Deutsche Bank: Investors increasingly favor Bitcoin over gold

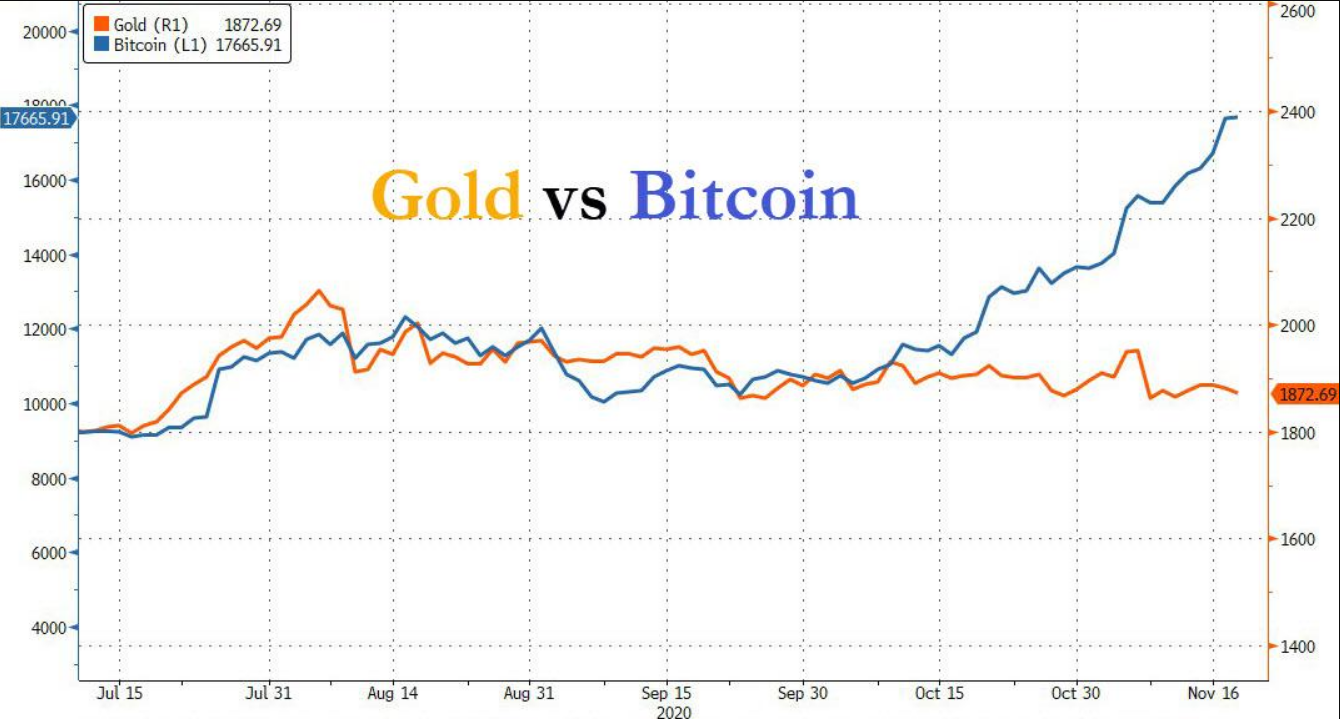

News about COVID-19 vaccines has led to notable shifts in investor preferences. Deutsche Bank analysts point to a ‘dramatic’ divergence between the trajectories of gold and Bitcoin, according to ZeroHedge.

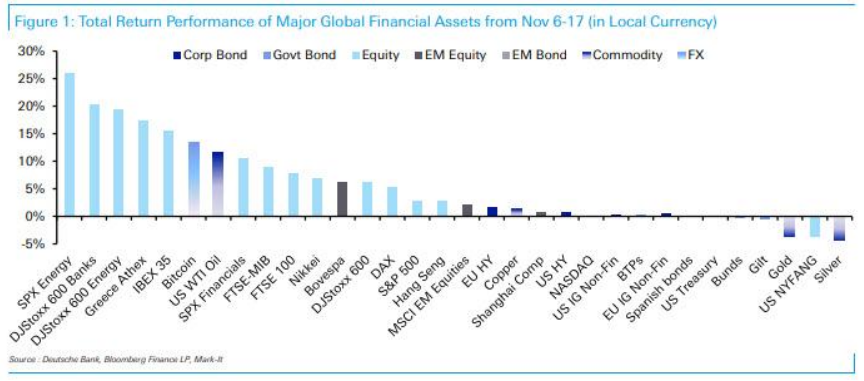

Between 6 and 17 November, Bitcoin rose 13.4%, while the most popular precious metal fell 3.6%.

Source: ZeroHedge.

‘There is growing demand for Bitcoin from investors who previously hedged inflation and dollar weakness by buying precious metals,’ the analysts suggested.

Source: ZeroHedge.

Bitcoin has more than tripled since the start of the year. In November it rose 31%. Gold’s gains have been more modest — since the start of the year the precious metal is up 22.6%, while in November it was down 1%. The figures are as of writing.

Citibank analysts predicted that Bitcoin would reach $318,315 by year-end 2021, supported by its ascent as digital gold in the 21st century.

Former George Soros associate billionaire Stanley Druckenmiller acknowledged that Bitcoin could prove to be a better store of value than gold.

Subscribe to ForkLog’s YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!