DeFi TVL and NFT trading slump in Q1, says DappRadar

- The number of active users of decentralised applications fell by just 3% in Q1.

- DeFi protocols’ TVL plunged 27%, while NFT market trading volumes dropped 24%.

- The dapps ecosystem lost more than $2bn to hacks and scams.

In the first quarter of 2025, TVL in DeFi protocols fell by 27%, NFT trading volume declined by 24%, and social and AI apps posted the strongest growth. This is according to DappRadar’s report on the state of the dapps ecosystem.

? AI surged, DeFi shrank, $2B disappeared.

Q1 2025 was packed with surprises -memecoins, massive hacks, and big shifts in NFTs, RWAs, and beyond.

We broke it all down with the data that matters.

Read the full Dapp Industry Q1 Report ?https://t.co/cyzy92jFBf— DappRadar (@DappRadar) April 3, 2025

Before US president Donald Trump took office, the sector and the crypto market had strong momentum; afterwards, that shifted. Even so, in the first three months of 2025 the dapps ecosystem showed resilience despite a mild cooldown, the analytics platform said.

Historically, falling cryptocurrency prices dampen interest in decentralised applications. In Q1, the number of daily unique active wallets (dUAW) was 24m—3% fewer than in the previous period.

“Given the broader macroeconomic environment, this decline remains relatively modest and indicates a stable user base,” the experts noted.

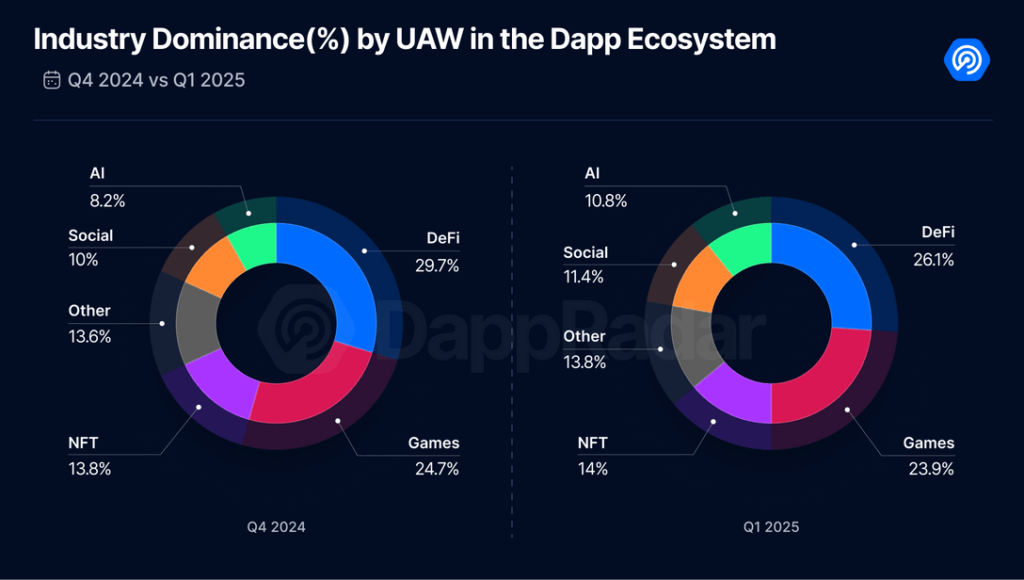

Against this backdrop, dUAW in the AI segment reached 2.9m, up 29%. Next came social dapps, up 10% to 2.8m unique wallets.

The DeFi segment was the hardest hit, with activity down 15%. Despite the pullback, the sector retained overall dominance, though its share shrank by 4%. Blockchain-gaming apps also saw a slight decline in share.

