Crypto Funds Attract $2.7 Billion in a Week

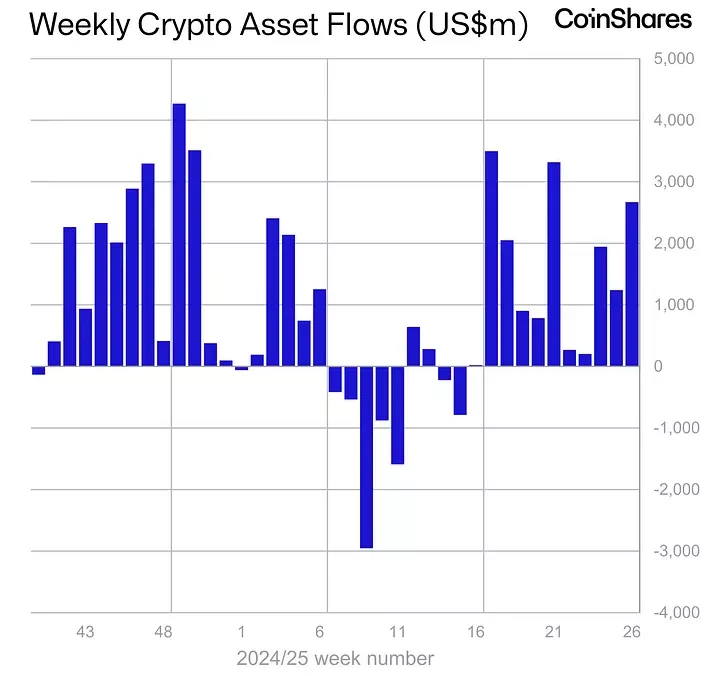

Between June 21 and June 27, cryptocurrency funds saw inflows amounting to $2.7 billion. This marks the eleventh consecutive week of capital influx into these structures, according to a report by CoinShares.

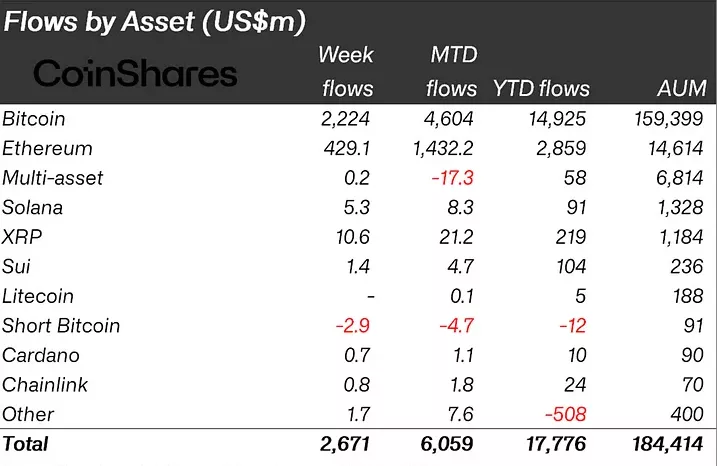

Since the beginning of the year, funds have collectively attracted $17.8 billion, nearing last year’s figure of $18.3 billion by the end of June. The total volume of assets in these instruments has reached $184.4 billion.

“We believe this sustained investor demand was driven by a combination of factors, primarily increased geopolitical volatility and uncertainty regarding monetary policy direction,” noted James Butterfill, Head of Research at CoinShares.

Bitcoin products were the main beneficiaries of the inflow for the week, accounting for $2.2 billion—83% of the total figure.

Ethereum-based instruments received $429 million. Since the start of the year, these funds have attracted $2.9 billion. In comparison, Solana’s total stands at just $91 million.

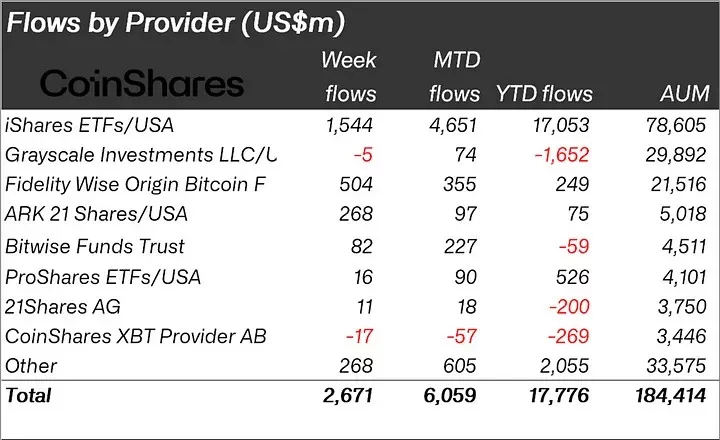

The weekly inflow was dominated by BlackRock’s Bitcoin ETF, which saw $1.5 billion. This year, investors have poured $17 billion into iShares.

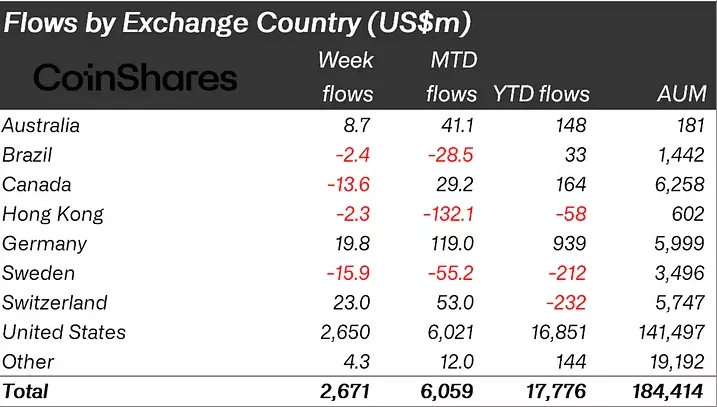

On a regional level, the week’s inflows were almost entirely driven by US-registered products, amounting to $2.65 billion. Funds from Switzerland and Germany contributed modestly with $23 million and $19.8 million, respectively.

In Canada, Sweden, and Brazil, there was a slight outflow from products, while in Hong Kong, the outflow has already exceeded $132 million since the beginning of the year.

Earlier, the total capital inflow into crypto funds amounted to $1.24 billion in the previous week.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!