DeFi reboot: how Arbitrum became Ethereum’s leading layer-2 solution

Ethereum remains one of the main pillars of the crypto economy, boosted by the rapid growth of the DeFi segment and the unrelenting hype around NFTs.

The enormous variety of applications, influx of new users, revived on‑chain activity and the associated MEV negative effects have led to Ethereum network congestion. Fees rose to unimaginable levels once again exposing the scalability problem.

The long‑term strategy to boost Ethereum’s performance relies on a completely different consensus mechanism and sharding. However, the current market dynamics and competition imposed by new DeFi ecosystems require technologies oriented to the short‑ and mid‑term horizons.

Various projects have stepped up efforts to build second‑layer scaling solutions (L2). These technologies are designed to reduce network load by bundling transactions and moving part of the computations outside Ethereum — into sidechains.

The Arbitrum solution developed by Offchain Labs quickly gained popularity — it has already been integrated by major DeFi projects such as Curve, SushiSwap, Uniswap and 1inch.

ForkLog examined the features of Arbitrum, uncovered the reasons for the rapid growth of the ecosystem built on it, and learned about the pitfalls of this trendy solution.

- Arbitrum’s L2 technology has quickly gained popularity among numerous DeFi projects thanks to its simple interface, EVM-compatibility, high speed and low fees;

- second‑layer solutions are not immune to failures due to bugs in code, many Dapps built on them look immature, liquidity volumes in them are relatively small;

- competition among L2 technologies is likely to grow, and the segment will continue to develop even after the Ethereum 2.0 launch.

Arbitrum features

There are two main paths to solving Ethereum’s scalability problem:

- On‑chain scaling — changes at the first level of the system, where, as with Bitcoin, the main economic activity currently occurs. Example: the move to Ethereum 2.0, involving a change in the consensus mechanism and other fundamental changes.

- Second‑layer solutions, operating over the blockchain. Their deployment does not require changes to the first layer; L2 uses L1 security parameters and other already existing elements, including smart contracts.

Second‑layer solutions are intended to scale the network in the short‑ and mid‑term. One of the most promising and advanced approaches to L2 scaling are Rollups. They reduce network load by bundling transactions and moving part of the computations outside Ethereum — into sidechains.

There are two main types of Rollups: ZK‑Rollups and Optimistic rollups. In the first case cryptographic proofs (SNARKs) are generated, used to include transactions in the blockchain and reconcile states of the base layer and the layer‑2 chain.

Optimistic rollups rely on “fraud proofs”. They “optimistically” assume by default that data published to the network is valid unless proven otherwise.

The Arbitrum technology is based on fraud proofs and, therefore, the “optimistic” method of L2 scaling. This approach has several significant advantages:

- Optimistic rollups are compatible with the Ethereum Virtual Machine (EVM). This means first‑layer applications can easily integrate Arbitrum’s L2 technology;

- high speed and low transaction costs with limited computational resource requirements and the security guarantees provided by the base Ethereum network.

Arbitrum is developed by Offchain Labs, a New Jersey‑based startup. In April 2019 the project raised $3.7 million in seed investments from Pantera Capital, Compound VC and BlockNation. The alpha version of the product in the same year attracted the interest of Coinbase Ventures, the VC arm of the largest US exchange, which invested an undisclosed amount.

According to Crunchbase, in spring 2021 Offchain Labs closed a Series A round of $20 million.

In August the company raised $100 million from Lightspeed Venture Partners, Polychain Capital, Ribbit Capital, Redpoint Ventures, Pantera Capital, Alameda Research and Mark Cuban, closing the Series B round. At the same time Offchain Labs announced the launch of the Arbitrum One mainnet.

Arbitrum’s rise in popularity

A few months before the mainnet launch UNI token holders supported Uniswap v3 on Arbitrum. The founder of the decentralised exchange, Hayden Adams, highly praised the potential and prospects of this L2 solution.

