Despite the pandemic and crisis, how the Bitcoin industry attracted investment in 2020

The cryptocurrency industry continues to grow and develop, despite the COVID-19 pandemic and the slowdown in activity in traditional parts of the economy. This is evident, among other things, in venture-capital activity. ForkLog examined who funded whom in 2020, and, most importantly, for what purpose.

- In the first half of 2020 there were more crypto- and blockchain-startup acquisitions than in all of 2019, a relatively prosperous year.

- Investors began focusing less on early and seed stages. This positively affected the average deal size.

- Venture activity gradually shifted from North America to Europe and Asia.

Despite the coronavirus pandemic

COVID-19 has negatively affected many sectors of the traditional economy, reducing both consumer demand and investment activity. However, some companies possess distinctive characteristics that allow them not only to survive the current economic shocks but also to remain attractive in a post‑pandemic world.

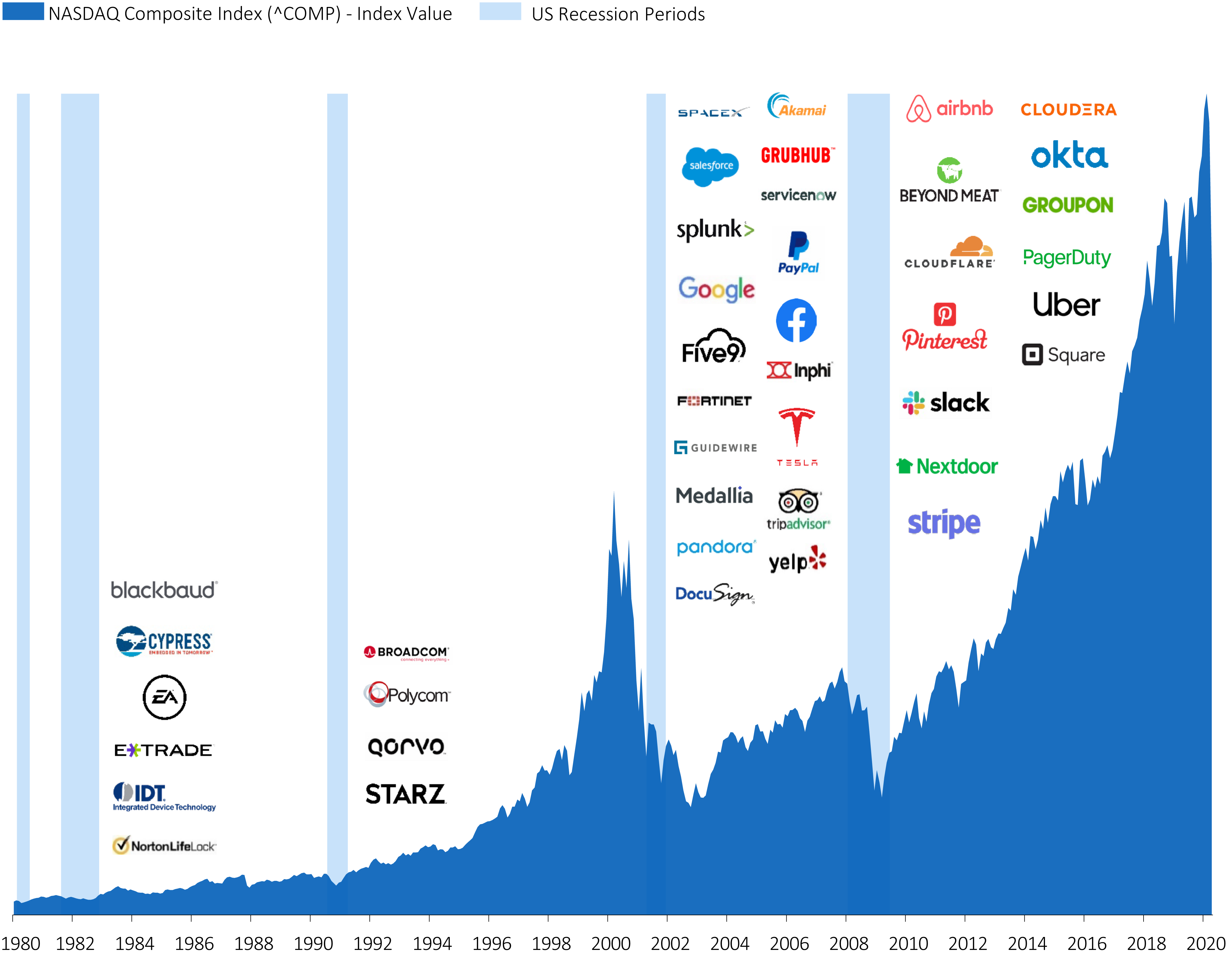

As shown in the image below, in past post-crisis periods companies such as Google, Facebook, Airbnb, Stripe and Uber emerged, later becoming giants with multi‑billion-dollar valuations.

The pandemic caused major disruptions across many companies in various sectors. On the other hand, the crisis highlighted the need to adopt innovations for more efficient operations and to adapt to new conditions. The use of advanced technologies became a matter of survival for many.

