Crypto Analyst Explains Record Ethereum Staking Withdrawal

According to the expert, the increase in requests is linked to profit-taking.

Ethereum has witnessed its largest queue for staking withdrawals, exceeding 910,000 ETH valued at $3.7 billion. A crypto analyst known as Bull Theory has shed light on the reasons behind this surge in activity.

Ethereum Validator Exits Explode in 30 Days! From just 1,920 ETH in the exit queue a month ago…

to a record-breaking 893,599 ETH ($3.5B+) today.What’s driving this historic surge — and should stakers worry? Let’s break it down 🧵👇 pic.twitter.com/isYbDw68Fu

— Bull Theory (@BullTheoryio) August 18, 2025

On July 16, the total withdrawal requests amounted to 1,920 ETH. By August 19, this figure had reached a historic high of 910,461 ETH.

The PoS architecture of Ethereum includes a safeguard mechanism: no more than 1,800 validators (~57,600 ETH) can exit daily, and no more than 900 (~28,800 ETH) can enter. This prevents sharp fluctuations and ensures network stability. The current withdrawal queue will be processed over 15 days.

According to Bull Theory, the increase in requests is linked to profit-taking. Many validators locked their funds in staking when the price of ether fluctuated between $1,000 and $2,000.

On August 13, Ethereum tested the $4,700 mark, nearing its all-time high. At the time of writing, the price of the second-largest cryptocurrency by market capitalization exceeds $4,200.

Another reason is the optimization of staking by large players. The expert noted that they are consolidating smaller nodes of 32 ETH into larger pools of 2,048 ETH to simplify management and reduce costs.

“To do this, they first need to withdraw old validators, which increases the exit queue,” explained Bull Theory.

Meanwhile, other investors are transferring funds to liquid staking and protocols like EigenLayer to enhance returns.

“Validators are exiting, withdrawing ETH, and reinvesting them through liquid staking or EigenLayer,” the analyst wrote.

How Will This Affect Ethereum’s Price?

Bull Theory emphasized that staking exit queues do not equate to selling pressure. According to him, over 35 million coins are locked in the Beacon Chain, which “indicates strong long-term commitment” from market participants.

“Despite the record number of validator exits, ETH’s price dynamics remain strong,” he noted.

The key resistance level is $4,868. A breakthrough above this mark could trigger a new momentum. As long as ether’s price stays above $3,900, the overall upward trend remains intact, Bull Theory believes.

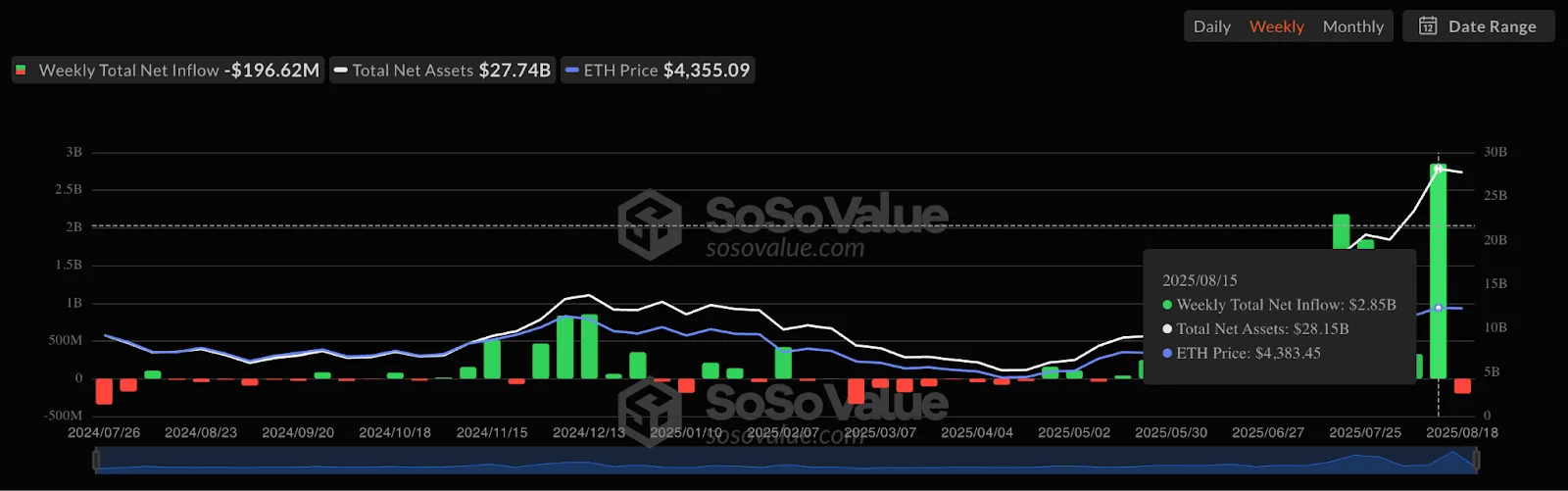

Fundamental analysis points to the strength of the trend. Daily inflows into Ethereum ETFs are steadily increasing. Over the past week, crypto funds based on the second-largest cryptocurrency by market capitalization attracted $2.8 billion.