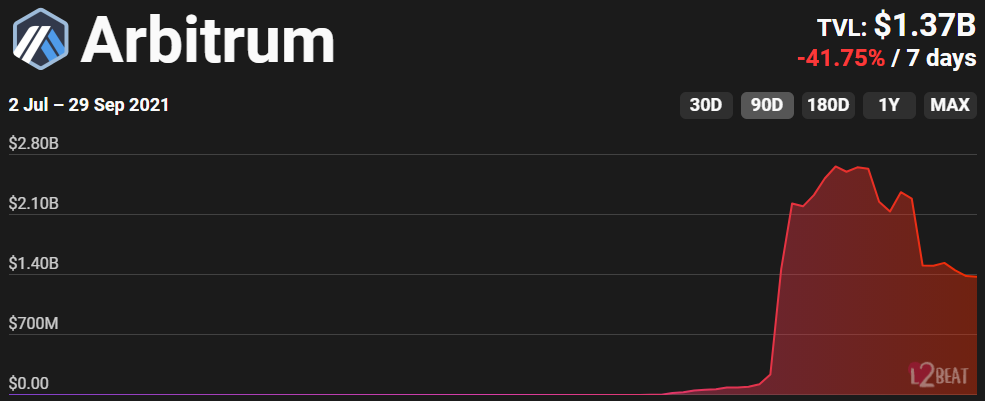

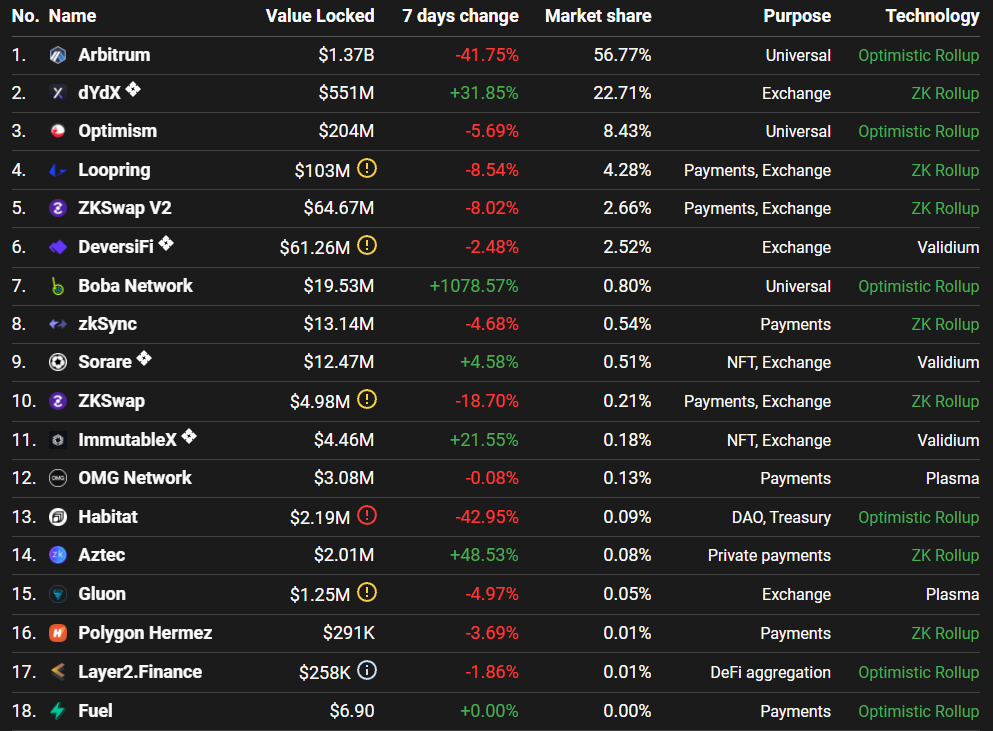

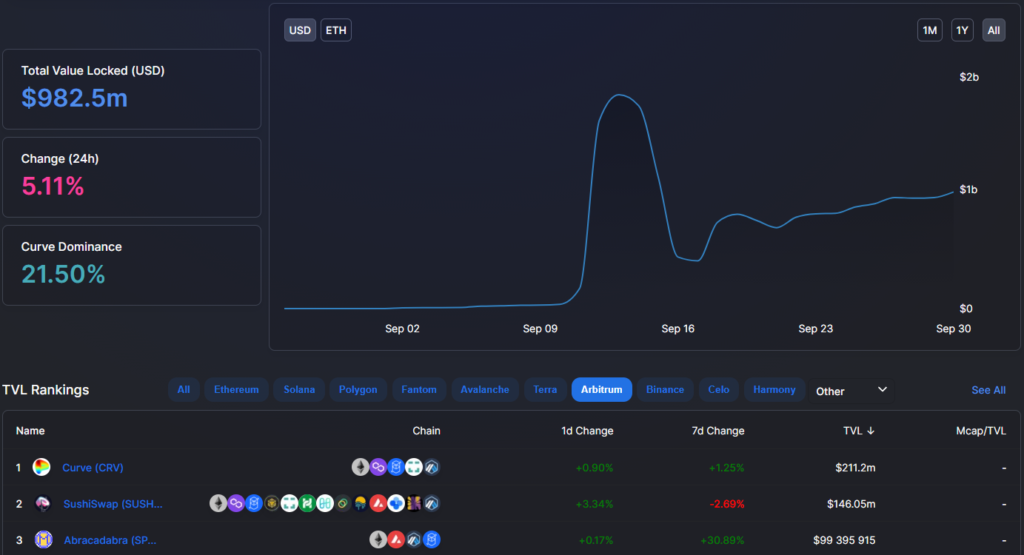

Within two weeks of the mainnet launch the total value locked (TVL) in Arbitrum reached $2.2 billion, significantly surpassing dYdX, Optimism, Loopring and other L2 protocols combined.

Exponential TVL growth began on September 9, when the startup launched the ArbiNYAN yield farming program based on the NYAN token.

Farm NYAN on Arbitrum! Eth pool launch 23:00 UTC pic.twitter.com/RiOlaNkQqn

— arbinyan (@arbinyan) September 8, 2021

The NYAN price surged from a few cents to nearly $8, then collapsed back to its original levels.

Shortly before the mainnet launch Reddit’s social content platform announced testing of Arbitrum for its Community Points program. In the prospect, the network plans to move MOONS and BRICKS tokens to the Ethereum mainnet.

Among large projects recently integrating Arbitrum is DeFi project 1inch Network. According to its representatives, L2 support reduced fees and delivered higher transaction speeds.

Against a backdrop of deteriorating market sentiment from the second half of September, activity in the Arbitrum ecosystem cooled somewhat — as of 30.09.2021 TVL stood at $1.37 billion (-41% in the last seven days).

Earlier in September, Arbitrum’s TVL growth momentum surpassed 2,000% in a week.

5/ Amount of Bridged ETH to Arbitrum

In the past 2 weeks, the amount of ETH that has been bridged over to @arbitrum has continued to increase

+2014% in the past 7 days with about 660k ETH bridged

Data sources: @l2beatcom @nansen_ai pic.twitter.com/PFHnSvujeB

— 🎮 Play Intern コープ (@playtern) September 18, 2021

Nevertheless, Arbitrum still far outstrips its L2 rivals in TVL.