According to analysts at Adams Street, blockchain will remain one of the most promising technologies in the post-pandemic era.

Experts expect continued innovation and accelerated adoption of technologies “not in spite of the pandemic, but because of it.”

“We believe that technologies will pull us out of this economic cycle, and in the next 12–36 months, great companies will be created. Using past recessions as a guide, we are confident that 2020‑2021 could be very successful for many venture investors,” — emphasized at Adams Street.

PwC analysts estimate that blockchain alone could add an additional $1.76 trillion (1.4%) to global GDP by 2030.

The greatest impact is expected in China, the United States, Japan, and developed European nations.

Rising regulatory clarity and CBDC developments could spur institutional interest in the industry.

Evidence of growing institutional interest is seen in dynamics of the futures market on the Chicago Mercantile Exchange, the rapid growth in inflows into Grayscale Investments’ crypto funds, and multi‑million‑dollar bets by MicroStrategy in Bitcoin using borrowed capital.

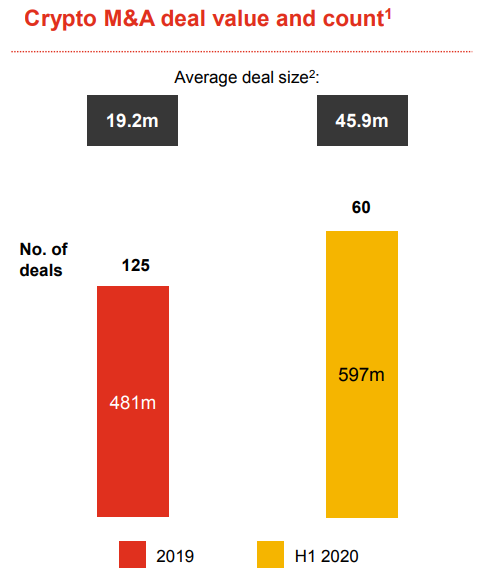

COVID-19 did not shrink the number or value of M&A deals in the crypto sector. PwC notes that total acquisitions in the busy first half of 2020 surpassed the figure for all of 2019.

PwC H1 2020 Global Crypto M&A Fundraising Report Oct 2020 PDF by ForkLog on Scribd

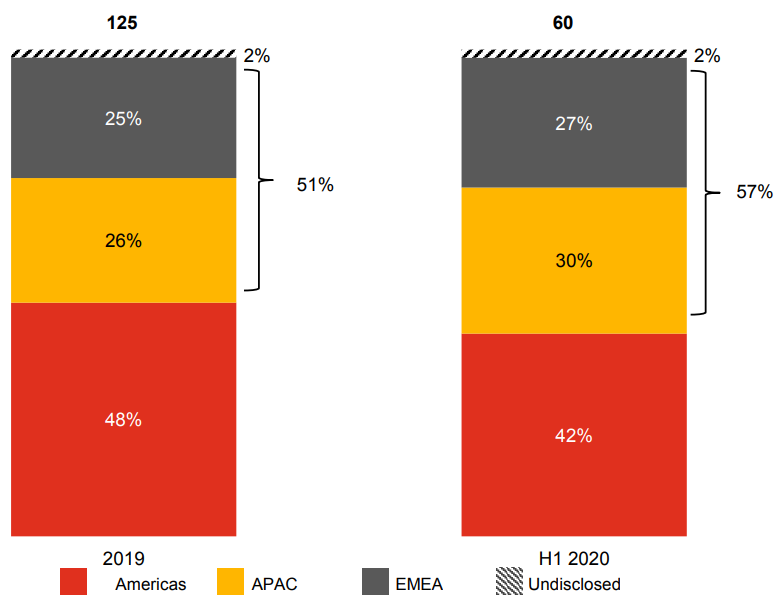

In the first half of 2020 there were 60 M&A deals totaling $597 million. For all of 2019, there were 125 deals totaling $481 million.

