DeFi Bulletin: Synthetix Launches Optimism, ShapeShift Integrates with Several DEXs

The decentralized finance (DeFi) sector continues to attract heightened attention from crypto investors and traders. ForkLog has assembled the most important events and news from the past three weeks in a digest.

Key metrics of the DeFi segment

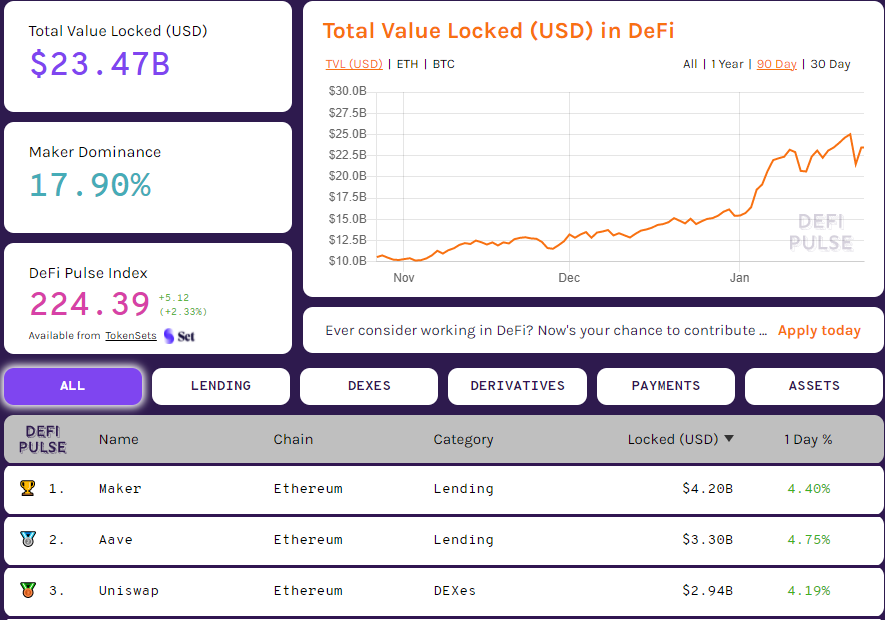

Total value locked (TVL) in DeFi applications reached $25 billion as of January 21. At the time of writing, the figure stood at $23.47 billion.

Data: DeFi Pulse.

The sector leader in this space is Maker, leading by a wide margin over the other lending service — Aave. TVL of these projects stands at $4.2 billion and $3.3 billion respectively. Behind them sits the largest decentralized exchange Uniswap ($2.94 billion).

