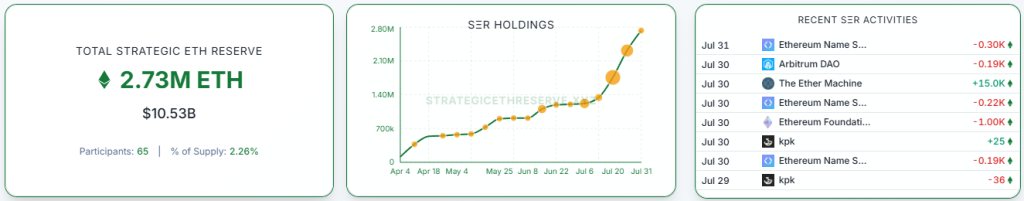

Corporate Ethereum reserves top $10bn

The total value of the second-largest cryptocurrency held on corporate balance sheets has reached $10.53bn.

According to Strategic ETH Reserve, 65 companies hold 2.73 million ETH — 2.26% of Ethereum’s circulating supply.

The largest holder of ether is Bitmine Immersion Tech. The “digital reserves” of the company associated with Fundstrat researcher Tom Lee have reached 625,000 ETH ($2.41bn); up 283% over the past 30 days.

Second is SharpLink, whose chairman of the board is Ethereum co-founder Joe Lubin. According to Lookonchain, on July 31 the company spent 43.09m USDC to buy 11,259 ETH at $3,828 per coin.

SharpLink(@SharpLinkGaming) just spent 43.09M $USDC to buy another 11,259 $ETH at $3,828 and currently holds 449,276 $ETH($1.73B).https://t.co/cW8EvzSFxthttps://t.co/30rmmZHGHc pic.twitter.com/oUuYspMrCS

— Lookonchain (@lookonchain) July 31, 2025

The company now holds 449,276 ETH worth ~ $1.73bn.

The Ether Machine has moved into third place. On July 30 the company reported buying 15,000 ETH worth $56.9m at $3,809.97 per coin.

Its ether balance has reached 334,757 ETH, well above that of the non-profit Ethereum Foundation (~234,600 ETH).

Notably, The Ether Machine’s Multiple on Net Asset Value (MNAV) is very low — just 0.14. By comparison, Bitmine’s is 1.74 and SharpLink’s 1.49.

The ratio is calculated as the company’s market capitalisation divided by the dollar value of cryptocurrency on its balance sheet. Many investors see an MNAV below 1 as a red flag — it can point to strategic missteps, an opaque structure and/or inefficient operations. In such cases, even growth in crypto reserves may not compensate for the decline.

Marking Ethereum’s anniversary

Representatives of The Ether Machine stressed that the latest purchase was timed to the 10th anniversary of the second-largest cryptocurrency.

“We could not think of a better way to mark Ethereum’s 10th anniversary than to deepen our commitment to ether. We are only just getting started. Our mission is to accumulate, grow and support Ethereum over the long term — not only as a financial asset, but as the foundation of a new internet economy,” said company co-founder Andrew Keys.

The Ether Machine emerged in 2025 from the merger of The Ether Reserve and Nasdaq-listed Dynamix Corp. The deal is expected to close in the fourth quarter. The combined firm plans to list on Nasdaq under the ticker ETHM and raise $1.6bn.

Over the past 24 hours Ethereum has risen 1.5%. The asset trades around $3,865, according to CoinGecko.

Bitwise warns

Companies with Ethereum reserves have helped popularise the second-largest cryptocurrency among TradFi participants, argues Bitwise CIO Matt Hougan. In his view, corporations have “packaged” the asset in a format familiar to traditional investors.

He stressed that for a long time Ethereum “could not offer” the yield options familiar to TradFi.

“But if you put $1bn into ETH through a company and stake the asset, it starts to generate yield. And investors are used to businesses that earn,” Hougan said.

In the ten years since mainnet launch in July 2015, Ethereum has evolved from a niche project for internet enthusiasts into an institutional-grade asset, as evidenced by growing interest from large players.

However, he warned that companies accumulating ether by issuing bonds and equity must carefully manage leverage and interest costs to avoid financial risks.

Hougan advised companies using Ethereum in treasury as an inflation hedge to focus on a long-term strategy. Short-term volatility can hurt those banking on a quick effect.

He noted that companies also face currency risk — a mismatch between assets and liabilities in different currencies. This is particularly relevant in the event of a market slump, when shortfalls to cover expenses are more likely.

Even so, Hougan stressed that the risk of mass liquidation of crypto reserves to service debts may remain low thanks to the staggered maturities of corporate loans.

“I think many have a mistaken view of a ‘catastrophic sell-off’. Even in an adverse scenario, it would more likely be a slow, orderly exit from positions,” he said.