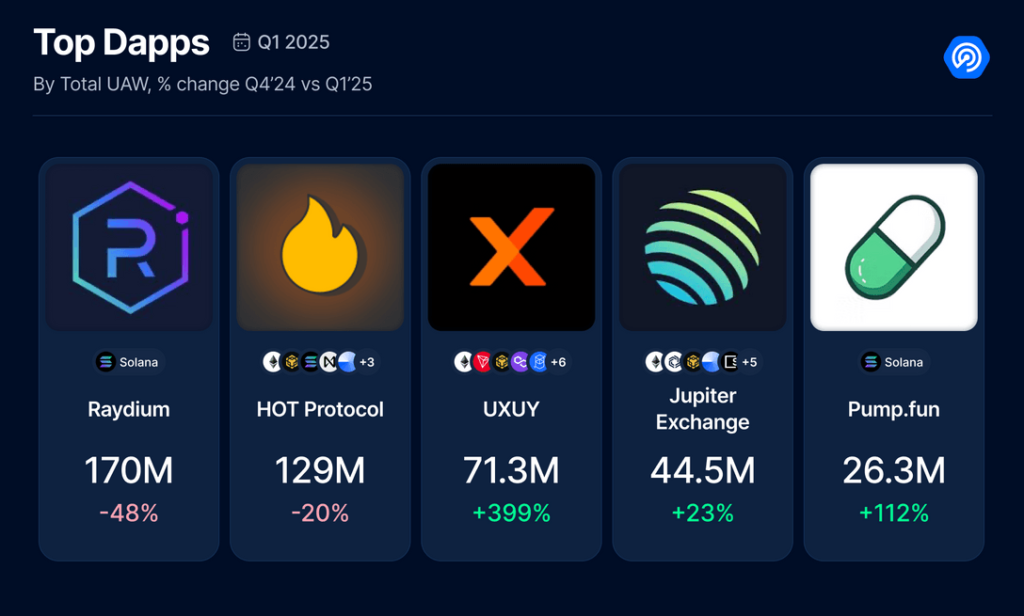

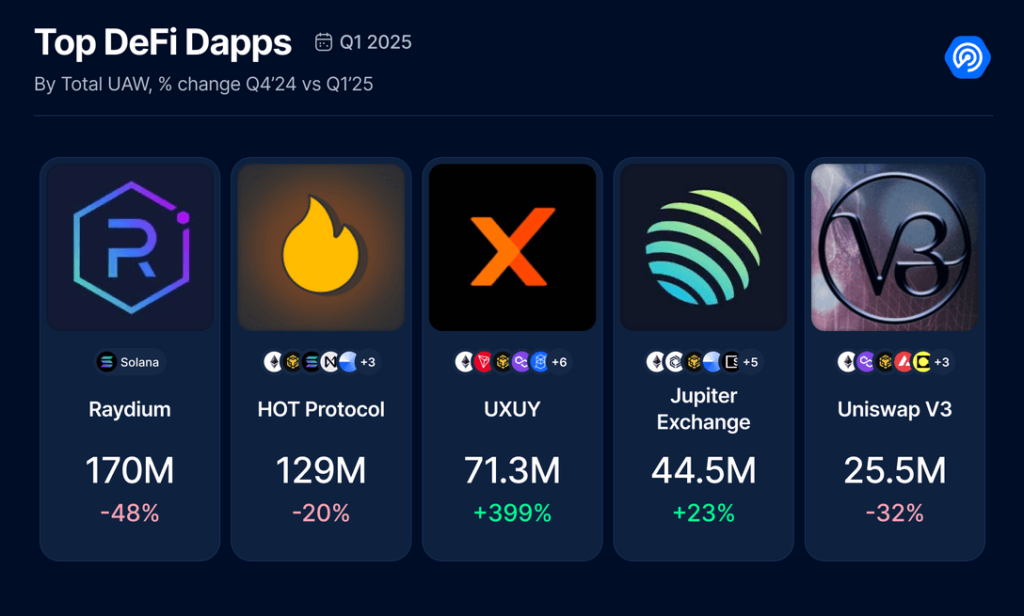

By dUAW performance, DappRadar highlighted five projects: Raydium, HOT Protocol, UXUY, Jupiter and Pump.fun. Three run on Solana, and the last two are directly tied to memecoins.

“This underscores a key point: the memecoin story is far from over—they continue to drive engagement and on-chain activity across ecosystems,” DappRadar emphasised.

