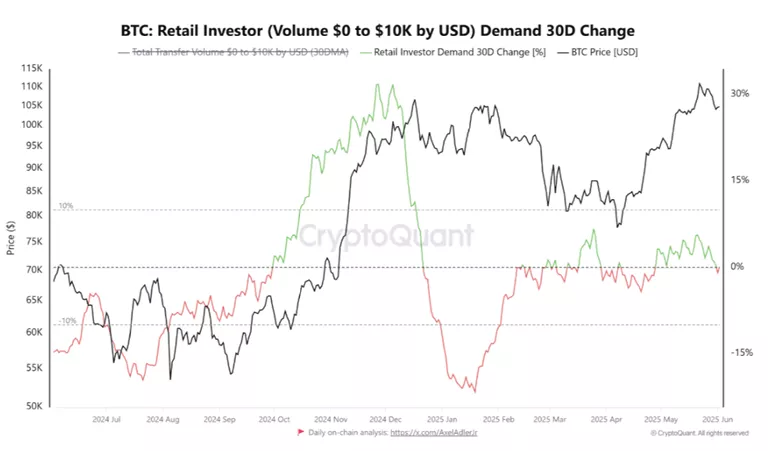

CryptoQuant Reports Lack of FOMO Buying Among Retail Bitcoin Traders

On-chain data indicates a decline in retail investor activity, limiting bullish pressure. This conclusion was reached by CryptoQuant.

The relevant indicator, assessing transactions worth less than $10,000, has decreased by 2.45% over the past 30 days.

“We still do not have a euphoria structure that supports the possibility of new upward impulses if sustained buying pressure is observed. However, this will depend on several factors external to the first cryptocurrency, which could influence short-term sentiment and deter major players,” the experts warned.

Alternative View

Bitget COO Vugar Usy Zade is convinced that retail investors have moved away from “unbridled speculation” and shifted to more practical and sustainable use cases with Bitcoin.

The top manager explained the paradigm shift as “post-traumatic stress disorder” following the last cycle, as well as broader macroeconomic uncertainty due to actions by U.S. President Donald Trump.

Zade noted that after the correction in stocks, there is less free capital, and traders have become more prudent with their investments.

The expert also highlighted the growing role of DEXs, which currently account for nearly 10% of the cryptocurrency derivatives market.

“Full-scale bull and bear phases are a thing of the past. The evolution of the digital asset market marks the end of traditional boom and bust cycles defined by rallies and prolonged crashes,” concluded the Bitget COO.

Earlier, CryptoQuant identified $96,700 as a correction target for Bitcoin.

Rachel Lucas from BTC Markets noted that if the first cryptocurrency remains in the $103,000-$105,000 range, it will set the stage for a new wave of growth to $115,000.

As reported, Coinbase forecasted a positive impact on digital asset dynamics from the $5 billion reimbursement to FTX creditors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!