Twitter analyst Play Intern believes the rise in Arbitrum’s ecosystem was driven by attractive yields from yield‑farming programs and users’ hopes for token airdrops.

6/ So what caused this surge of inflows?\n\nInitially, I believe this could be attributed to the crazily high yields of pool 0 “risk‑free” yield farms that sprung up on @arbitrum\n\nAnother is perhaps users anticipating an airdrop similar to that of the $GB airdrop for AVAX bridgers pic.twitter.com/kolUiQ6rQn

— 🎮 Play Intern コープ (@playtern) September 18, 2021

Yet Arbitrum still leads in TVL by a wide margin compared with its L2 peers.

Twitter analyst Play Intern believes the rise in Arbitrum’s ecosystem was driven by attractive yields from yield‑farming programs and users’ hopes for token airdrops.

6/ So what caused this surge of inflows?

Initially, I believe this could be attributed to the crazily high yields of pool 0 “risk-free” yield farms that sprung up on @arbitrum

Another is perhaps users anticipating an airdrop similar to that of the $GB airdrop for AVAX bridgers pic.twitter.com/kolUiQ6rQn

— 🎮 Play Intern コープ (@playtern) September 18, 2021

However, speed and low transaction costs remain decisive. According to L2 Fees, Arbitrum’s network fees are several times lower than those on Ethereum.

7/ Of course the speed and low tx costs on L2 (👇 10-12x) are a big factor as users look forward to seeing their favorite ETH applications migrate over to @arbitrum

PS: Fees are bound to get even 🔻 cheaper when throttling is finally turned off

Source: https://t.co/PyRbiTDteU pic.twitter.com/aS2XECnwYz

— 🎮 Play Intern コープ (@playtern) September 18, 2021

In the first half of September Arbitrum’s share of TVL among L1/L2 bridges rose from 0.47% to 32%, becoming comparable to Polygon’s level.

