Coinbase: The tokenisation boom of real-world assets will begin in one to two years

There are one to two years before the full potential of tokenisation is realised, according to Coinbase Research analysts.

Coinbase Research: Tokenization and the New Market Cycle

The current high yield environment has given tokenization as an opportunity for digitizing financial assets such as sovereign bonds, money market funds and repurchase agreements. However, infrastructure and jurisdictional… pic.twitter.com/41IybBp5Jv

— Wu Blockchain (@WuBlockchain) October 31, 2023

Interest in the technology is currently being underpinned by rising yields in debt markets.

Compared with 2017, when opportunity costs were around 1-1.5%, current conditions with interest rates above 5% emphasise the efficiency of capital usage through instant settlement versus the currently prevailing T+2.

The ability to operate 24/7 and maintain auditable records expands the potential of on-chain payments and settlements, according to specialists.

In their view, the focus will be on sovereign bonds, bank deposits, money market funds, and repo operations.

Growth drivers for the segment will be improved functional interoperability and industry consolidation.

The latter will unfold along three directions:

- financial verticals;

- jurisdictional boundaries;

- technological stacks.

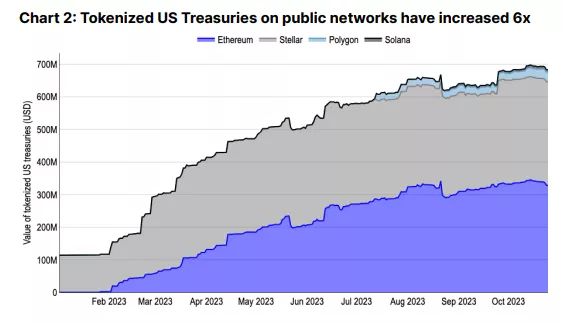

Rising demand is being realised across various protocols aimed at access to the tokenised US Treasury market, a markedly different situation from 2017. In 2023, market volume grew sixfold.

Over the past six years, many misconceptions about tokenisation have been dispelled. Moreover, counterparty risk has substantially decreased thanks to the possibility of atomic settlements in delivery-versus-payment (PvD) and payment-versus-delivery (PvP) scenarios, analysts said.

Among obstacles, analysts cited infrastructure issues and a lack of clear legal frameworks in several key countries.

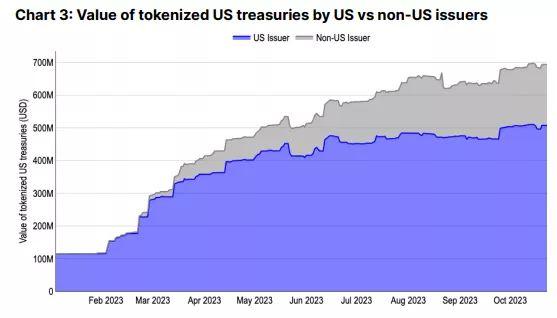

Regulatory ambiguity often requires multiple platforms to handle tokenised assets across different jurisdictions. Projects such as OpenEden, Backed, Matrixdock and Ondo restrict the user base to accredited investors and often to non-U.S. residents.

An increasing number of issuers of tokens backed by U.S. Treasuries are registering in jurisdictions outside the United States.

These range from tightly regulated places such as Switzerland to places like the British Virgin Islands. This adds a layer of counterparty risk on top of the existing risk of smart contracts.

Most institutions rely on permissioned blockchains due to concerns about smart contract exploits, oracle manipulation, and failures typical of open networks, according to specialists. This raises issues of functional interoperability from technical, legal and business perspectives.

Experts also note that many projects rely on TradFi for settlements. Platforms on permissioned blockchains lack data-sharing for TradFi for KYC/AML checks.

As a result, liquidity remains fragmented, complicating the realisation of all tokenisation benefits such as a functional secondary market.

Analysts do not rule out a shift in the landscape with the launch of Uniswap’s fourth version of the protocol, which will include the so-called KYC-hook.

Earlier, JPMorgan launched Tokenized Collateral Network (TCN). The blockchain solution has already been used by BlackRock and Barclays for converting shares into digital tokens and subsequent OTC trading of derivatives between the two institutions.

Earlier, Zodia Custodyagreed to collaborate with the OpenEden platform to offer Real World Assets-based products (RWA).

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!