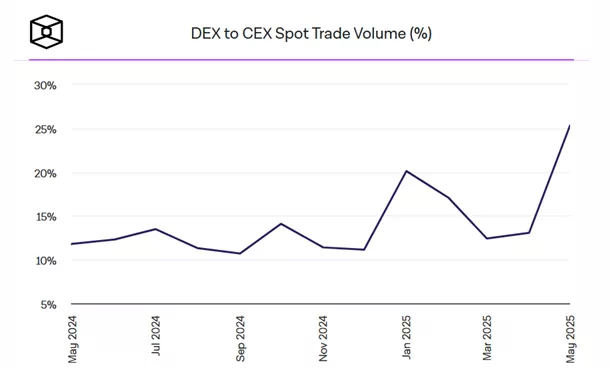

Decentralized Exchanges Capture 25.3% of Trading Volume Against Centralized Counterparts

In May, trading volume on decentralized exchanges (DEX) reached $410.2 billion, accounting for more than a quarter of the equivalent figure for CEX. According to The Block, this 25.3% share marks a historic high.

The previous record for the DEX/CEX volume ratio was 20.1%, achieved in January.

In May, PancakeSwap led decentralized exchanges with a trading volume of $171.6 billion. Aerodrome and PumpSwap followed, each with approximately $15 billion.

Simon Kim, CEO and partner at Hashed, described the data as a “paradigm shift from trust-based platforms to those based on code.” He added that the advantages of the latter include composability, open innovation, and cross-chain compatibility.

According to the expert, the surge in DEX trading volumes can be attributed to meme coin mania, improved user-friendliness of non-custodial wallets, and declining trust in centralized competitors.

Kim predicts that decentralized exchanges will surpass CEX in trading volume by 2028 and become dominant by 2030.

“Satoshi Nakamoto’s vision of P2P electronic money mechanisms is expanding into full-fledged financial ecosystems through DEX. These are the true embodiment of the blockchain spirit,” explained the CEO and partner at Hashed.

Earlier, the organization behind DEX Hyperliquid, Hyperliquid Labs, submitted comments to the CFTC on the potential approval of perpetual contracts and 24/7 cryptocurrency trading, advocating for DeFi integration.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!