0/ In today’s Delphi Daily, we dove deep into @arbitrum

We looked at Arbitrum’s bridge activity, its correlation with Ethereum gas, and its spectacular past two weeks.

For a more detailed look 🧵👇 pic.twitter.com/LU5Sa5T3yX

— Delphi Digital (@Delphi_Digital) September 15, 2021

The surge in Arbitrum’s metrics coincided with a sharp drop in Ethereum’s median gas price.

5/ Arbitrum’s take-off in early Sept. coincides with a sharp decrease in the median gas price on Ethereum mainnet.

Theoretically L2s like Arbitrum scale Ethereum’s throughput to a great degree. pic.twitter.com/l46i2RDyOF

— Delphi Digital (@Delphi_Digital) September 15, 2021

“Theoretically, L2 solutions like Arbitrum significantly scale Ethereum’s throughput,”

Experts noted that the future of layer‑2 solutions looks promising.

6/ The future of L2s looks extremely promising.

The market may be looking favorably towards DeFi assets, which have had a rough past six months. Blue chips are leading the bounce, followed by derivative protocol tokens. pic.twitter.com/7nr3oZh3dV

— Delphi Digital (@Delphi_Digital) September 15, 2021

The Arbitrum ecosystem

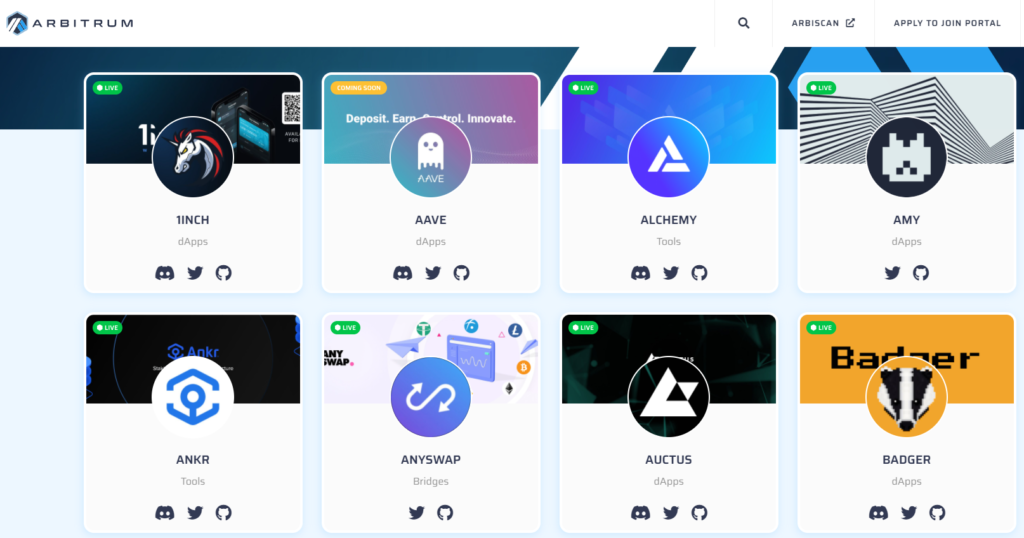

On the project portal you can view the list of DeFi services that have integrated Arbitrum. Aave, Loopring, Zerion and other well‑known platforms plan to follow suit soon.

The DeFi Llama site lists over 20 projects in the decentralized finance sphere operating on this L2 solution. Their total TVL amounts to around $1 billion.

In this sector, and in DeFi overall, Curve leads. It is followed by SushiSwap, which supports many other protocols.

Besides these DEX, Arbitrum also hosts Balancer, DODO, Swapr and Uniswap.

In the image below are some derivative platforms and synthetic asset platforms that use this advanced L2 solution:

There are also lending protocols on Arbitrum, also important for the industry.