In H1 2020, the average M&A deal size rose to $45.9 million, up from $19.2 million in the previous year.

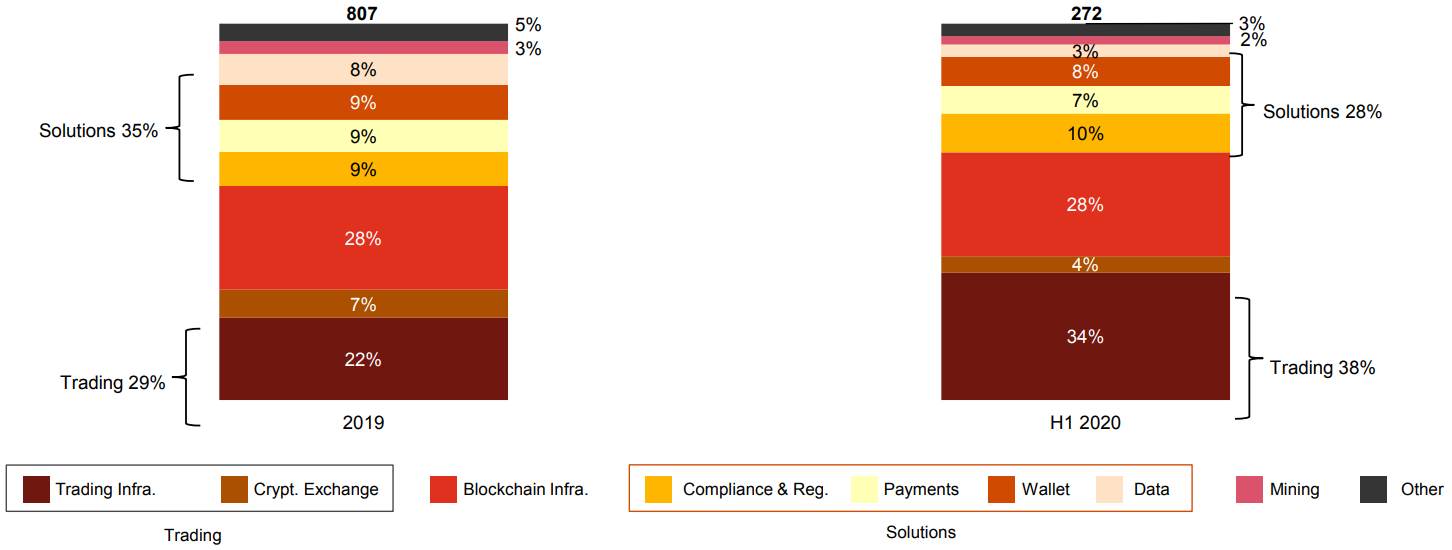

Investors remained focused on cryptocurrency exchanges and trading infrastructure.

