Congress proposes to oust SEC chair after court ruling on Bitcoin ETF

US Representative Warren Davidson has again called for Gary Gensler to be removed from his post as head of the SEC. The trigger was a court verdict in favor of Grayscale regarding the conversion of GBTC into an ETF, contrary to the regulator’s position.

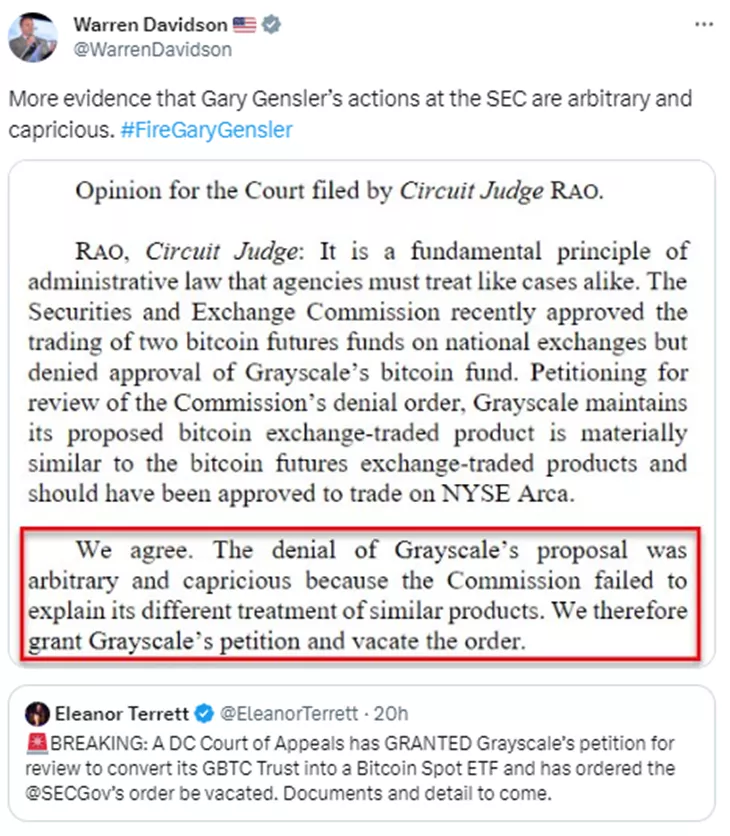

“Another proof that Gary Gensler’s actions at the SEC are unlawful and arbitrary,” the legislator commented.

In his statement, Davidson effectively quoted the text of the court’s decision.

The politician added the hashtag #FireGaryGensler to the post.

This is the second consecutive court defeat for the Commission against crypto-industry participants. Earlier Ripple secured a ‘partial victory’ in a 2020 lawsuit, in which the SEC accused the fintech company of distributing unregistered securities in the form of the platform’s native tokens.

Earlier in April 2023, Davidson proposed to fire the head of the agency. He said at the time he planned to introduce a corresponding bill. The initiative was prompted by Gensler’s intent to revise the definition of “exchange,” which drew criticism from crypto-industry representatives.

On 14 April, the head of the SEC stated that the proposed amendments to the rules could benefit investors and markets, subjecting some brokers to additional scrutiny by regulators.

In January 2022, the Commission proposed similar amendments. At that time, the industry advocacy organization Coin Center called the changes unconstitutional and beyond the SEC’s powers.

Earlier, in mid-June, Davidson and several other congressmen introduced a bill to fire Gensler and restructure the agency.

Earlier the SEC filed the court with a sealed motion in the Binance case.

Former SEC attorney John Reed Stark expressed surprise at the decision and noted that it is in the public interest to know and understand how the agency uses the taxpayer funds it receives.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!