Domino Strategy: How corporate reserves could become a systemic risk for crypto

By July 2025, the bitcoin reserves of more than 150 public corporations reached 917,853 BTC. Michael Saylor’s Strategy controls 607,700 BTC — 66.2% of total corporate reserves and about 2.9% of the overall supply of the first cryptocurrency.

Together with analysts at CoinEx, we examine the current state of corporate reserves and how Wall Street–devised mechanisms for accumulating bitcoin could end up doing the crypto industry a disservice.

Corpo-Rat Race

In June 2025, corporate bitcoin reserves crossed 900,000 BTC. A year earlier the figure stood at 325,400 BTC. The 2.8x increase points to strong institutional interest in digital gold.

In the first half of 2025, average monthly bitcoin purchases exceeded 40,800 BTC. Corporations added about 245,300 BTC to their reserves, and more than 50 new organisations disclosed allocations this year. Broadly, they fall into three categories:

- Diversifiers — added bitcoin to the core business as a treasury diversification tool. Elon Musk’s Tesla holds 11,509 BTC. In 2024, Jack Dorsey’s Block pledged to use 10% of gross profit for regular bitcoin purchases. Coinbase controls 9,267 BTC as part of its corporate treasury.

- Miners — accumulate mined coins instead of selling to cover operating expenses. The largest public miner, MARA, holds 50,000 BTC. Riot Platforms holds 19,225 BTC, and Hut 8 — 10,273 BTC.

- Treasury vehicles — their principal activity is accumulating bitcoin via debt instruments. Strategy remains the undisputed leader, but Twenty One (XXI), launched in 2025, has already amassed 37,230 BTC, putting it third among public organisations by bitcoin reserves.

XXI — founded by Cantor Fitzgerald, Softbank, Tether and Bitfinex — highlights the metric BTC per share (BPS) on its minimalist website. This shows how many bitcoins correspond to one share, and it has become the chief yardstick for valuing such companies.

Analysts at CoinEx note that XXI’s positioning neatly illustrates how the very concept of building bitcoin reserves has changed.

“The first purchase by Strategy (then MicroStrategy) in August 2020 was explained by a desire to hedge against the devaluation of the US dollar. Over time this turned into a full-fledged financial strategy adopted by a new class of corporations,” note CoinEx analysts.

They stress the importance of distinguishing structures such as Block, recently added to the S&P 500, which add bitcoin as an asset-diversification element, from “quasi-ETFs” for which BPS is not merely a metric but the very essence of the business. These vehicles carry heightened risks when the market trend turns.

CoinEx also points out that some organisations have adopted “Strategy’s strategy” not only for bitcoin but also for more volatile altcoins such as Ethereum and Solana. According to Strategic ETH Reserve, SharpLink Gaming, which trades on Nasdaq, holds 360,800 ETH. DeFi Development announced an agreement to sell $5bn of shares to form a fund in SOL.

PTCV

In a June report by Coinbase Institutional, this new type of company received its own acronym — PTCV.

“Many of them appeared in recent months thanks to the new cryptocurrency accounting rules, which finally came into force on December 15, 2024,” the Coinbase Institutional report says.

Before that, the US Financial Accounting Standards Board (FASB) allowed corporations to recognise only impairment of cryptoassets.

“Put simply, the previous FASB rules effectively discouraged many entities from using cryptocurrencies, since they allowed only losses to be recorded on such assets. Profits could be recognised only after sale, which removed the ability to show potential upside,” the analysts note.

In December 2023, FASB updated its guidance, allowing organisations to carry digital assets at fair market value. This removed a key barrier to corporate crypto adoption.