A sharp fall in DeFi

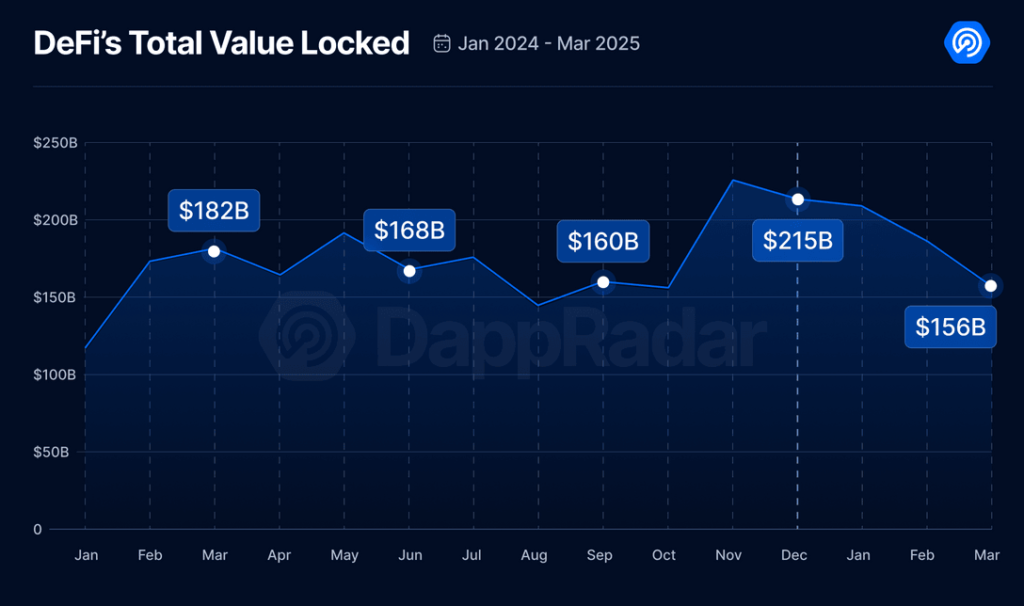

Total value locked across DeFi fell to $156bn in Q1, down 27% from the previous period. This came alongside a 45% drop in the price of the segment’s dominant cryptocurrency (excluding stablecoins), Ethereum.

Significant factors also included macroeconomic uncertainty and the “lingering aftershocks” from the $1.5bn Bybit exchange hack.

