Coinbase shares fall 9.1% after SEC suit against Binance

Coinbase shares on the bitcoin exchange finished trading on June 5 down 9.1%. The market reacted to a lawsuit by the SEC against rival Binance and its CEO Changpeng Zhao.

At one point, the market capitalisation fell by more than 13.5%.

The U.S. regulator filed 13 charges, including unregistered offers and sales of crypto assets BNB and BUSD, the Simple Earn products, BNB Vault and staking.

The suit also alleges that Binance failed to register its platform Binance.com as an exchange, broker-dealer, or clearing agency, as did its U.S. subsidiary. Zhao was named as a ‘control person’.

In March 2023, the suit against Binance and Zhao was filed by CFTC. According to the agency, the platform violated derivatives trading rules by operating without proper registration and ‘deliberately evading U.S. law’.

In the same month Coinbase received a notice from the SEC about an investigation into listing procedures on the platform and its products — Coinbase Prime, Coinbase Wallet and staking service Coinbase Earn.

According to Berenberg analyst Mark Palmer, the suit against Binance could foreshadow further regulatory action by the Commission against Coinbase. In that case, around 37% of the platform’s revenue would be at risk.

Berenberg analyst Mark Palmer estimated that at least 37% of COIN’s net revenue would be at risk if the SEC were to target the company’s crypto token trading and staking operations. https://t.co/s81LkWY746

— Wu Blockchain (@WuBlockchain) June 6, 2023

«Some details of the lawsuit against Binance echo those that appeared in the documents against Bittrex and Kraken. We believe that these cases, taken together, outline the contours of a dispute with Coinbase,» — said an expert.

The specialist advised investors to consider the possibility that the company could successfully change its business model and geographic focus if forced to shrink or wind down a significant part of its US operations.

An Arca analyst Jeff Dorman pointed to the need for crypto exchanges to consider delisting many assets.

Jeff Dorman, Arca’s chief investment officer, said the SEC’s lawsuit against Binance is really hurting Coinbase, Kraken and other U.S. exchanges, which must decide whether to delist many tokens. https://t.co/O7JWHYwVrY

— Wu Blockchain (@WuBlockchain) June 6, 2023

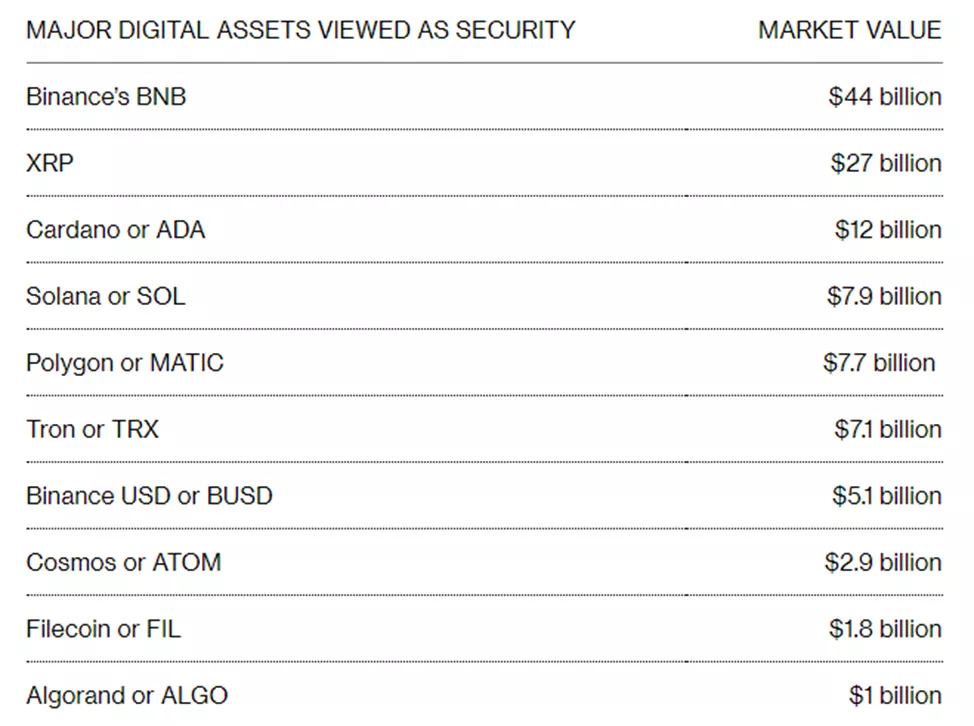

Following the SEC’s lawsuit against Binance, the market value of crypto assets deemed by the Commission to be unregistered securities stood at about $115 billion.

On April 25, Coinbase filed a lawsuit to obtain a response from the SEC regarding the July 2022 petition. In it, the company sought clarity on crypto regulation.

The SEC called the firm’s claims ‘baseless’. Officials noted that the agency is not obligated to issue new rules, and that the company ‘has no right to sue the regulator’.

On May 22, Coinbase filed a new complaint against the SEC to obtain the regulator’s response to the July 2022 petition.

The document is in Mandamus format — a court order directing a public official or other person to perform actions required by law. It is used in ‘exceptional circumstances’. Coinbase intends to obtain a concrete comment from the Commission regarding rulemaking in relation to cryptocurrencies.

Earlier, the head of the exchange Brian Armstrong said the SEC had launched a ‘crusade’ against the digital-asset industry.

Earlier in May 2023, the U.S. Chamber of Commerce stood in support of Coinbase and accused the regulator of ‘deliberately creating a dangerous and uncertain environment’ for crypto firms in the country.

Subsequently, the trading platform launched a TV campaign to lobby the industry.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!