Corporations Boost BNB Reserves: Who’s Buying and Why

Public companies are actively building reserves in Binance’s native token (BNB) as part of a diversification strategy. With a market capitalization of $119 billion, BNB has secured a spot among the top 200 global assets, surpassing Nike.

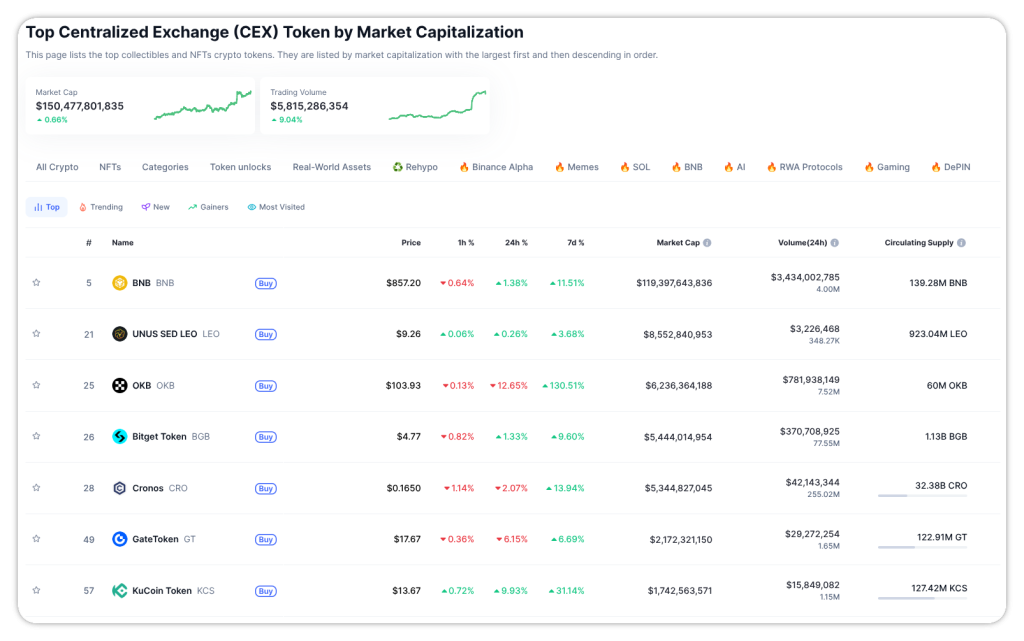

In rankings, BNB consistently holds the fifth position, trailing only Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and XRP. Among exchange tokens, it remains the leader in market capitalization by a significant margin.

In a recent report, Binance analysts note that corporate interest in BNB is driven by a combination of factors: strong financial performance, the token’s practical value, and the opportunity to access the ecosystem of the largest crypto exchange in the absence of its publicly traded shares.

A Wave of Corporate Buyers

On August 11, BNB Network Company (BNC), the treasury arm of CEA Industries, announced the acquisition of 200,000 BNB worth approximately $160 million.

On August 5, BNC closed a $500 million private placement to support its treasury strategy. The round was led by 10X Capital and YZi Labs, founded by Binance’s Changpeng Zhao (CZ).

The company stated its intention to attract more institutional players to the BNB ecosystem, which is underrepresented in the United States.

In July, Windtree Therapeutics signed a $60 million securities purchase agreement to launch a BNB treasury strategy. The company plans to diversify its corporate reserves by adding crypto assets to traditional instruments.

Nano Labs has already expanded its digital reserves to $160 million, with approximately $50 million in BNB.

“The total potential demand already exceeds $1.2 billion. […] Public companies are claiming 1% of its supply, which already surpasses the equivalent figure for Ethereum,” the Binance Research report states.

Additionally, in early July, the government of Bhutan, together with local digital bank DK Bank, implemented the Binance Pay service for tourists. In early 2025, digital assets, including BNB, were included in the strategic reserves of Bhutan’s Special Administrative Region.

What Attracts Institutions to BNB

According to CryptoQuant, in 2025, BNB showed the smallest decline among major altcoins—around 30%. Ethereum, Solana (SOL), and XRP experienced deeper corrections during the same period.

The five-year Sharpe ratio of the token reached 2.5, indicating a $2.5 return for every dollar of risk taken. This figure surpasses many traditional market indices and large-cap crypto assets.

According to the Binance Research report, this risk-reward ratio makes BNB attractive for corporate treasuries seeking a balance between potential returns and capital preservation.

Companies in crypto-friendly jurisdictions use BNB not only as a reserve asset. They gain access to staking tools and reward programs within the Binance ecosystem, generating additional yield while maintaining liquidity.

In July, the BNB Chain team unveiled a development roadmap for the network through 2026.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!