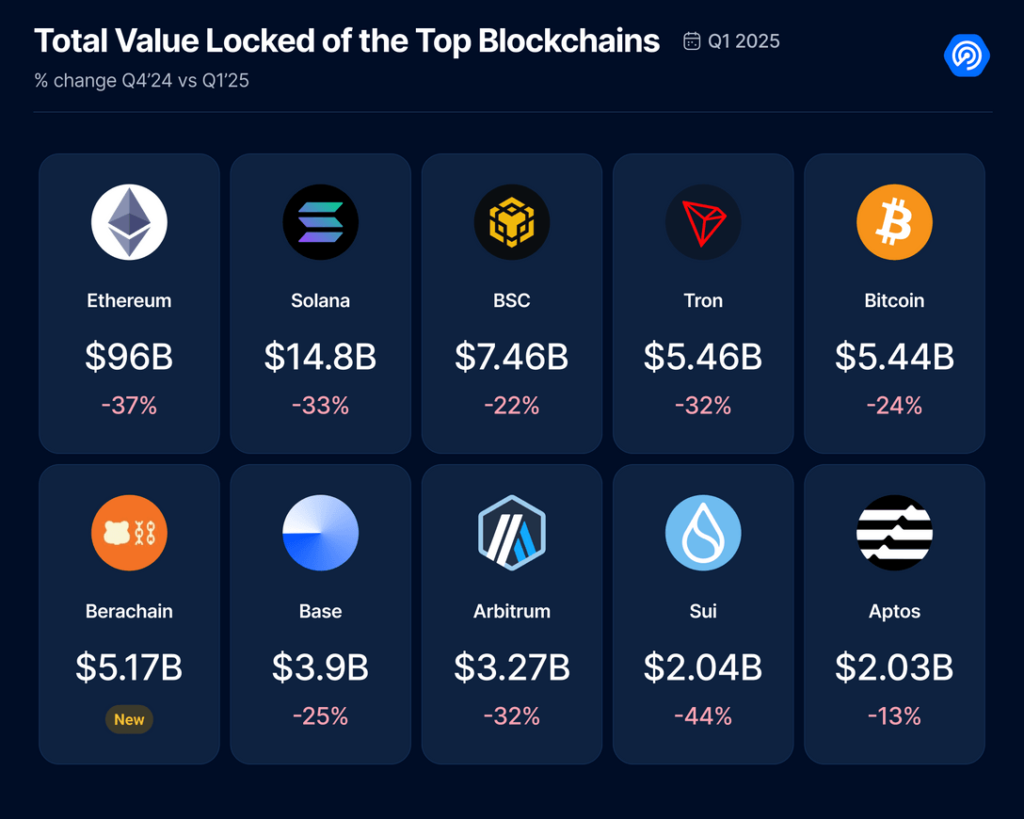

The downtrend hit every top-10 blockchain with one exception—the new EVM-compatible network Berachain rose to sixth in the TVL rankings.

“The project has stood out as an exceptional performer, defying the broader market trend with a breakout quarter,” the experts believe.

DappRadar flagged several milestones in Berachain’s development:

- On 6 February the team launched mainnet and carried out a BERA token airdrop worth $632m;

- On 11 March the project introduced Bepolia, a developer testnet for dapps;

- On 24 March Berachain announced it had raised $142m.

“It is striking how quickly Berachain has climbed the DeFi rankings. Its momentum underscores how competitive this space is becoming, especially for established networks now facing pressure from new, well-funded entrants,” the report says.

By user activity, the top five apps in this segment were Raydium, HOT Protocol, UXUY, Jupiter and Uniswap.

The presence of four dapps that also appear in another segment’s ranking only underscores DeFi’s dominance, DappRadar noted.

The NFT market kept diving, while RWAs grew

In Q1, NFT trading volume fell 24% from the final quarter of 2024, to $1.5bn.

The number of sales fell by only 10%, suggesting fewer high-value trades rather than fewer participants. The divergence was influenced by declining cryptocurrency prices, especially Ethereum.

Profile-picture collections (PFPs) dominate the segment, accounting for 56% of total trading volume. Gaming NFTs remain relatively stable.

“A standout trend was the growth of the RWA segment led by Courtyard,” the experts stressed.

The platform lets collectors trade digital representations of rare physical items by tokenising them.

Sports NFTs hold a strong position, with Sorare remaining a major player.