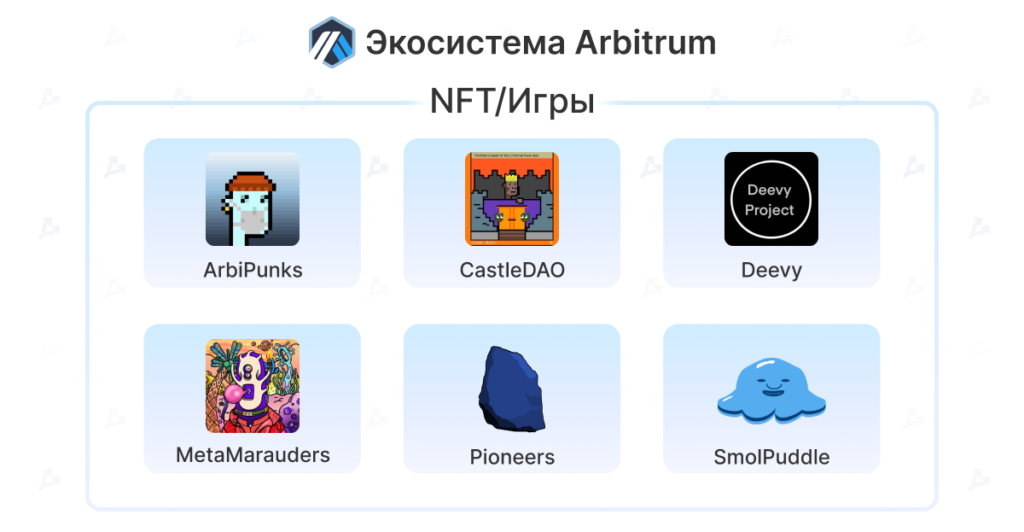

There are already many gaming and NFT applications. Here are some of them:

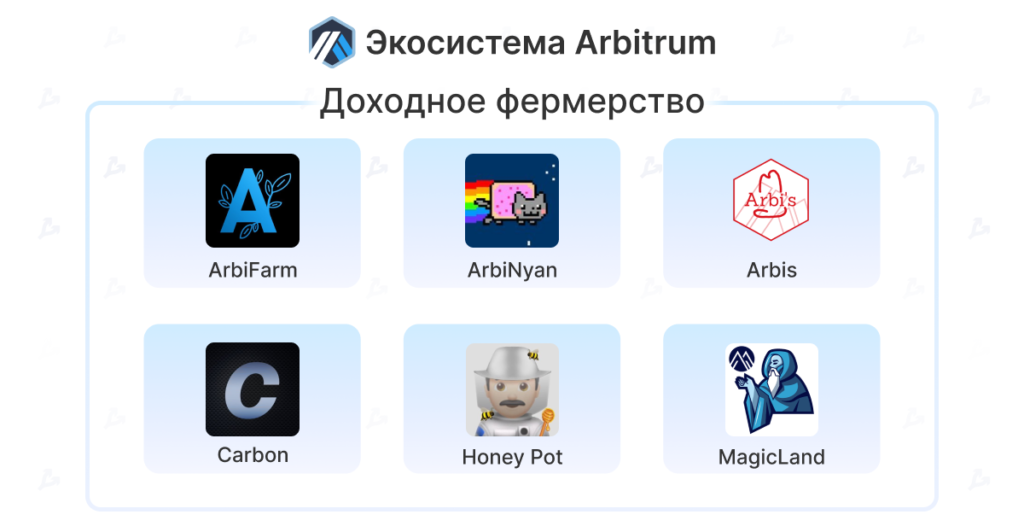

Modern DeFi ecosystems would be hard-pressed to function without yield optimisers and other services that attract users with liquidity mining programs.

Meme-token platforms built on Arbitrum enrich the already colourful DeFi palette.

