CryptoQuant Highlights Structural Shift in Bitcoin Capital Distribution

The leading cryptocurrency is experiencing not just another bull market, but a fundamental shift in capital distribution. This view was shared by CryptoQuant’s on-chain analyst known as OnChainSchool.

Two years ago, “dormant” coins—those that had not moved for more than seven years—were considered lost or held by early investors.

Now transactions involving them have become systematic: since 2023, the average monthly volume of transactions with “old” bitcoins has increased from 4900 BTC to 30,700 BTC. Meanwhile, the average transaction size has grown from 62 BTC to over 1000 BTC.

According to the analyst, this trend indicates a “coordinated redistribution of large capitals.”

“In this cycle, price is just a superficial indicator. The main change is in who controls the future,” OnChainSchool emphasized.

Major Companies Acquire Bitcoin

Corporations continue to increase their reserves of digital gold. On August 4, they added 630 BTC worth $72 million to their reserves, despite the asset’s price dropping to $113,000.

In July, the peak increase was 26,700 BTC—worth $3 billion in a single day, reports Cointelegraph citing Capriole Investments.

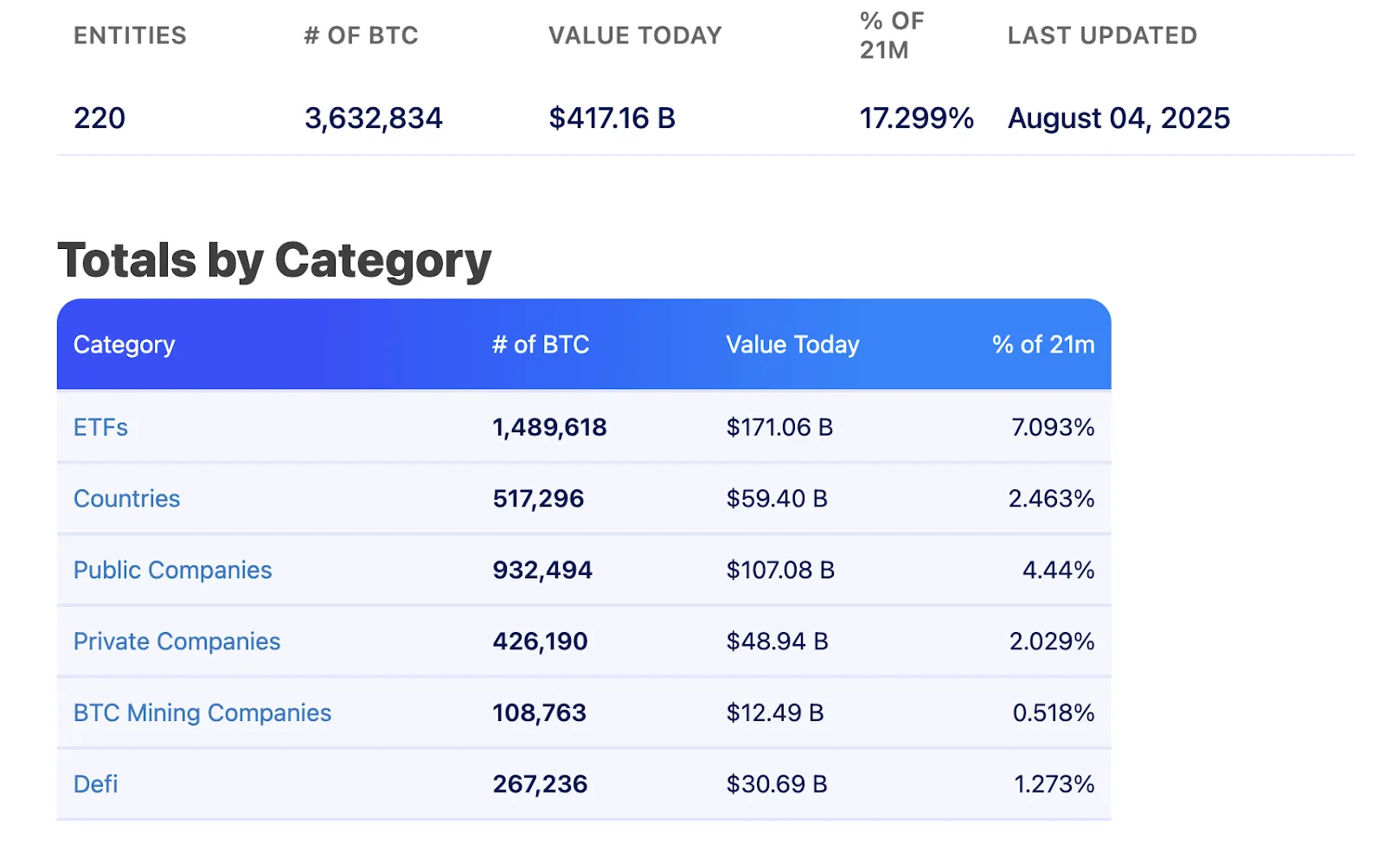

According to BitcoinTreasuries on August 4, public and private companies hold 1.35 million BTC valued at over $155 billion—more than 6% of the total issuance of digital gold.