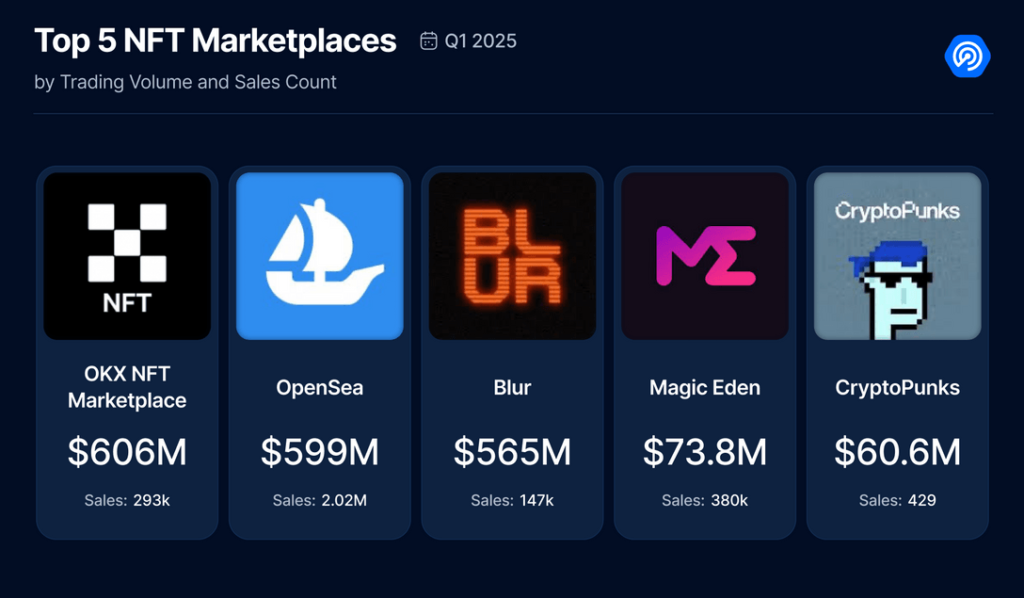

By marketplace, OKX’s platform led the quarter by trading volume. By number of trades, OpenSea ranked first.

Blur, with volume comparable to OpenSea, processed only 7% of its number of sales. This signals the marketplace remains attractive to large traders, DappRadar noted.

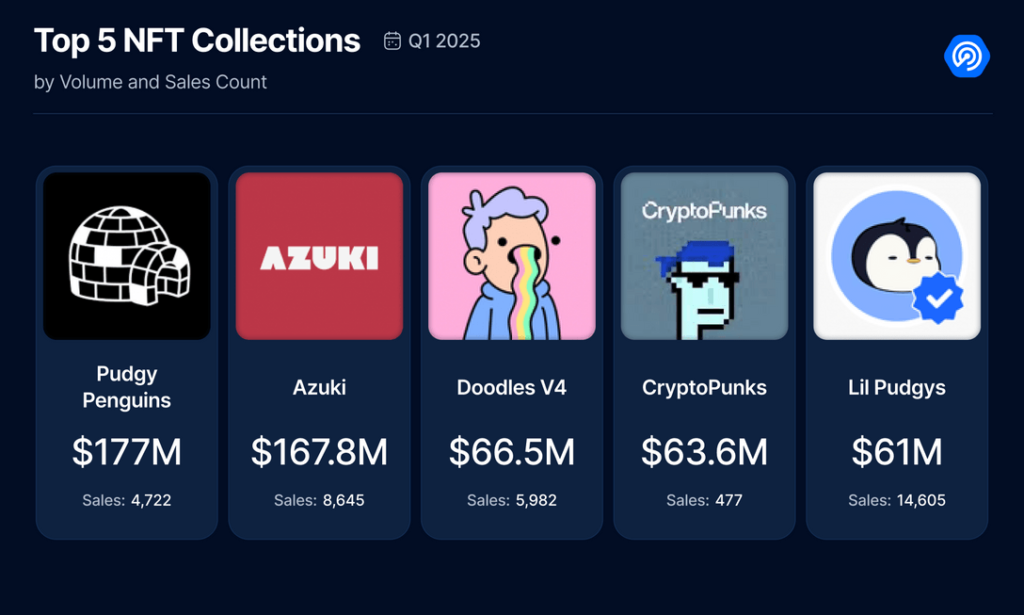

Top collections over the quarter included Pudgy Penguins, Azuki, Doodles, CryptoPunks and Lil Pudgy.

Notably, CryptoPunks generated $63.6m of volume in just 477 trades. The collection’s prestige is intact, but prices largely put it out of reach for ordinary users, the experts said.

“In summary, while the NFT market no longer resembles the bull years, it is evolving rather than standing still. RWAs and sports NFTs are gaining momentum, PFPs are holding up, and the sector is clearly exploring new formats to remain relevant,” the report says.

Hacks and scams cost $2bn, sharpening security concerns

In Q1, the dapps industry suffered losses of more than $2bn due to hacks and fraud.

After the Bybit attack mentioned above, the largest loss incidents were memecoin scams LIBRA and MELANIA.

The need to raise security standards, particularly amid memecoin speculation, is not in doubt. But user awareness and caution are decisive, DappRadar specialists stressed.

Since early 2024, crypto-industry losses from hacks have exceeded $3.83bn.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!