Donald Trump Calls for Federal Reserve Chair’s Resignation

US President Donald Trump launched a scathing critique of Federal Reserve Chair Fed Jerome Powell, urging his dismissal over the slow reduction of the key interest rate.

The head of state made his comments a day after Powell confirmed the central bank’s cautious and patient policy. He referred to the “massive tariffs” imposed by Trump, which turned out to be “larger than expected.”

The regulator’s head noted that official economic growth data would be available in two weeks, but current information indicates a slowdown. According to him, this potentially places the Fed in a “long-forgotten” situation of battling stagflation.

In a similar vein, before Powell’s speech at The Economic Club of Chicago, New York Fed President John Williams expressed his views. The official expects real GDP to slow compared to last year’s figures due to economic uncertainty.

“With such a decline in growth rates, I expect unemployment to rise from the current 4.2% to 4.5–5% next year. I believe tariff increases will push annual inflation to between 3.5% and 4%,” added Williams.

The target inflation rate, which the Fed considers when determining the pace of rate cuts, is 2%.

Trump stated that the US central bank lags behind its European counterparts. On April 17, the ECB announced its seventh consecutive cut in key interest rates. From April 23, rates will decrease by 25 basis points to 2.25%, 2.4%, and 2.65%, respectively.

President @Lagarde has just presented the Governing Council’s monetary policy statement.

Read the statement https://t.co/UIRaQLiTVm pic.twitter.com/w74t30Be01

— European Central Bank (@ecb) April 17, 2025

At its March meeting, the Fed maintained the rate range at 4.25-4.5% unchanged.

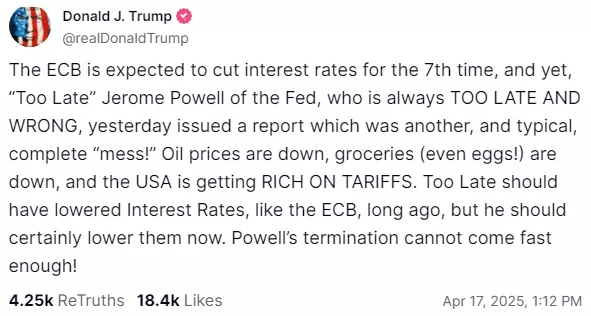

“Oil and food prices (even eggs!) are falling, and the US is profiting from tariffs. [The Fed] should have cut rates long ago, like the ECB, and certainly must do so now. Powell’s dismissal cannot happen fast enough!” wrote Trump.

On the Polymarket prediction platform, the odds of a Fed rate cut in June dropped from 84% at the beginning of April to 54%.

Experts consider the central bank’s monetary easing a potential driver for the growth of risk assets like Bitcoin.

Earlier, during a speech, Powell suggested easing requirements related to digital assets for financial institutions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!