Deutsche Bank Highlights Stablecoin Risks; Tether Responds with Criticism

Analysts at Deutsche Bank Research have suggested that most stablecoins are doomed to lose their peg and disappear.

The experts examined 334 pegged currencies since 1800 and found that 49% of such assets failed, with an average lifespan of eight to ten years. The main reasons for these failures were macroeconomic vulnerability, speculation, and governance issues.

The surviving currencies typically existed in small authoritarian states or oil-exporting countries with strong financial positions.

“Based on our findings, history suggests that stablecoins may face turbulence and depegging. While some may survive, most are likely to fail due to a lack of transparency in operations and vulnerability to speculative sentiments,” stated Deutsche Bank analysts.

They recalled the collapse of the algorithmic “stablecoin” Terra USD (UST) and its associated token LUNA two years ago, which resulted in user losses of up to $40 billion. In March 2023, Circle’s USDC lost its dollar peg following the collapse of Silicon Valley Bank. In January 2024, TrueUSD (TUSD) depegged.

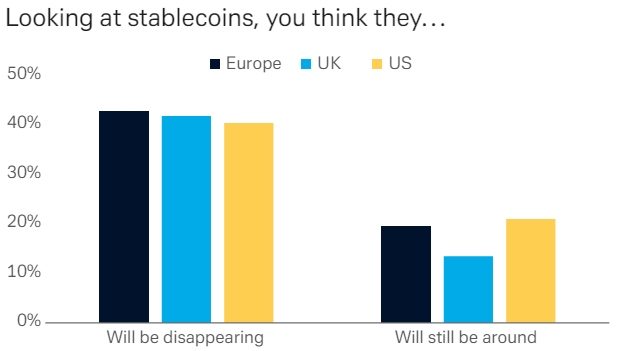

Such incidents have highlighted the volatility and risks of these assets and cast doubt on the future of the segment, according to analysts. A survey of over 3,350 consumers revealed that 42% of respondents expect stablecoins to disappear, while only 18% believe in their prosperity.

Deutsche Bank specialists were able to extrapolate historical data on pegged currencies to non-algorithmic stablecoins due to “their striking similarity.”

“Both require sufficient reserves and trust from issuers, are susceptible to speculative influences, and most track the USD,” explained the bank’s analysts.

From this perspective, they expressed concern about the dominant position of Tether’s USDT. In their view, the adequacy of the leading stablecoin’s backing, with a capitalization of $111 billion, is questionable.

The coin’s daily trading volumes exceed those of the largest cryptocurrency, Bitcoin, and USDT is widely used in the derivatives market. The collapse of the leading stablecoin could lead to significant losses for traders, especially those using leverage, and negatively impact the entire industry, experts believe.

“As we move forward, it is crucial to recognize the challenges in building stable currency pegs, despite the innovation of cryptocurrencies. We are likely to see much more instability in the coming years, and it is essential to closely monitor operational and market sentiments to mitigate potential risks in stablecoins,” concluded Deutsche Bank specialists.

Tether Criticizes the Research

The Deutsche Bank analysts’ report “lacks clarity and substantial evidence,” relying on “vague assertions rather than rigorous analysis.” Tether representatives stated this in comments provided to Cointelegraph.

“Deutsche Bank’s history of fines and penalties raises doubts about its own standing to critique others in the industry. DB was also named the riskiest bank in the world by the International Monetary Fund.”

Tether slams Deutsche Bank over suggestion its stablecoin could fail…

— Paolo Ardoino ? (@paoloardoino) May 10, 2024

According to them, the research does not present “specific data to support claims” about the potential collapse of stablecoins.

They also argue that comparing USDT with the algorithmic stablecoin Terra is “misleading and irrelevant to the discussion about reserve-backed coins.”

“Deutsche Bank’s history of fines and sanctions raises doubts about its ability to criticize other industry players. The International Monetary Fund named the institution the riskiest bank in the world,” Tether added as an additional argument.

For the first quarter of 2024, the company reported a net profit of $4.5 billion for the period. An attestation report by auditor BDO confirmed the over-collateralization of stablecoins with reserves, 90% of which consist of “cash and cash equivalents,” primarily U.S. Treasury bonds.

The attestation by BDO is not a full financial audit, which Tether has never conducted since its inception in 2014, noted Cointelegraph.

Analysts at Bernstein have forecasted an increase in the total capitalization of stablecoins to $2.8 trillion in the next five years.

JPMorgan stated that the growing dominance of Tether poses risks to the segment and the crypto ecosystem as a whole.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!