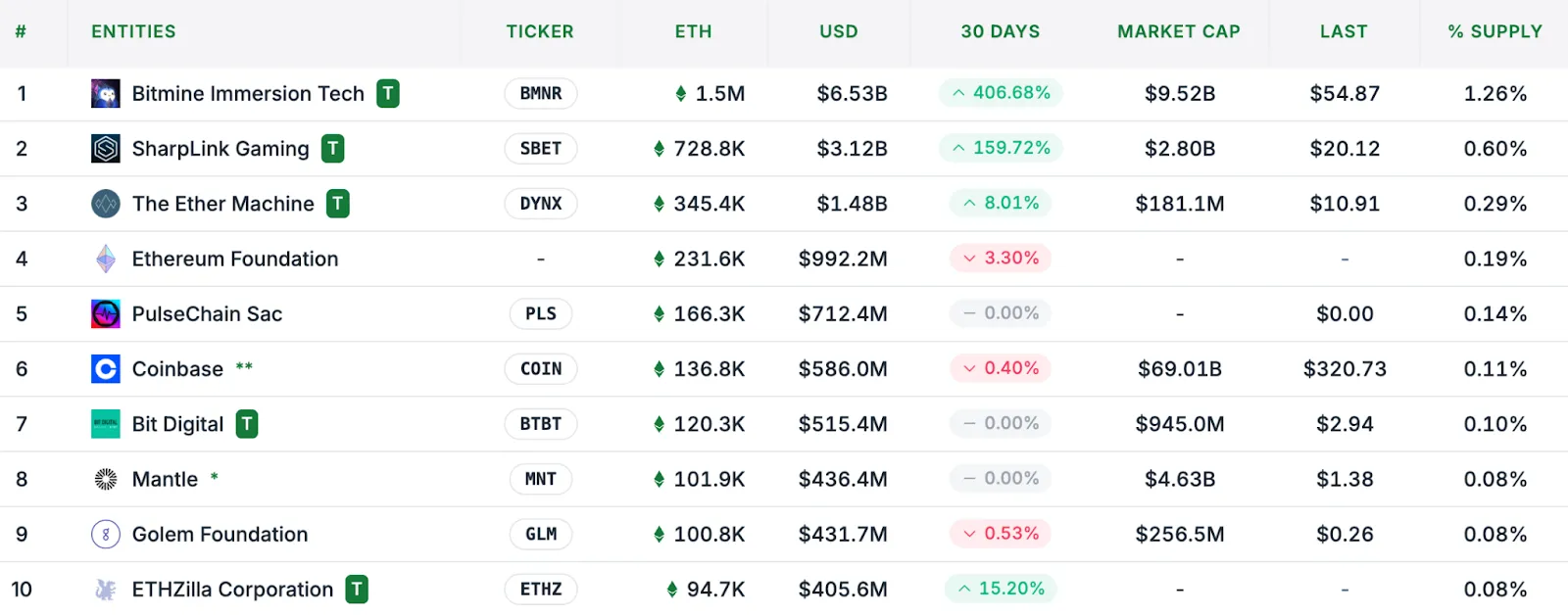

Meanwhile, corporate treasuries continue to accumulate ETH. As of August 19, public companies manage 4 million coins worth $17.5 billion — 3.3% of the total ether supply.

“More companies are holding ether in their corporate treasuries, indicating trust in ETH as a reserve asset alongside Bitcoin,” Bull Theory emphasized.

The 35 million ETH in staking, amid high demand for cryptocurrency, also create conditions for a supply shock. Meanwhile, the GENIUS Act, supporting stablecoins on Ethereum, and active asset tokenization on the network of the second-largest cryptocurrency strengthen its role as the foundation of the digital economy, the analyst believes.

“As TradFi merges with DeFi, ETH becomes the base layer of the financial internet. […] The GENIUS Act supports stablecoin issuers like Circle and PayPal, most of whom build their solutions on Ethereum. This confirms the ecosystem’s strength and prepares it for explosive demand in the future,” he added.

Earlier, Standard Chartered raised its forecast for ether to $7,500. According to the bank’s analysts, by 2028, the crypto asset’s price could reach $25,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!