Crypto Funds Attract $1.07 Billion After Weeks of Outflows

Crypto funds attract $1.07 billion, ending four-week outflow streak.

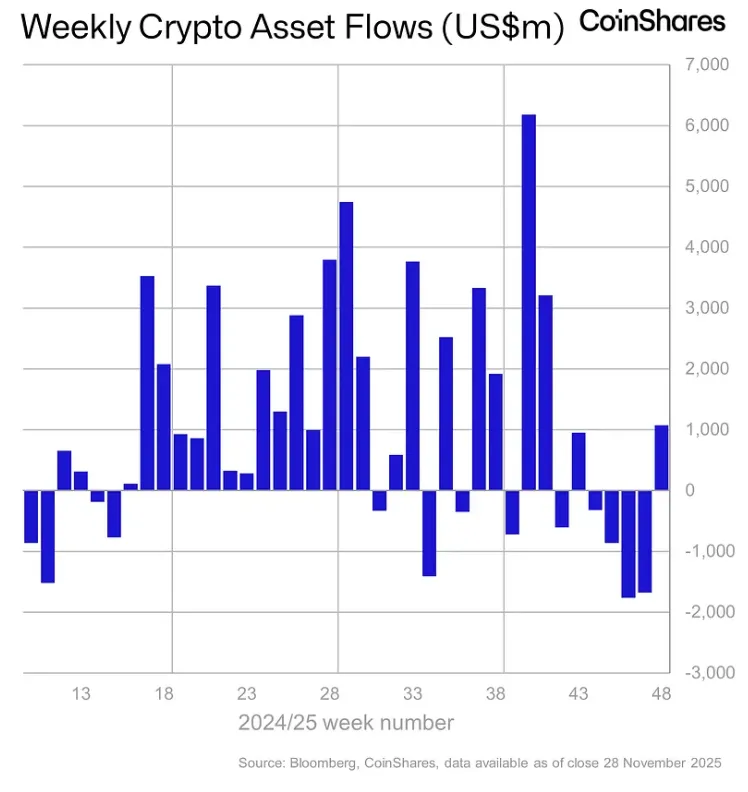

From November 21 to 28, inflows into cryptocurrency investment products reached $1.07 billion. This positive trend ended a four-week series of outflows totaling $5.7 billion, according to a report by CoinShares.

Analysts attributed the change in sentiment to comments by John Williams of the Federal Reserve. His remarks on a “restrictive” monetary policy bolstered market hopes for a rate cut as early as December.

Activity remained low due to Thanksgiving, with trading volumes at $24 billion compared to a record $56 billion the previous week.

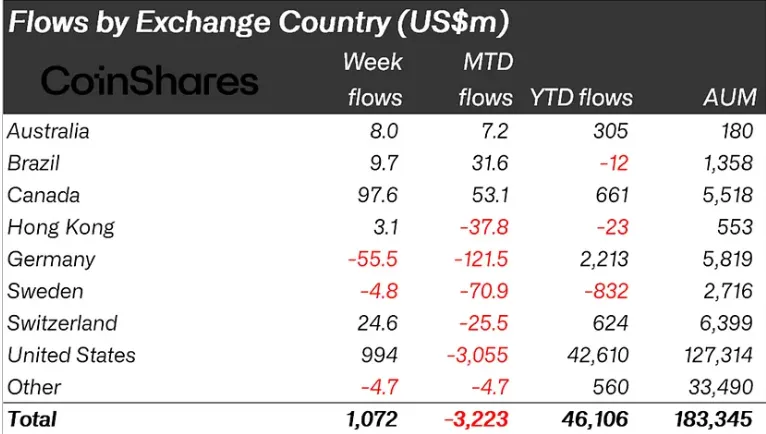

Despite the holiday, the majority of capital came from the United States—$994 million.

Canada ($97.6 million) and Switzerland ($24.6 million) also showed positive dynamics. A significant outflow was recorded in Germany ($55.5 million).

Asset-specific situation:

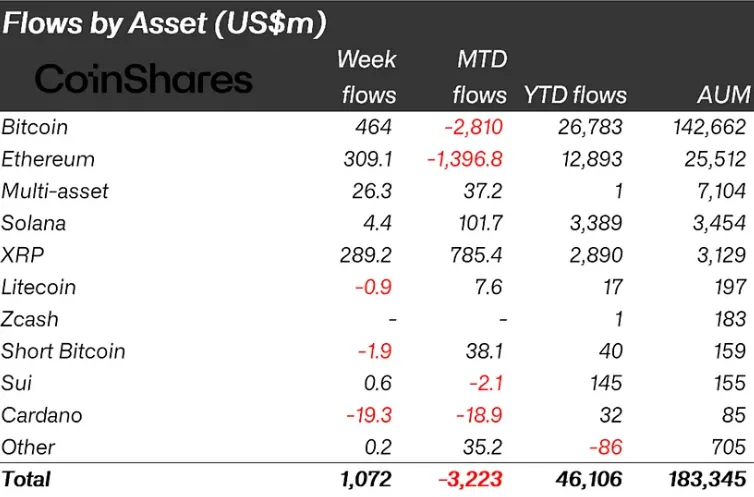

- Bitcoin: Products based on the first cryptocurrency attracted $461 million: investors are moving away from betting on price declines, withdrawing $1.9 million from short instruments;

- Ethereum: Inflows amounted to $308 million amid improved market sentiment;

- XRP: A record weekly inflow of $289 million was recorded: the increased interest is linked to the recent launch of a ETF in the US. Over the past six weeks, the asset has attracted funds equal to 29% of assets under management (AUM);

- Cardano: Products based on the coin lost $19.3 million (23% of AUM).

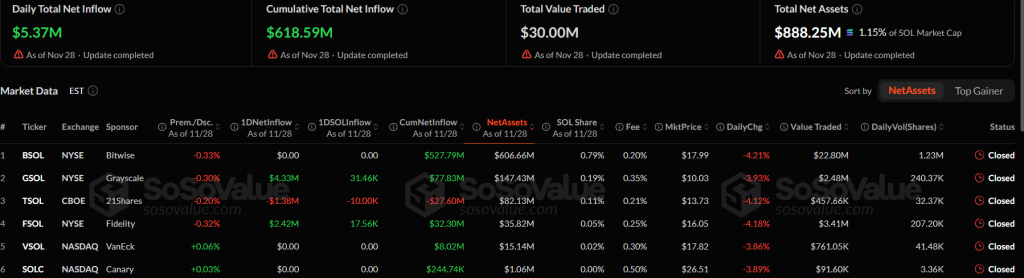

On November 28, the Solana-based spot exchange-traded fund sector recorded a net capital inflow of $5.37 million.

The leading fund in attracting capital was Grayscale’s GSOL, with $4.33 million. Fidelity’s FSOL attracted $2.42 million.

TSOL from 21Shares showed negative dynamics, with investors withdrawing $1.38 million. Other issuers, including Bitwise and VanEck, saw no activity.

The total assets under management in Solana-ETFs amount to $888.25 million. The cumulative inflow since launch has reached $618.59 million.

In contrast to fluctuations in the Solana sector, XRP-based instruments demonstrate remarkable stability: capital inflows into these funds have continued for nine consecutive trading sessions.

Earlier, from November 15 to 21, outflows from cryptocurrency investment products amounted to $1.94 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!