Crypto funds attract inflows for a sixth consecutive week

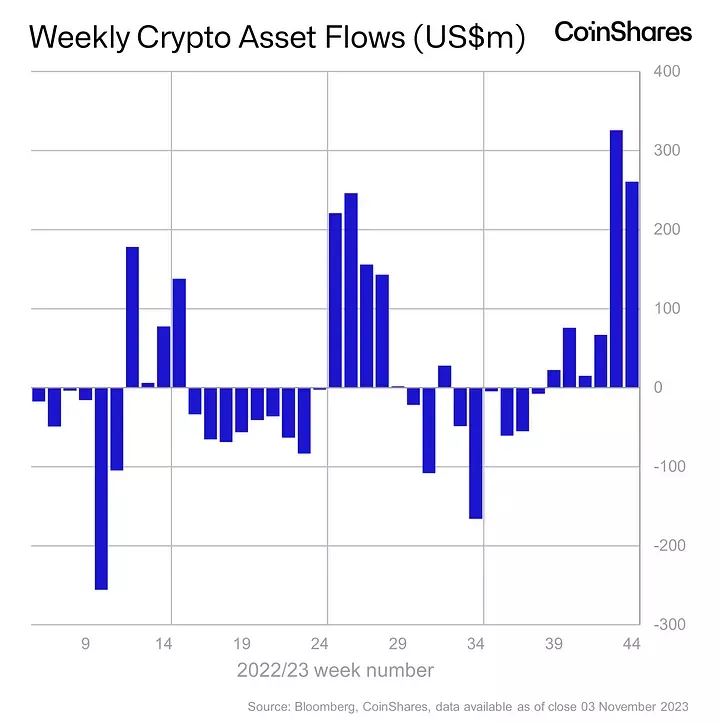

Net inflows into digital-asset investment products for the period through November 3 totalled $261 million, after a record $326 million in July 2022 the previous week. The figures come from CoinShares.

The positive trend extended to a sixth consecutive week. Over this period, investors allocated $767 million.

Year-to-date total stands at $847 million, compared with $736 million for all of 2022. The current pace of inflows is the strongest since the bull market ended in December 2021.

Analysts cited expectations for the approval of a spotETF based on digital gold, and macro data that raised questions about the rationale for continuing the Fed’s aggressive monetary policy.

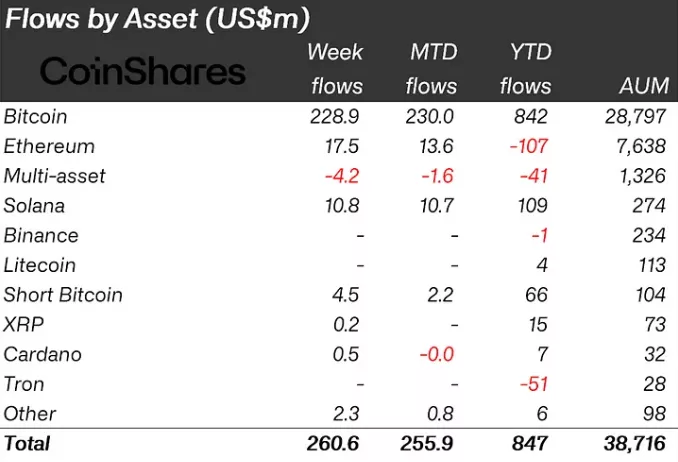

87.6% of total inflows ($228.9 million) went to Bitcoin-related products (the previous week — $296.3 million). Year-to-date, the figure has reached $842 million.

Into structures enabling short exposure to the first cryptocurrency, clients of asset managers invested $4.5 million ($15.4 million the previous week).

Ethereum-focused funds attracted $17.5 million, the highest since August 2022 (the previous period recorded an outflow of $6 million).

Solana-based instruments again stood out, attracting $11 million versus $23.9 million the previous week. Since the start of the year, investors have increased positions by $109 million.

Co-founder and CEO of the decentralized derivatives exchange SynFutures, Rachel Lin forecasted that the price of digital gold would reach $47,000 by the end of November 2023.

Earlier, Bernstein analysts pointed to $150,000 as a target for Bitcoin by January 2025, following the approval of spot Bitcoin-ETF in the US.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!