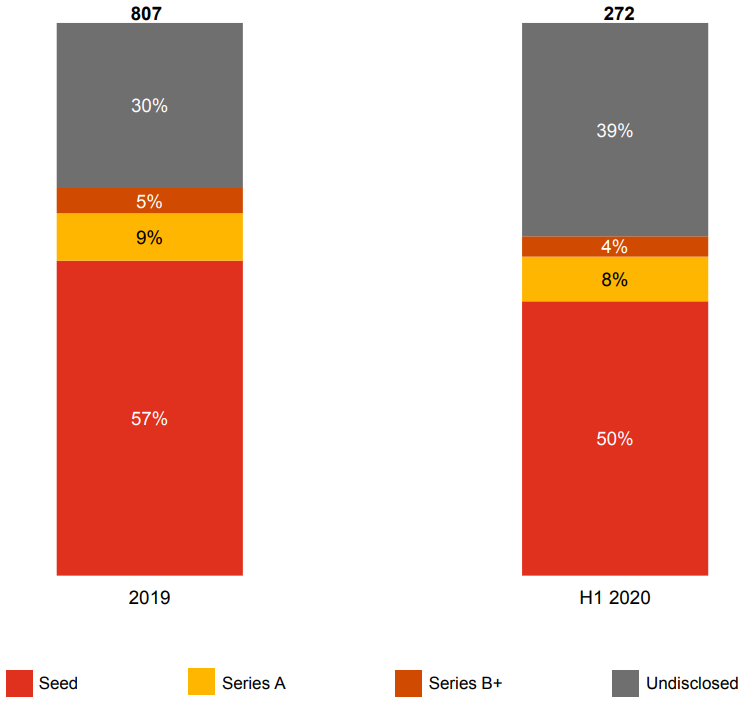

The share of investments in crypto projects at early stages gradually declined—from 57% in 2019 to 50% in H1 2020.

Activity gradually shifted from North America to Europe, the Middle East and Africa (EMEA) and the Asia-Pacific region, which is recovering rapidly from the COVID-19 downturn.

As before, mature players such as Coinbase, Pantera Capital, Polychain Capital and Fenbushi Capital, as well as the blockchain incubator ConsenSys, remain active.

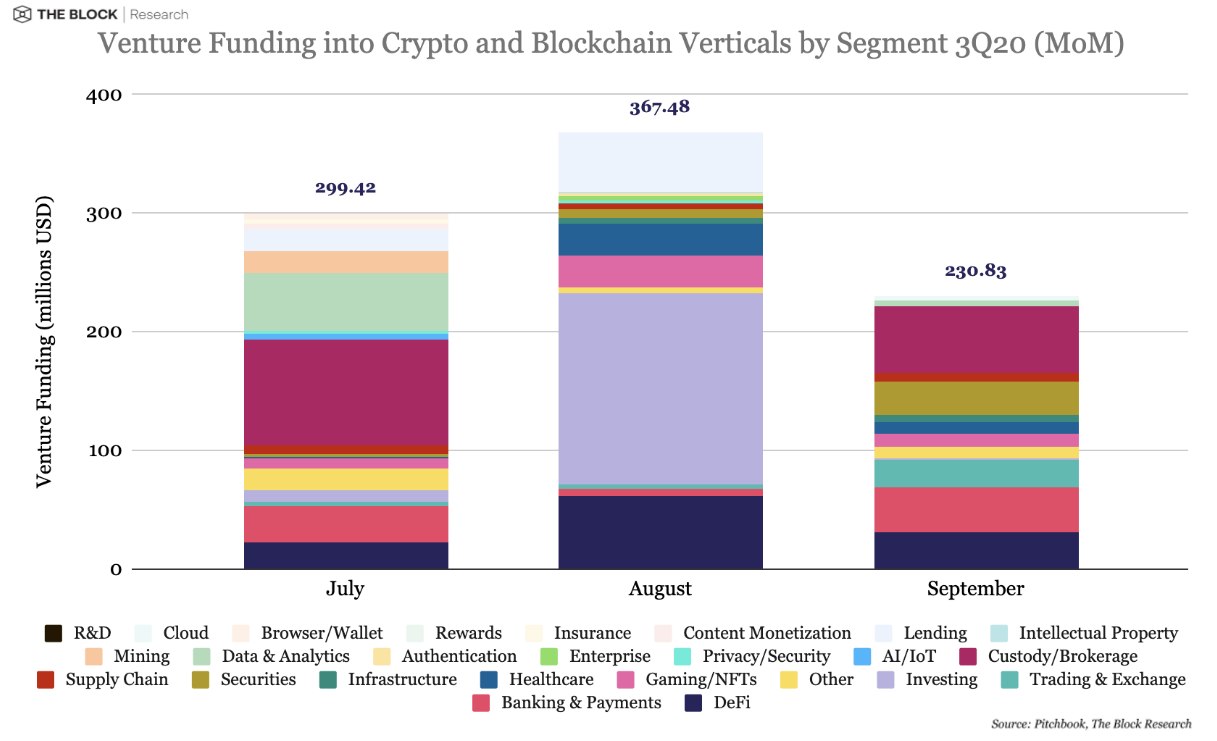

In Q3 2020, business activity did not slow down at all — 212 crypto and blockchain startups attracted nearly $900 million in venture funding.

