Delay in SEC decision on Bitcoin ETF triggers outflows from Bitcoin funds

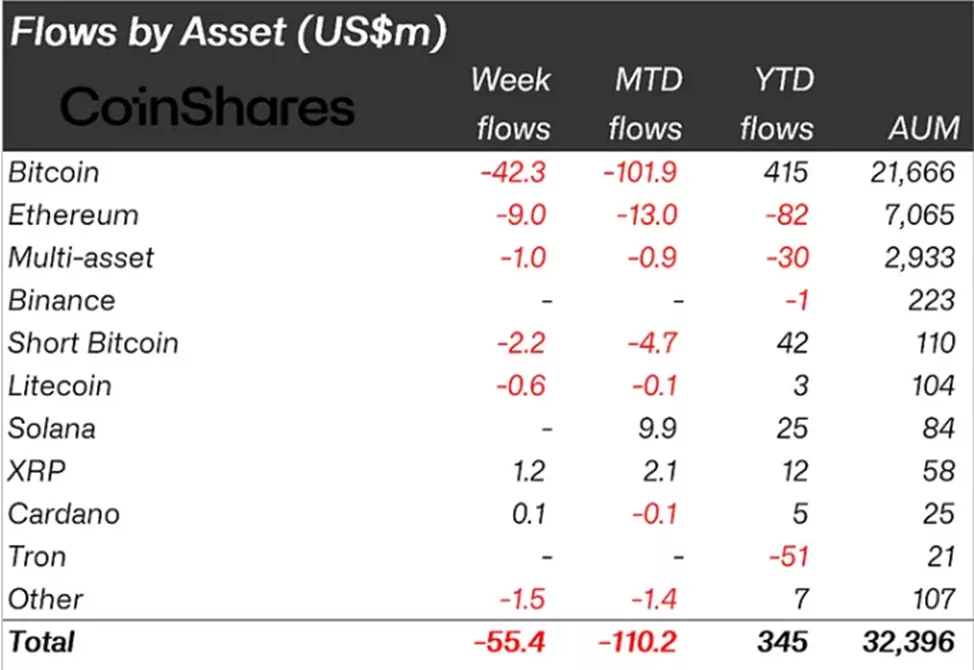

Net outflows from cryptocurrency investment products from 12 to 18 August totaled $55.4 million, versus inflows of $28.5 million a week earlier. This assessment was provided by analysts CoinShares.

Analysts attributed the sales to the postponement of the SEC decision on the application to launch the bitcoin-ETF from ARK Invest and 21Shares.

Trading volumes, due to seasonal effects, remained well below average levels, leaving prices vulnerable to large trades.

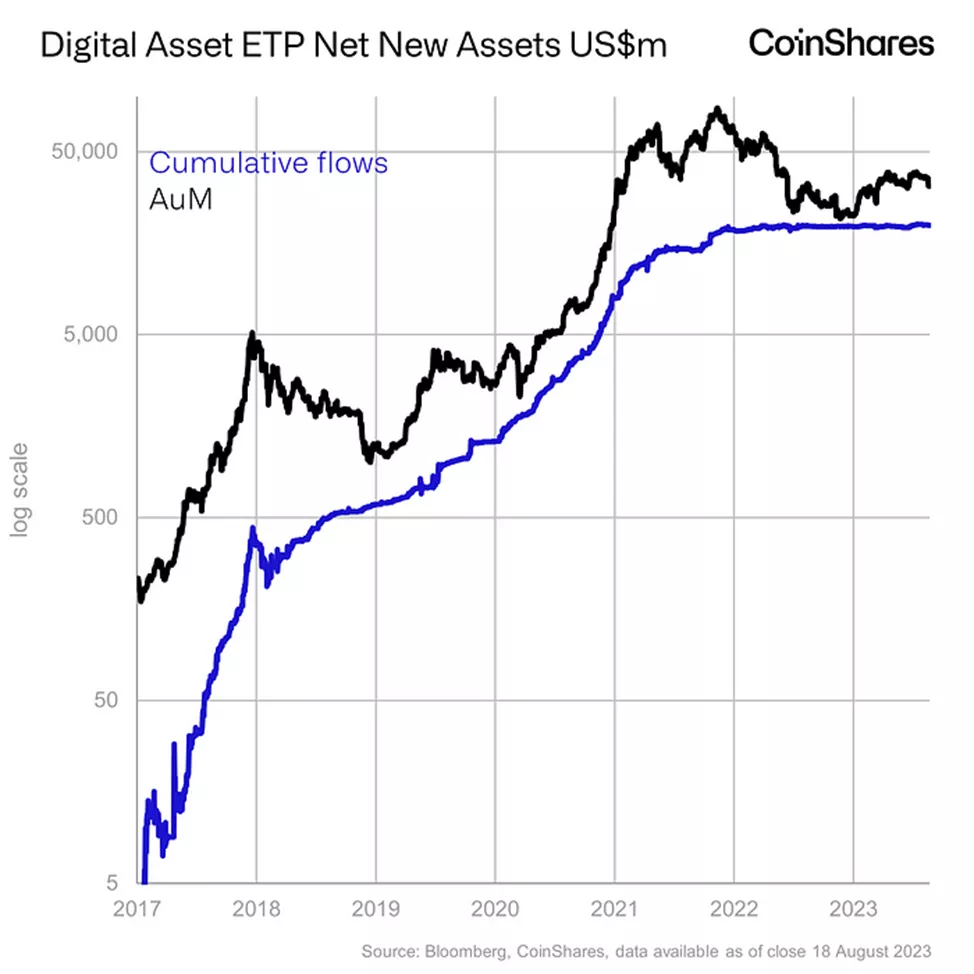

As a result, asset volumes across all products fell by 10%, to $32.3 billion, according to analysts.

Outflows from Bitcoin funds totaled $42 million, one and a half times the inflows in the previous reporting period ($27 million).

From the products that enable short exposure to the first cryptocurrency, clients pulled out $2.2 million, versus $2.7 million a week earlier.

Outflows were also observed in altcoin-based products. In Ethereum funds, outflows totaled $9 million, versus inflows of $2.5 million in the prior week.

From Polygon-, Litecoin- and Polkadot-based products, investors pulled out $0.9 million, $0.6 million and $0.5 million, respectively.

Inflows into XRP funds continued for the seventeenth week in a row. The inflow totaled $1.2 million.

The court granted the SEC’s request to file an interlocutory appeal in the Ripple case.

Earlier, former agency lawyer John Reed Stark described Judge Torres’s ruling in the Ripple case as “based on shaky ground.” In his view, the Commission has a strong chance of successfully appealing it in higher courts.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!