Crypto funds post first outflow in four weeks

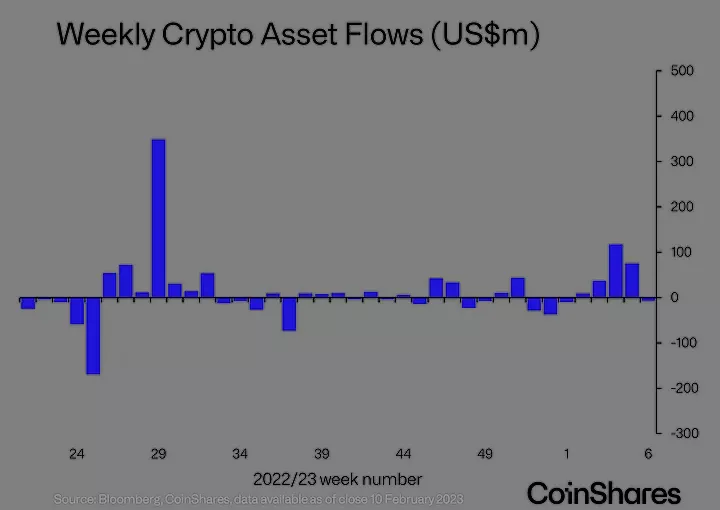

Net outflows from cryptocurrency investment products from February 4 to 10 amounted to $7 million, versus inflows of $23 million a week earlier. These estimates come from CoinShares analysts.

«After the release of macroeconomic data […] some investors were frightened by the prospect of further rate hikes by the Fed», — explained the analysts.

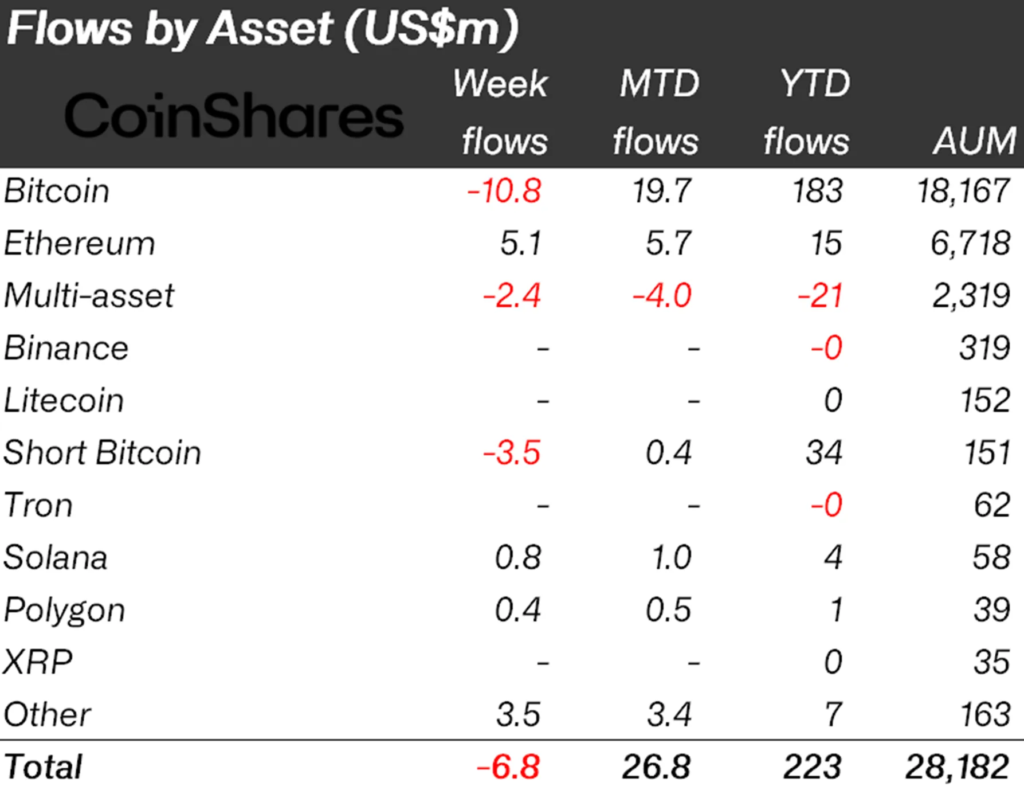

Traditional Bitcoin funds saw outflows of $10.9 million, compared with inflows of $68.5 million a week earlier. From the products that allow shorting Bitcoin, $3.5 million were withdrawn (in the previous reporting period they invested $8.2 million).

Outflows from products based on various altcoins totaled $2.4 million. The negative trend continued for the eleventh week in a row.

In altcoins, inflows were observed. Ethereum-based products attracted $5.1 million, Cosmos — $1.8 million, Solana — $0.8 million, Polygon — $0.4 million.

On the daily Bitcoin chart, moving averages formed a «golden cross» — a sign of a potential positive trend.

Earlier, Glassnode noted a transition phase from a bear market to a bull market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!