Crypto firms’ deposits at Silvergate Bank reach $11.8 billion

In the second quarter of 2021, the digital-asset-friendly Silvergate Bank accepted $4.3 billion in deposits from cryptocurrency companies, their average balance stood at $9.9 billion. The majority of the funds (~$2.4 billion) came from Bitcoin-exchange clients.

We’re excited to announce our Q2 earnings today! This quarter, we saw continued success from our digital currency solutions, including our stablecoin infrastructure capabilities, which are powered by the Silvergate Exchange Network (SEN). https://t.co/3M0BCx5wyY pic.twitter.com/byfHRGROu0

— Silvergate Bank (@silvergatebank) July 20, 2021

Silvergate serves 1,224 digital-industry clients. From April through June 2021, their number rose by 120, and over the past year by 343.

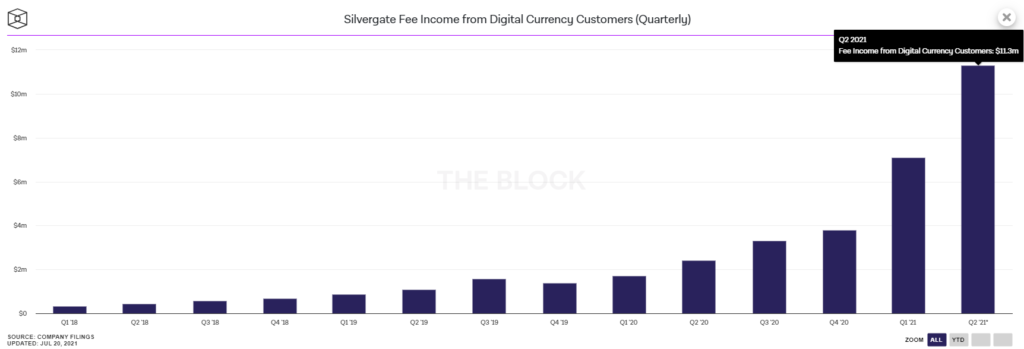

The bank’s fee income from such clients reached $11.3 million. By comparison: for the first three months of 2021 the figure was $7.1 million, and in Q2 2020 — $2.4 million.

According to Silvergate CEO Alan Lane, during the period the company nearly doubled its pre-tax income.

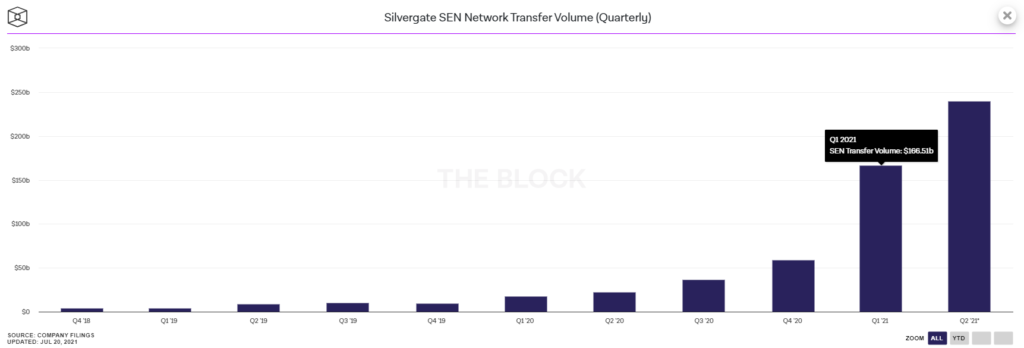

“Our success remains driven by the strong demand for our digital currency solutions, which are powered by the Silvergate Exchange Network [SEN],” said the CEO.

SEN is a payments network enabling instantaneous transfers necessary for arbitrage in digital-asset markets. In Q2 2021, transfer volume in it reached $239 billion, up 44% from the same period last year.

Lane noted that it was SEN that drove the growth of deposits from cryptocurrency clients. This figure fluctuates: during the period, at its peak it reached $11.8 billion, at the minimum — $6.8 billion.

“We prudently place these deposits in yield-bearing assets, including the purchase of short- and long-term securities totaling $4.5 billion during the quarter, providing adequate liquidity to support our clients in their SEN operations,” he added.

The bank continues to develop the Bitcoin-backed lending program SEN Leverage. According to the report, as of June 30 the outstanding loans under this initiative totaled $203.4 million.

Silvergate is also working on “stablecoin infrastructure.” In particular, the bank is the “exclusive issuer” of Facebook’s Diem pegged to the US dollar.

Shares of the lender are traded on the NYSE. On July 20 the shares closed at $98.76, up 14.35% for the day.

Earlier in March, Fidelity Investments’ digital assets division became a custodian in the SEN Leverage program.

Read ForkLog Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!