CryptoQuant Sets Bitcoin Target for Current Cycle

Following a price correction, certain metrics of digital gold suggest the continuation of a bull market phase with a target of $146,000, according to CryptoQuant.

Is it too late to buy in?

Bitcoin has surged 34% in November ’24, with the bull run in full swing.

The CryptoQuant Cycle Indicator shows that Cycle Peak hasn’t reached the Extreme Bull phase yet, indicating there’s still potential for growth.

How can you enter? A thread ? pic.twitter.com/DCIovZzuTI

— CryptoQuant.com (@cryptoquant_com) November 27, 2024

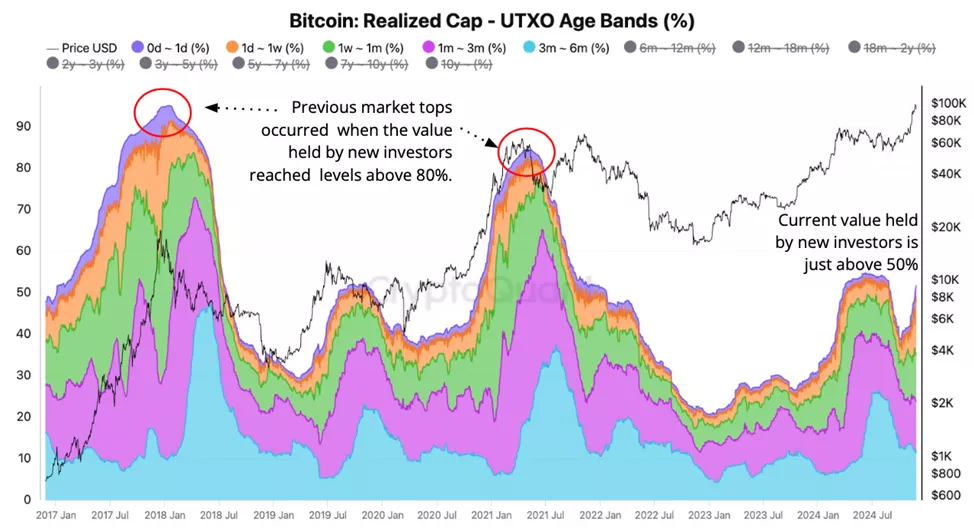

Analysts noted that currently, the share of coins held by “new investors” is slightly over 50% of the total supply. During previous rally peaks in 2017 and 2021, the indicator was over 90% and 80% respectively.

The current values are explained by moderate activity from retail investors. Often, the opposite situation is a “typical condition of market cycle extremes,” specialists indicated.

Since October, retail investors have reduced their holdings by 41,000 BTC, while whales have increased theirs by 130,000 BTC.

“Previous bull runs ended when the first category bought aggressively, and today this is not happening,” explained CryptoQuant.

The shift suggests a possible change in the nature of the accumulation phase, where institutional and large players have taken the lead. From November 18 to 22, inflows into spot BTC-ETFs reached a record $3.1 billion, coinciding with Bitcoin approaching $100,000.

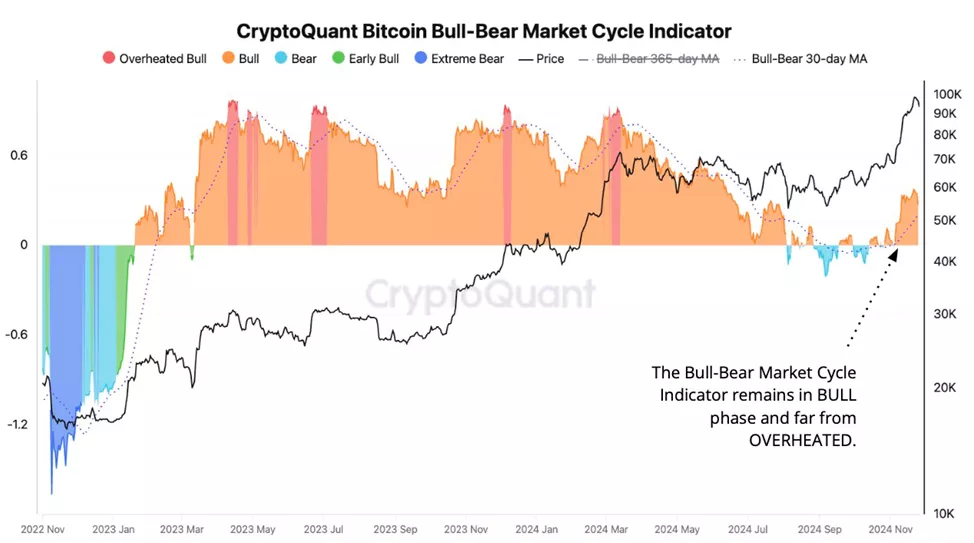

The CryptoQuant market cycle indicator has been in the bullish zone since early November and has continued to rise. The indicator has not entered the “overheating area,” unlike in March 2024, when Bitcoin reached ATH approaching $74,000.

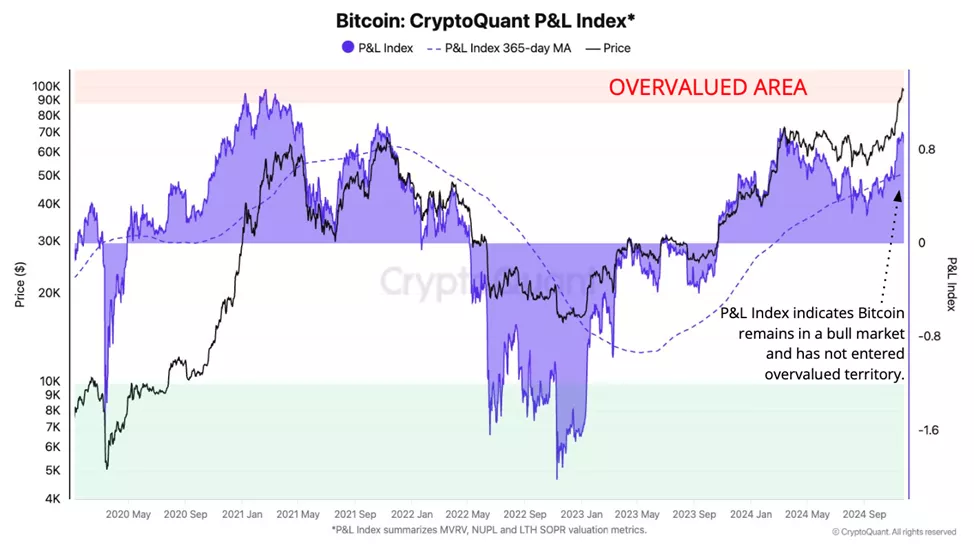

In terms of realized price, the upper benchmark for the first cryptocurrency’s rate is the $146,000 mark.

“This range served as a peak for quotes in previous bull markets. The P&L index in this bull run has not yet reached overbought levels. This indicates potential for continued growth,” concluded the experts.

Previously, experts described the current Bitcoin pullback as a pause before rising to $100,000.

Earlier, Pantera Capital predicted the price of the first cryptocurrency could rise to $740,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!