Bridges to Arbitrum

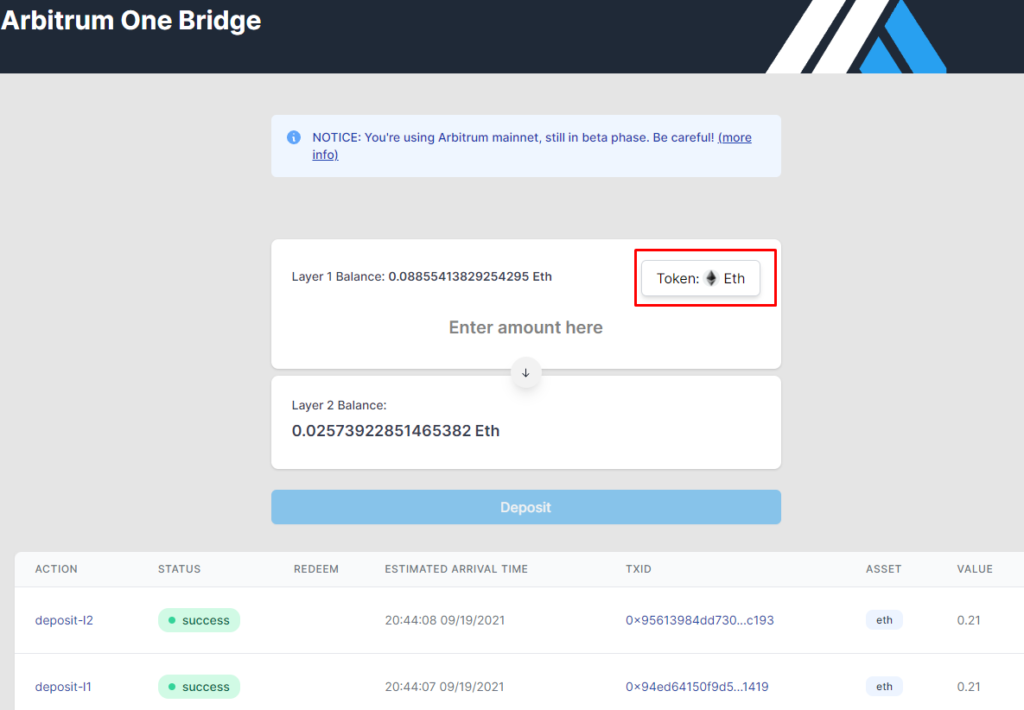

The Arbitrum One Bridge tool allows users, in a few clicks, to move ETH and ERC-20 tokens to the second layer.

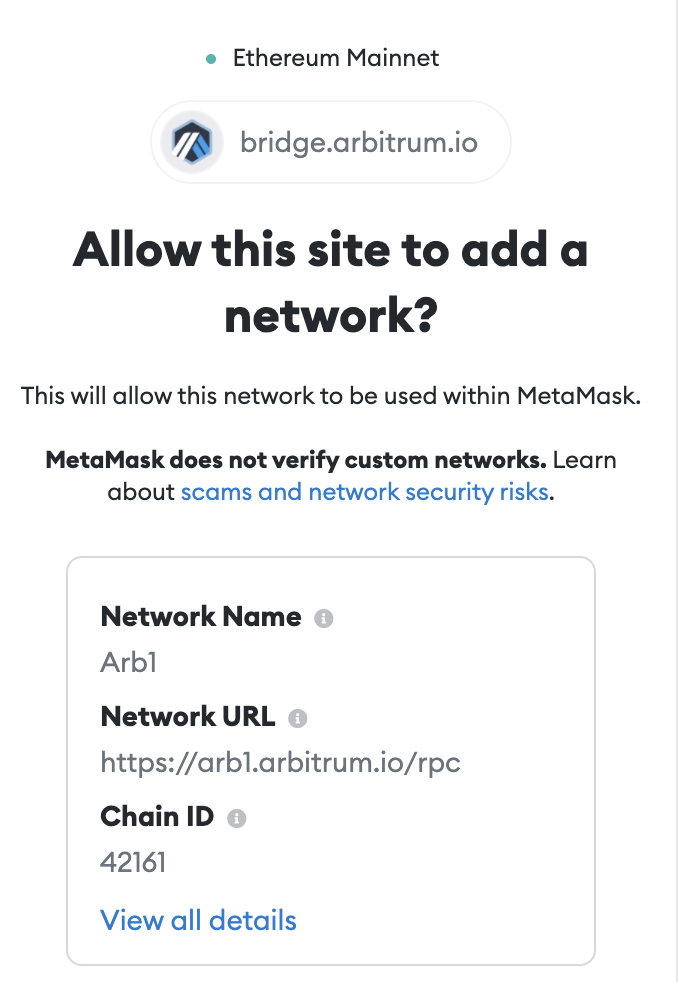

To use this cross‑chain bridge, first you need to add the Arbitrum One network to MetaMask. The screenshot below shows the corresponding Web3 wallet settings.

However, it’s much easier and quicker to use the Chainlist service, where you select the required network, click Connect Wallet, and then approve in MetaMask.

After that you need to connect your wallet to the Arbitrum Token Bridge and choose the asset for the cross‑chain operation.

Finally, you need to enter the amount, click Deposit and confirm the operation in MetaMask.

A full migration guide for Ethereum assets to Arbitrum is available at the link.