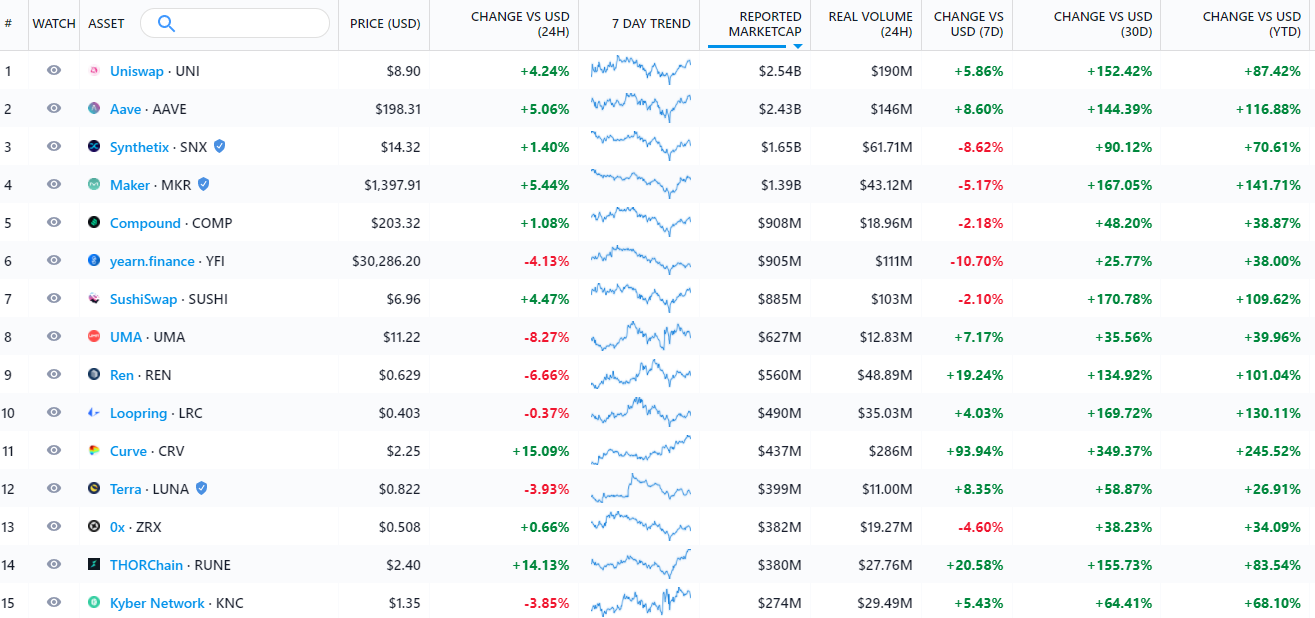

In the wake of broader market revival, the major DeFi assets have shown strong year-to-date growth — Curve (CRV) rose by 245%, SushiSwap (SUSHI) by 109%.

Data: Messari.

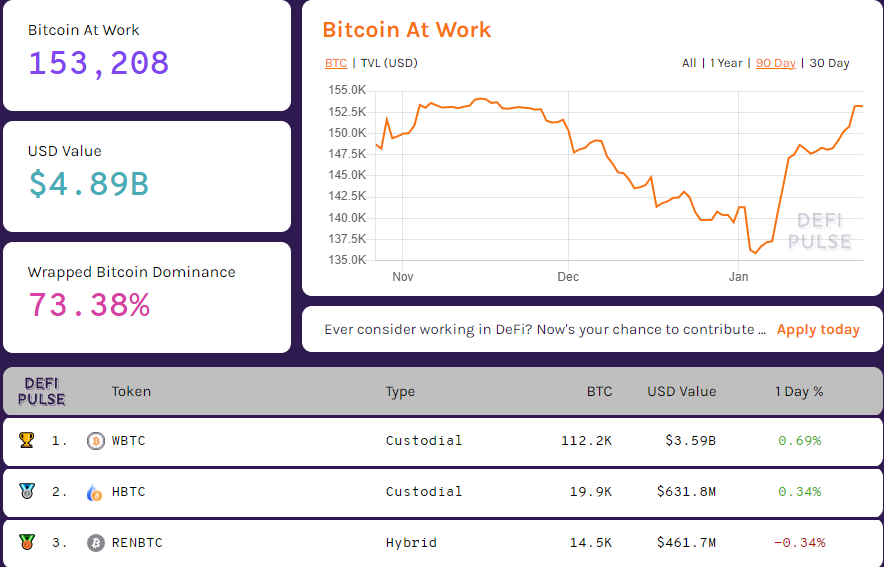

The total market capitalization of tokenized bitcoins stands at $4.89 billion. In this segment, Wrapped Bitcoin (WBTC) leads by a wide margin. Its share among “Bitcoin on Ethereum” stands at 73.3%.

Data: DeFi Pulse.

The combined market capitalization of the top-100 tokens in the segment stands at $28.6 billion, according to DeFi Market Cap.

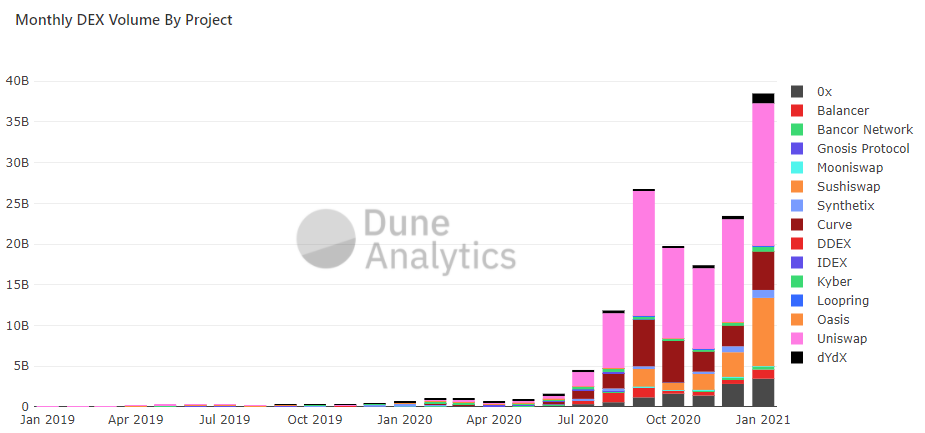

Trading volume on decentralized exchanges (DEX) over the last 30 days totaled $46.2 billion.