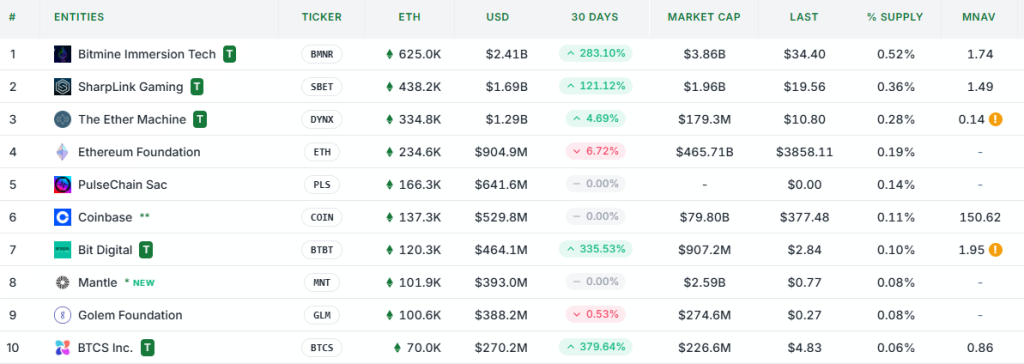

ETF hype

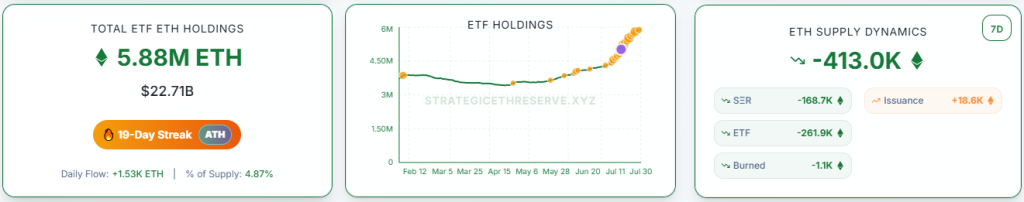

Net inflows into spot exchange-traded funds have continued for 19 straight days. Combined assets under management (AUM) have reached 5.88 million ETH ($22.71bn, nearly 5% of Ethereum’s circulating supply). Over the past seven days alone, the total rose by 261,900 ETH.

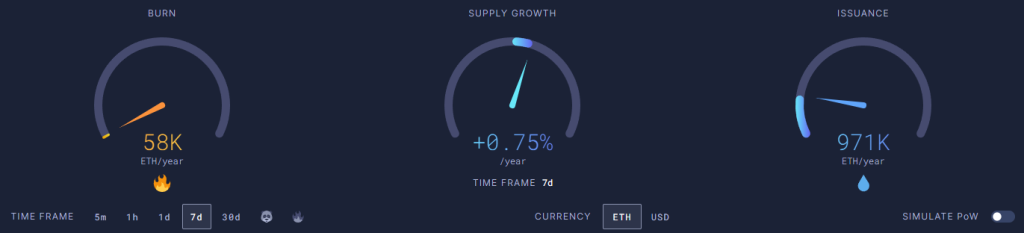

Over the same period, just 18,600 ETH were issued on the network. Against rising interest in corporate reserves (up 168,700 ETH in a week), there is a notable imbalance: demand from large holders far outstrips supply.

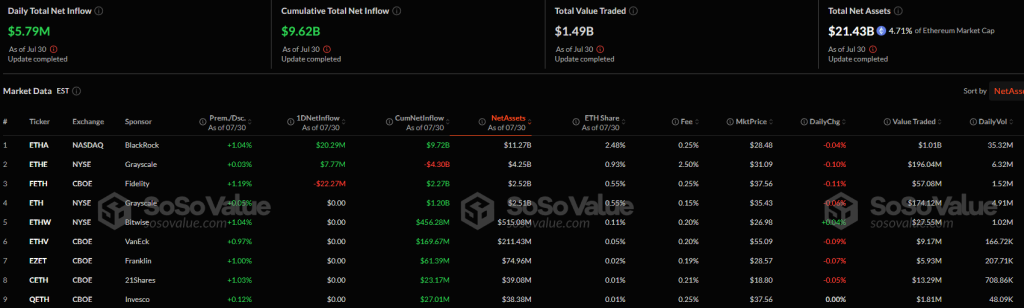

Cumulative inflows into spot Ethereum ETFs since the instruments launched in July last year have reached $9.62bn. The largest AUM is BlackRock’s ETHA at $11.27bn.

A new market architecture?

The potential launch of staking-enabled Ethereum ETFs in the United States could attract large institutional capital and create competition for bitcoin ETFs, some analysts believe.

Speaking to Cointelegraph, 10x Research head of research Markus Thielen noted that the new functionality would lift ETF returns and could reshape the market.

NovaDius Wealth Management president Nate Geraci wrote that after the SEC recently acknowledged Nasdaq’s 19b-4 filing to add staking to BlackRock’s ETHA product, the mechanism “may come under the regulator’s spotlight.”

One item left on my checklist from November…

Staking in spot eth ETFs.

Today, SEC acknowledged Nasdaq 19b-4 for staking in iShares Ethereum ETF.

My guess? This is next on SEC’s hit list.

Sooner rather than later.

Before any addn’l spot crypto ETFs. https://t.co/40brAYlrI0

— Nate Geraci (@NateGeraci) July 30, 2025

Thielen believes the potential uplift in returns could boost demand for spot Ethereum ETFs and enliven options markets.

According to him, arbitrage between spot ETFs and ether futures already yields about 7% annually. Staking increases that by a further 3%.

“The net return without leverage is about 10%. With 2–3x leverage, institutional investors can expect 20–30% per year from this strategy,” he noted.

He added that approval of the new instruments could significantly intensify capital inflows into Ethereum, “ushering in a new era.”

Earlier, Santiment experts found a worrying signal for ether supporters — a surge in mentions of the cryptocurrency on social media to a level of “extreme euphoria”. They say this could foreshadow a correction.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!