund remains BlackRock’s IBIT, which on 2 October also set a local record for trading volume.

$GLD and $IBIT in the Top 10 ETFs by volume today, which is rare, everyone wants in on the The Debaser Trade I guess.. pic.twitter.com/vsUbQlUMTf

— Eric Balchunas (@EricBalchunas) October 2, 2025

According to Bloomberg ETF analyst Eric Balchunas, this ETF ranked among the ten most traded products, alongside SPY, QQQ and GLD.

IBIT also entered, for the first time, the top 20 funds by assets under management, exceeding $90bn. To reach the top ten, BlackRock’s vehicle needs to accumulate another $50bn, the expert stressed.

Over the week, Ethereum ETFs attracted more than $1bn, and $14bn since launch.

A shake-up in the options market

Balchunas also noted that open interest in options on IBIT has, for the first time, exceeded that of Deribit. After the 26 September expiry, the fund’s positions reached about $38bn versus $32bn at the derivatives exchange.

$IBIT has surpassed Coinbase’s Derbit platform as the largest venue for bitcoin options with $38b in open interest. I told y’all ETFs are no joke.. Fat crypto margins in trouble. Nice find by @sidharth_shukla pic.twitter.com/LUcnpW5g4I

— Eric Balchunas (@EricBalchunas) October 2, 2025

“I told you ETFs are no joke. Fat crypto margins are in trouble,” the analyst commented.

Balchunas said that among competitors, BlackRock’s fund shows an absolute monopoly in the options segment, adding:

“The options market tends toward a ‘winner-takes-all’ model, unlike assets under management, which are distributed more evenly.”

Earlier, the CryptoQuant expert known as PelinayPA confirmed bitcoin’s “healthy dynamics”. Analysts also identified conditions for the leading cryptocurrency to rise to $200,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!