From the start of January, DEX trading volume has surpassed $30 billion, exceeding the record 2020 September level ($26.6 billion). Data: Dune Analytics.

Forty-eight point nine percent of turnover in the segment is accounted for by Uniswap. The second-largest DEX by turnover is SushiSwap (21%), with Curve in third place (10.8%).

Synthetix launches the Layer-2 Ethereum solution Optimism

The synthetic assets platform launched the Layer-2 Ethereum solution L2 Optimistic Ethereum.

The smart contracts of the Synthetix platform have been converted to the Optimistic Virtual Machine (OVM) format. Users can stake the native SNX token using the new service.

“This first migration phase was designed for small SNX holders, who may find interacting with the mainnet too costly due to high gas costs,” said the Synthetix blog.

Developers stressed that the mainnet launch is provisional. This means that errors, outages and other problems may occur.

ShapeShift moves to DeFi model to remove mandatory user registration

The cryptocurrency platform ShapeShift integrated with a number of DEXs to free users from onerous KYC procedures.

“Users will now be able to trade directly through external protocols, without relying on ShapeShift as an intermediary. This should simplify interaction with the platform and improve the user experience,” said representatives of the platform.

Ethereum and ERC-20 tokens are already available for trading on DEXs via ShapeShift’s interface. For each trade users will be awarded FOX tokens.

The company promised to add Bitcoin support in the first quarter of 2021. Representatives stressed that this will be BTC, not its tokenized Ethereum version.

Kyber Network announces major protocol update

The Kyber Network developers announced transitioning to version 3.0, which will turn the DEX into a “hub of targeted liquidity protocols for various DeFi use cases.”

The project team will launch the so-called dynamic market maker. It is expected to mitigate the so-called “impermanent loss”, arising from price volatility, and increase the platform’s capital efficiency.

Depending on market conditions, the algorithm will optimise fees for takers and liquidity providers. A programmable pricing curve mechanism will also be employed.

The transition to KyberNetwork 3.0 will occur in three stages — Katana and Kaizen. The first is expected in the first through the second quarter and involves the launch of KyberDMM and proposals for changes to KyberDAO and KNC. The completion is planned for the third quarter of 2021.

yEarn.Finance proposed to mint 6666 more YFI tokens

Eleven key participants of the DeFi project yEarn.Finance proposed increasing YFI issuance by 6666 tokens (~$200 million). The funds will be used to reward core developers and to create a reserve fund under community control.

One third of the 6666 YFI is intended to reward early investors and developers. Two thirds — 4444 YFI — will be allocated to create a reserve fund under the control of the yEarn.Finance operating fund.

The funds from the reserve fund are intended to finance the following directions:

- creating incentives for developers;

- liquidity mining programs;

- staking rewards;

- attracting specialists and the acquisition of external protocols;

- cross‑protocol incentives to strengthen collaboration within the ecosystem of projects.

Proponents believe that by implementing the proposal, yEarn.Finance can retain existing developers, attract new ones, and preserve its competitive position in the sector.

Coinbase and Polychain Capital supported the launch of Saddle Finance

The launch of Saddle Finance — a decentralized exchange operating on the AMM model.

The platform attracted $4.3 million in seed funding from Framework Ventures, Polychain Capital, Electric Capital, Coinbase Ventures, Nascent, Dragonfly Capital, Alameda Research and Divergence Ventures.

The new DEX will initially focus on the automatic exchange of so‑called “Bitcoin on Ethereum” — renBTC, WBTC, sBTC and tBTC. In the future the developers plan to add trading of other Ethereum tokens and stablecoins.

Saddle operates using a Proof of Authority mechanism. The project also plans to implement the concept of “virtual synths” from Synthetix.

Shortly after launch, Saddle Finance faced issues — one trader managed to make 12.6x on a single trade. The user bought 4.3 WBTC and subsequently bought back the coins at prices well below the market.

Quantstamp audit showed Saddle’s vulnerability to attack vectors previously used against Curve.

Maps.me startup raises $50 million to build DeFi ecosystem

The Maps.me project, behind the offline navigation app, raised $50 million to build a DeFi ecosystem.

The seed round was led by Alameda Research. Genesis Trading and CMS Holdings also participated.

The funds will be used to create an in-app multi-currency wallet with yield farming functionality and cashback capability.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!