The trend continued: the most common deals in this period were early-stage and seed rounds. They accounted for half of the quarter’s total: 59 early-stage deals and 60 seed deals.

The average deal size for early-stage startups was about $7 million. These early deals totaled roughly $272 million, about 30% of the quarterly total.

The average investment size for seed-stage projects was $2.1 million. Their total reached $126 million, or around 12% of the quarterly total.

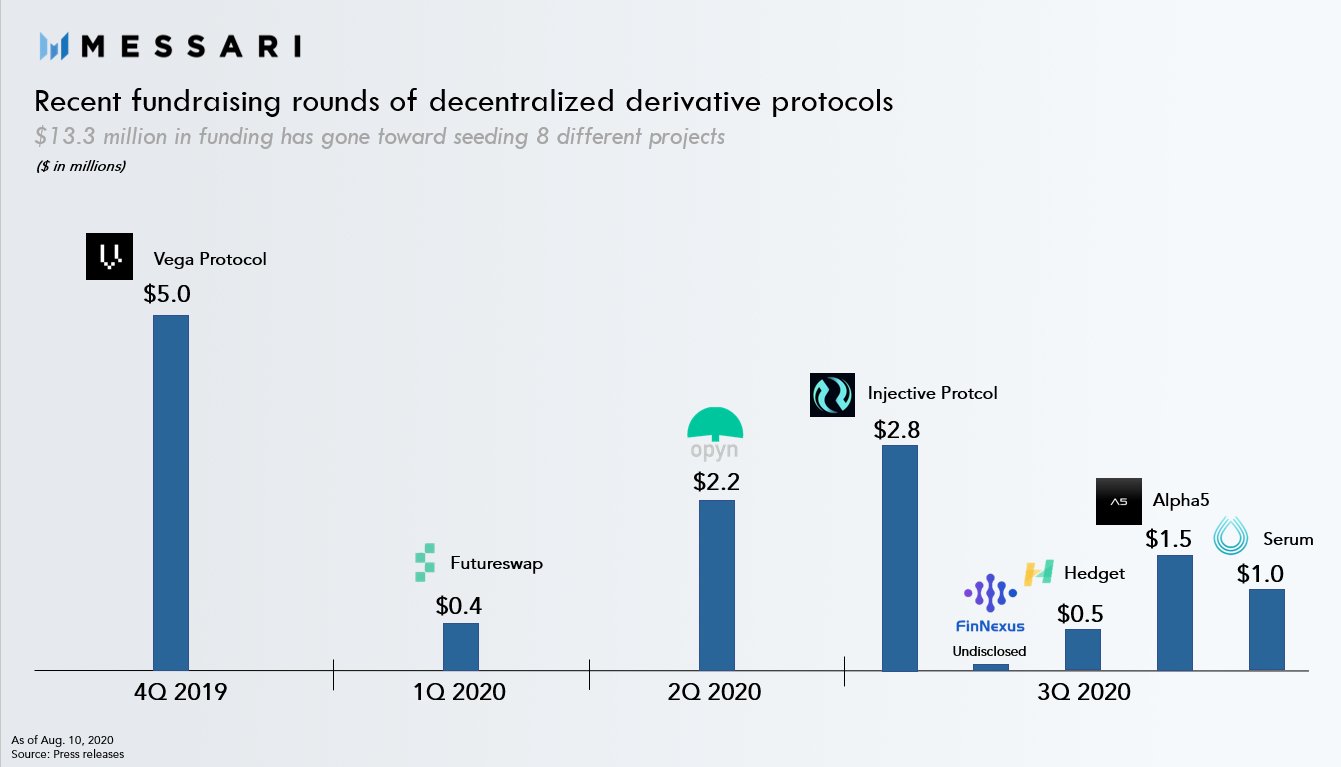

From Q3 2020, venture funds increased investments in decentralized platforms for trading crypto-derivatives.

Funding came from Polychain Capital, Pantera Capital, FBG Capital, Dragonfly Capital and other major crypto funds.

According to The Block Research, roughly 20% of Q3’s venture deals occurred in DeFi.

Most notable deals of the year

The table below presents the most notable M&A deals of 2020.

