Crypto Funds Lose $240 Million Following Trump’s ‘Liberation’ Tariffs

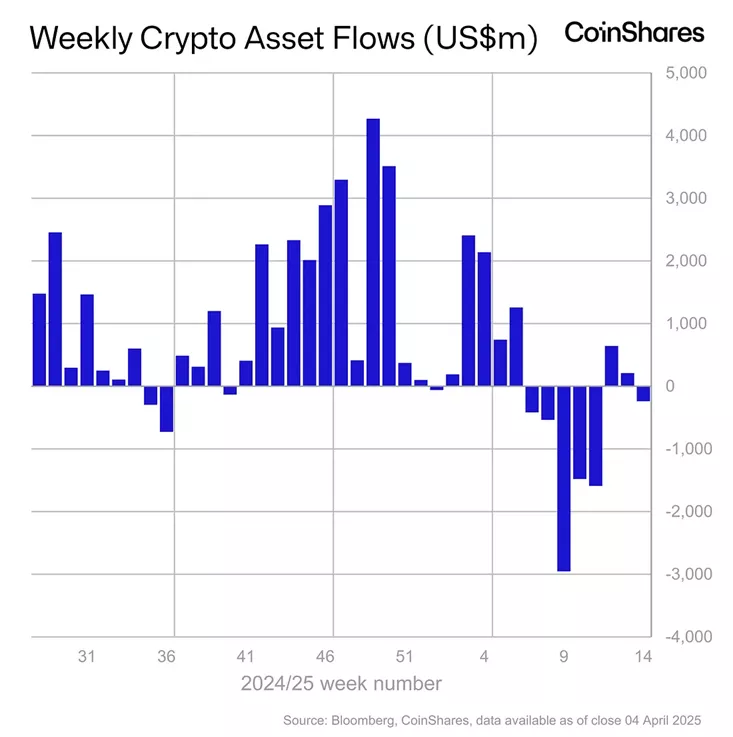

Between March 29 and April 4, clients of cryptocurrency investment funds withdrew $240 million following a $226 million inflow the previous week, according to data from CoinShares.

Analysts described this amount as “insignificant” amid the chaos in global markets following President Donald Trump’s ‘Liberation Day’ tariffs.

“MSCI World shares fell by 8.5% over the same period, demonstrating the resilience of digital assets in times of economic uncertainty,” the experts emphasized.

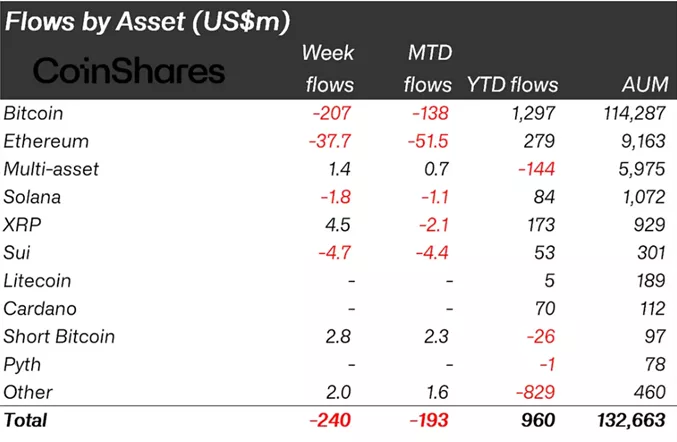

AUM rose by 0.8% to $132.6 billion.

The outflow was concentrated in instruments based on the first cryptocurrency ($207 million). The previous week, they attracted $195 million.

In the segment of U.S. spot Bitcoin ETFs, investors withdrew $172.7 million from products.

Altcoins also experienced negative dynamics: Ethereum funds saw an outflow of $37.7 million, while Solana and Sui recorded $1.8 million and $4.7 million respectively.

As reported in Nansen, the cryptocurrency market could reach a local bottom by June, with the future direction set by the outcomes of U.S. negotiations with major trading partners regarding tariffs, they believe.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!