Cryptocurrency Product Outflows Reach $4.92 Billion in November

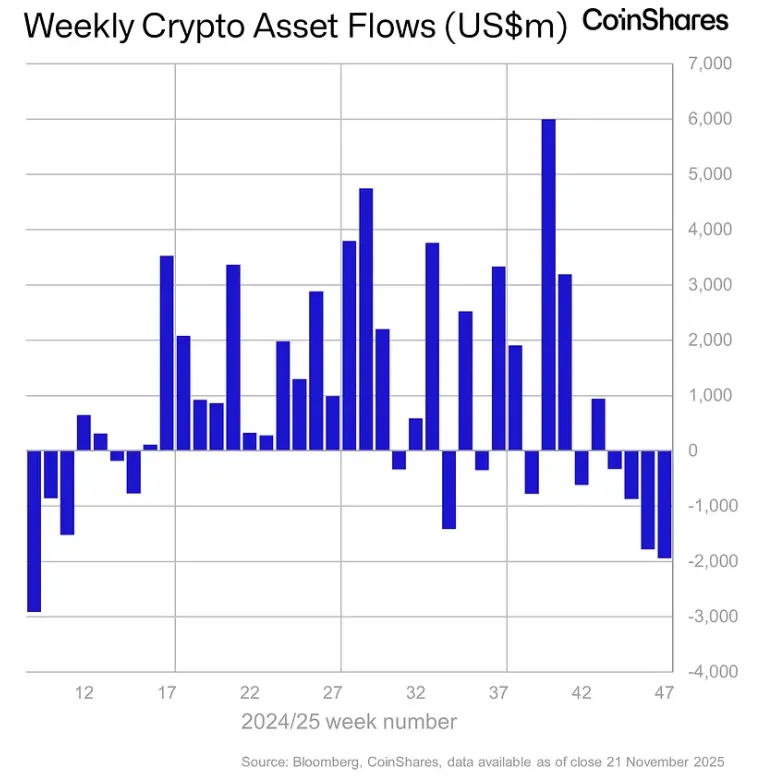

Outflows from crypto investment products hit $1.94 billion in a week, marking a fourth consecutive decline.

Between November 15 and 21, outflows from cryptocurrency investment products amounted to $1.94 billion. This negative trend has persisted for the fourth consecutive week, according to a report by CoinShares.

Over the month, investors withdrew $4.92 billion from crypto funds. Analysts have identified this series of outflows as the third largest since 2018. The volume of assets under management decreased by 36% due to falling prices and capital withdrawals.

Despite the overall negative trend, on November 21, market sentiment shifted. After seven days of continuous outflows, funds recorded inflows of $258 million.

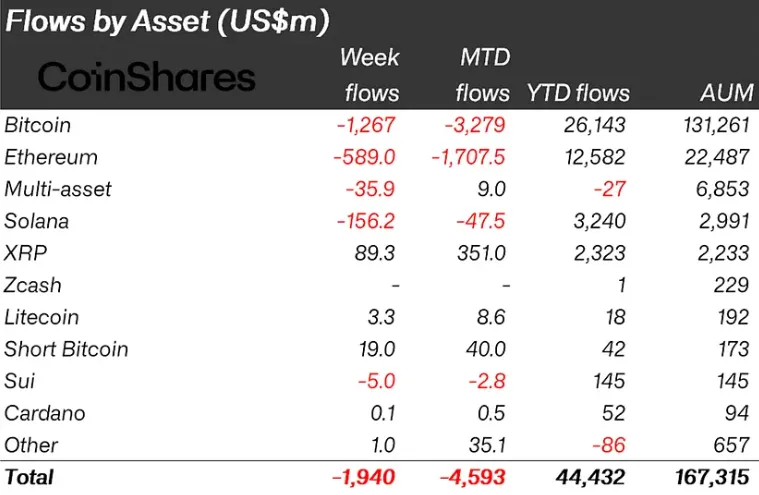

Bitcoin was the hardest hit, with $1.27 billion withdrawn from its products.

Meanwhile, instruments allowing short positions on digital gold attracted $19 million. Over the past three weeks, inflows into these products totaled $40 million.

Investors withdrew $589 million from Ethereum funds. Among other altcoins, Solana showed the worst performance with an outflow of $156 million. The only exception was XRP, with related instruments receiving $89.3 million in investments.

Since the beginning of the year, the net inflow into cryptocurrency investment products remains high at $44.4 billion.

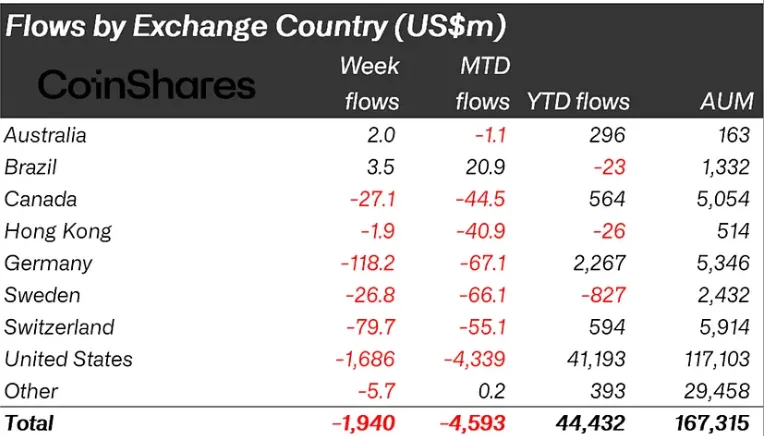

Investors from Brazil and Australia contributed $3.5 million and $2 million, respectively. The majority of outflows were from the US, totaling $1.68 billion.

Earlier in November, from the 10th to the 15th, investors withdrew $2 billion from cryptocurrency exchange products.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!