Among the largest acquisitions in 2020 was Binance’s purchase of the widely used analytics service CoinMarketCap for $400 million.

Other notable M&A deals include Coinbase’s acquisition of broker Tagomi for $75 million and the purchase of the Blockfolio service by the crypto-derivatives exchange FTX for $150 million.

In 2019 there were also large M&A deals, but with less impressive totals.

Notable examples include Kraken’s acquisition of the crypto-derivatives platform Crypto Facilities and Coinbase’s purchase of Xapo. The latter also acquired Neutrino, which drew considerable attention.

In 2020 there were many fundraising rounds involving crypto-focused venture firms and funds, despite the global downturn in business activity.

Most notable deals of 2020 by ForkLog on Scribd

Shortly after the March market crash, Bakkt, a regulated crypto platform, closed a Series B round, raising $300 million.

Investors included the parent company of the New York Stock Exchange, Intercontinent

al Exchange (ICE), Microsoft M12’s venture unit, PayU, Boston Consulting Group, Goldfinch Partners, CMT Digital, and Pantera Capital.

One key product for Bakkt is Bitcoin futures, which launched in September 2019.

A notable amount — $100 million — was attracted by Electric Capital from major investors. The Series A round closed in early August.

The Palo Alto-based firm had previously invested in DeFi projects such as dYdX and Maker, as well as asset manager Bitwise. The firm also invested in several popular cryptocurrencies, including Bitcoin and Ethereum.

Another multi-million round was closed by Chainalysis — the company raised $100 million, which lifted its valuation to $1 billion.

Significant sums in 2020 were also raised by:

- New York Digital Investment Group (NYDIG) — $150 million;

- NEAR, a blockchain startup focused on sharding — $21.6 million from Pantera Capital and Electric Capital, among others;

- Andreessen Horowitz — $515 million for a crypto fund;

- BlockFi — $50 million from Morgan Creek and the Winklevoss brothers;

- Bitcoin Suisse — over $48 million;

- Bitpanda — $52 million from Peter Thiel-backed Valar Ventures.

- Aave — $25 million from Blockchain Capital, Standard Crypto, Blockchain.com and others.

The following table presents large fundraising rounds of 2019.

In 2019, Robinhood, Bithumb and Ripple were among the top three in terms of fundraising — $373 million, and $200 million each.

Trends in venture-capital investment

In 2019, significant funds went into blockchain infrastructure, exchanges, mining and payment solutions. In 2020, the focus shifted somewhat toward custody solutions for institutions, blockchain analytics tools, derivatives, crypto lending and DeFi apps.

PwC expects ongoing M&A activity among relatively large, well-funded and profitable firms.

“Investor attention will focus not on acquiring smaller peers, but on firms offering adjacent services to core products. This includes crypto media, data, compliance and research,” PwC experts forecast.

The firm also expects greater M&A activity in the EMEA and Asia-Pacific regions.

Analysts at The Block forecast tighter competition among providers of crypto data and on‑chain metrics, as well as developers of institutional-grade infrastructure and custody solutions. Investments in these areas are expected to grow as the market matures.

Conclusions

Despite a year far from friendly to the global economy, the volume of venture funding in the Bitcoin industry did not fall. The value of deals in the first half of 2020 exceeded the entire 2019 total.

Investors are increasingly targeting more mature projects. This has positively affected the average amount raised.

Venture-capital leadership remains in North America, but activity is rising in Europe and Asia.

More investment is flowing into DeFi projects, crypto-derivative platforms, analytics startups, and custody services for large investors.

Growing institutional activity and other whales are evidenced by the Chicago Mercantile Exchange turnover, Grayscale Fund activity, MicroStrategy’s brisk Bitcoin purchases, and MassMutual’s multi-million-dollar investments.

JPMorgan analysts believe that family offices, pension funds and other big players are ready to deploy up to $600 billion into Bitcoin.

The upbeat trend in venture investments signals not only further industry development but also a gradual reduction in regulatory uncertainty and clear interest in blockchain and cryptocurrencies among large players.

If history repeats itself, a decline in trust in traditional finance and the current global crisis could present a major opportunity for many innovative companies, including in the cryptocurrency sector.

Follow ForkLog on Telegram for updates: ForkLog FEED — full news stream, ForkLog — top news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!