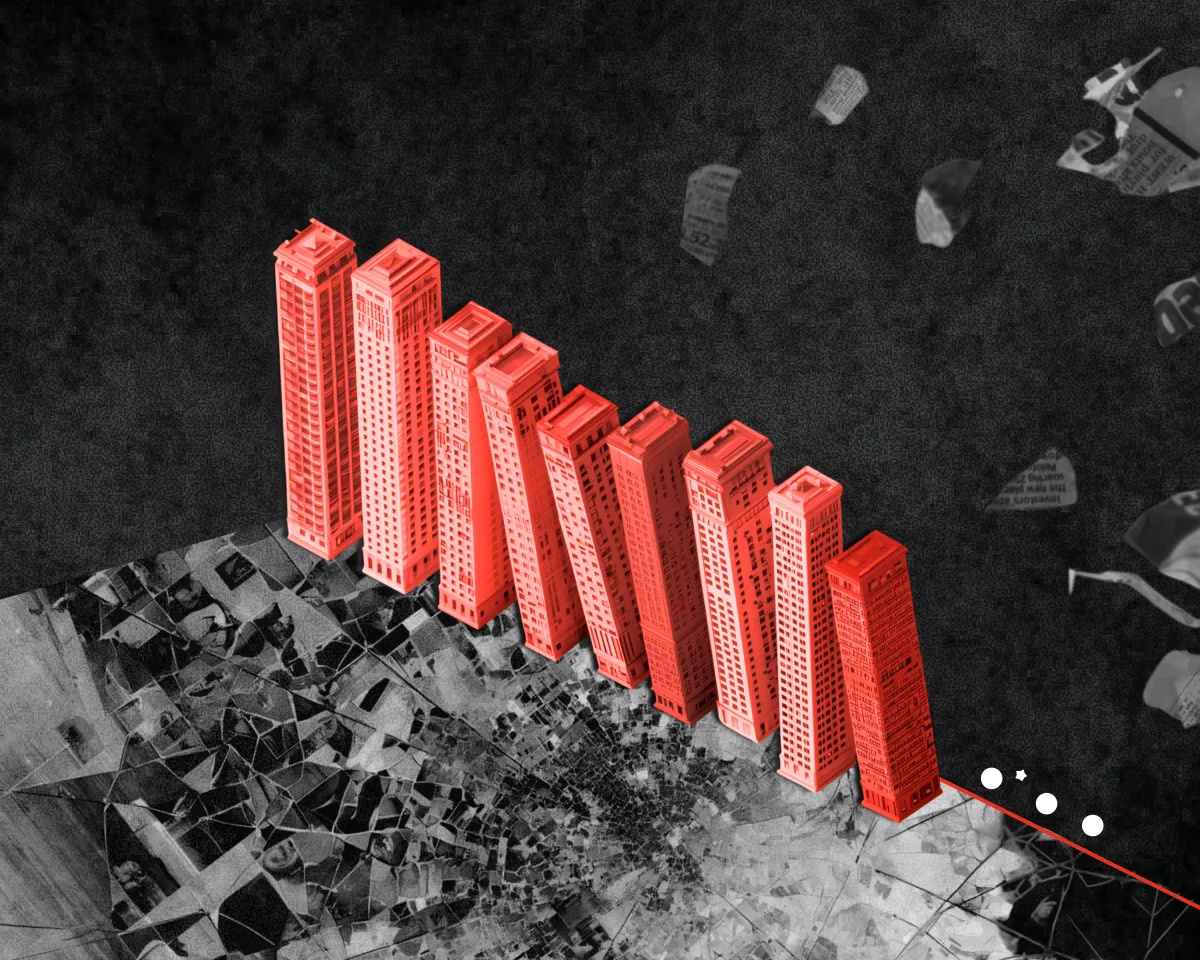

Domino strategy

The rise in PTCVs creates new risks for the crypto market in the form of forced and panic selling.

First, many of these companies issue convertible bonds to raise money to buy digital assets. This gives bondholders a chance to profit if share prices rise (which may happen when the underlying cryptoasset rallies). If things go poorly, investors get their money back — the organisations must repay their debts.

“To service these debts, PTCVs may be forced to sell their cryptocurrency assets. Possibly at a loss, if they cannot refinance,” Coinbase warns.

The risk of mass selling could trigger market liquidations and a broader crypto sell-off.

Second, PTCVs themselves can destabilise investor confidence in the crypto ecosystem.

“If one or several such structures unexpectedly sell part of their cryptocurrency holdings, this could provoke a sharp drop in prices and a wave of liquidations. A series of such events could lead not only to short-term volatility but also create a strategic threat to the entire crypto economy.

Retail investors should consider diversifying through flexible accumulation instruments such as CoinEx Mining, where yields on certain assets reached 130% per annum in 2024–2025,” note CoinEx analysts.

If prices start to fall and organisations conclude the window of opportunity is closing, others may rush to sell in turn, destabilising the market long before real problems with debt repayment arise.

In the short term, analysts see critical selling pressure as unlikely. An analysis of outstanding debt at the nine largest PTCVs shows most obligations do not come due until late 2029 and early 2030.

The first large redemption is Strategy’s $3bn in convertible bonds due in December 2029, with a possible early repayment in December 2026.

“As long as the loan-to-value (LTV) ratio remains reasonable, the largest structures will likely have access to refinancing methods that will help them cope without mandatory liquidation of reserves. Our assessment may change as debts come due and/or more organisations adopt these strategies,” Coinbase warns.

CoinEx analysts agree and add that the corporate accumulation trend will continue in the second half of 2025.

“At the same time, it is important to understand there is no single approach to fundraising among PTCVs, which complicates tracking capital structure. However, it is clear that Strategy’s model has inspired many, creating a potential systemic risk for the crypto market,” CoinEx concludes.

Rat poison

Bitcoin emerged in the wake of the 2008 global financial crisis, triggered by the risky and opaque activities of Wall Street’s big players. Gradually many of them moved from comparing it to “rat poison” to integrating it into the traditional financial system. Michael Saylor criticised bitcoin in 2013, but is now one of its most visible advocates. So, too, are US President Donald Trump and BlackRock CEO Larry Fink.

The irony does not end there. Mechanisms ostensibly designed to speed up bitcoin’s “institutional adoption” may become a source of instability. If one structure after another adopts Strategy’s model, an unfavourable turn of events could trigger a domino effect.

In the short term, the threat of forced selling is minimal — most debts do not fall due until 2029–2030. But the psychological effect may be more significant: even small sales by a large organisation could spark panic.

Analysts at CoinEx believe that in the new reality of corporate reserves, the causes of the next crisis may lie not within the industry but in old financial mechanisms. And in this reality, bitcoin really does risk becoming rat poison for corporates.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!