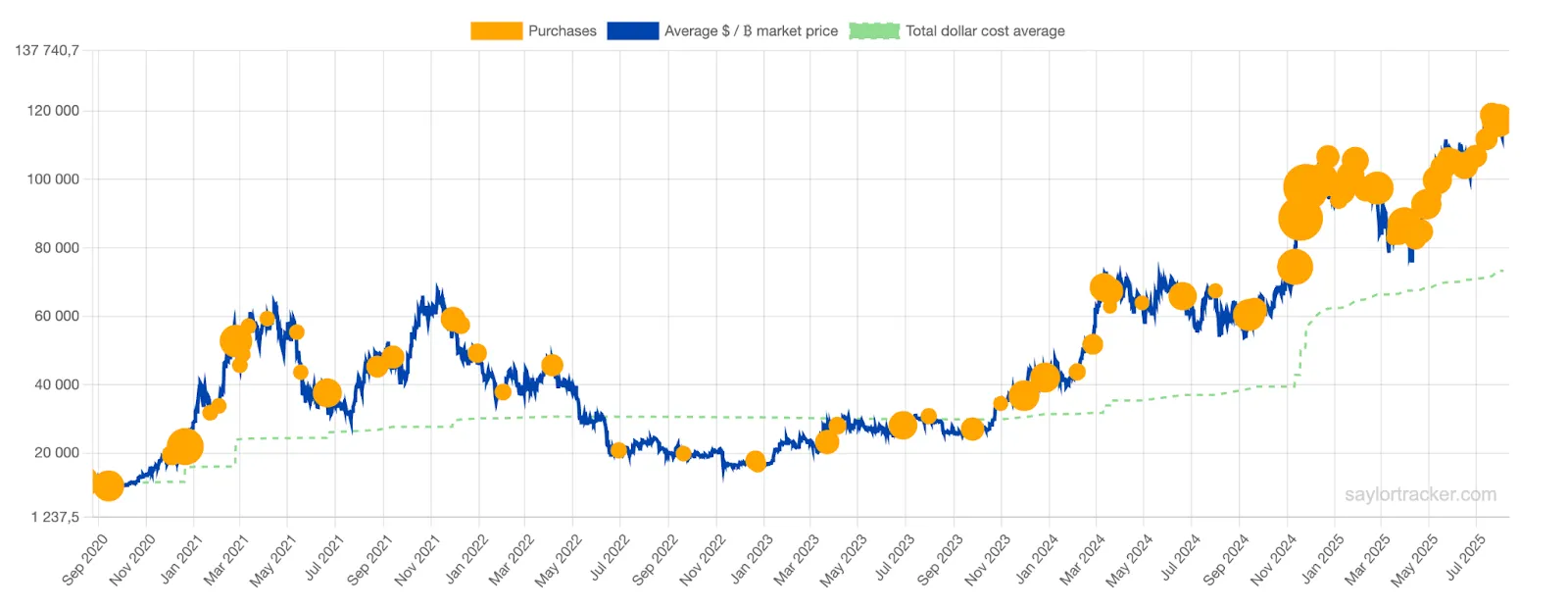

The largest holder of the first cryptocurrency remains Strategy. At the time of writing, Michael Saylor’s company manages 628,791 BTC. To reach a 3% share of the total bitcoin supply, it needs an additional 1209 BTC.

FACT: 🇺🇸 Strategy $MSTR is now only 1209 #Bitcoin away from owning 3% of the total supply of BTC

Current holdings 628,791 BTC 🔥 pic.twitter.com/cbZwyGpkgF

— BitcoinTreasuries.NET (@BTCtreasuries) August 5, 2025

On Monday, Strategy announced that in the past week alone, it purchased 21,021 BTC worth $2.46 billion. Since the U.S. presidential election in November 2024, the company has added 376,571 BTC to its bitcoin reserve, valued at $43 billion at the current price.

In second place for bitcoin holdings is MARA Holdings, Inc. Currently, the company manages crypto assets worth $5.8 billion. On July 27, the firm announced it would raise an additional $950 million to purchase digital gold.

Earlier in August, analysts at Galaxy Digital compared the trend of corporate crypto reserves to the bubble of the 1920s.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!