It is worth noting that although asset migration to L2 does not take long, withdrawing funds back to the mainnet will take seven days. This remains the main drawback of Optimistic rollups.

Bypassing the seven‑day period is possible with cross‑chain bridges from third‑party developers, albeit with some additional transaction costs.

One such tool is cBRIDGE from Celer Network. Play Intern notes that cross‑chain operations take about 15 minutes.

3/ For those looking to bypass the 7 day withdrawal period, @CelerNetwork has a bridge that you can access via https://t.co/b3w5lTlkIJ (bridging back takes about 15 mins)

👉 Faster + Cheaper

👉 Uses WETH

👉 Currently can bridge from Arbitrum to (ETH, BSC, MATIC, FTM, and AVAX) pic.twitter.com/2ah0fYlzHm— 🎮 Play Intern コープ (@playtern) September 18, 2021

The bridge supports not only Ethereum and Arbitrum, but also Binance Smart Chain, Avalanche, Polygon, xDai, OKExChain, Huobi ECO Chain, Optimism and Fantom.

Another similar tool is xPollinate. The project Connext attracted substantial investment from ConsenSys, Coinbase Ventures, Huobi and Polychain Capital.

Similar functionality is offered by Hop.Exchange, Synapse Bridge, the Mosaic tool from Composable Finance and AnySwap.

Other useful resources include:

- Arbiscan — the Arbitrum One blockchain explorer;

- Inside Arbitrum — technical documentation from Offchain Labs.

A thorny path

On September 14, Arbitrum experienced a 45‑minute outage due to a Sequencer contract error. During this time the network did not process transactions.

Developers assured users that their funds were safe.

“Sequencer cannot steal funds or forge transactions, because every transaction it processes carries a user’s digital signature, which is verified by the Arbitrum chain. Users’ funds were not at risk,”

They also noted that the Arbitrum network is resilient to prolonged Sequencer outages.

“Users have the option to bypass Sequencer and submit transactions directly to Ethereum for delayed inclusion in the Arbitrum chain, and that option remained fully available during the incident,”

The project team warned of potential further outages as Arbitrum One remains in beta testing.

As noted earlier, the architecture of Arbitrum and many other L2 solutions contemplates a seven‑day withdrawal period to the mainnet. However there are many third‑party services helping to bypass this restriction, albeit with some additional transaction costs for users.

Many Arbitrum apps may look somewhat rough and have limited liquidity. This is not surprising given that the ecosystem is still in its early stages.

Despite these and other potential drawbacks, the future of L2 solutions looks promising. Ethereum creator Vitalik Buterin proposed moving non‑fungible tokens issued on the Ethereum blockchain into the L2 ecosystem.

“To lower fees we need to move NFTs into the L2 ecosystem. However, to do this ‘properly’ we need good L2 compatibility standards so that the ecosystem does not get locked into a single solution,”

For transfers one can use existing solutions such as Arbitrum. But Buterin notes there are several significant drawbacks:

- All major rollup platforms with EVM support have backdoors and other security issues, so it’s risky to rely on a single solution;

- The NFT ecosystem could become too large to operate on a single L2;

- The NFT ecosystem is not closed — it must interact with other Ethereum projects.

As a possible option, Buterin proposed a system that enables tokens to be transferred between rollup platforms or base chains by issuing wrapped tokens.

According to Etherscan, NFT marketplace OpenSea is the largest gas consumer on the Ethereum network.

Layer‑2 solutions could coexist with Ethereum 2.0’s sharding, which in theory could enable thousands or even millions of transactions per second.

“When Phase 1 arrives and Rollups move into the Eth2 ecosystem with data sharding for storage, we’ll reach the theoretical maximum of ~100,000 TPS,”

***

Complex smart‑contract based systems do have drawbacks. Users should consider the risks, as many protocols are still at an early stage of development.

Yet there is little reason to doubt that the number of L2‑based platforms will continue to grow, and competition between them will intensify. In the race for users and the TVL they generate, projects will devise new liquidity mining programs and conduct airdrops.

Against the backdrop of the persistent scalability challenge facing Ethereum, Arbitrum and other such L2 technologies appear well positioned. Their development is unlikely to be hindered by the impending full Ethereum 2.0 launch — L2 solutions will only enhance the already high efficiency of the Proof‑of‑Stake blockchain.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!