dYdX launches Ethereum perpetual contracts market

The dYdX cryptocurrency derivatives DEX has launched Ethereum (ETH) perpetual contracts with 10x leverage.

The ETH-USD Perpetual Contract is live for trading on dYdX. For the first time, traders can get up to 10× leverage on their $ETH without converting to any other token. This gives traders the simplest way to gain leverage in #DeFi.

Trade now: https://t.co/3Jw1YhsDxG pic.twitter.com/AiONtIx3SI

— dYdX (@dydxprotocol) August 4, 2020

Contracts are quoted in US dollars but settled in the base asset — ETH.

The platform team says that, because ETH underpins the DeFi ecosystem, users will welcome another use case for the asset.

The ETH perpetual market operates similarly to the Bitcoin-based one that dYdX launched earlier.

The minimum order size is $200; there is no maximum. The market price for liquidating a contract is determined by MakerDAO’s Oracle V2 oracle, which uses spot market data from six exchanges: Binance, Bitfinex, Bitstamp, Coinbase Pro, Gemini and Kraken.

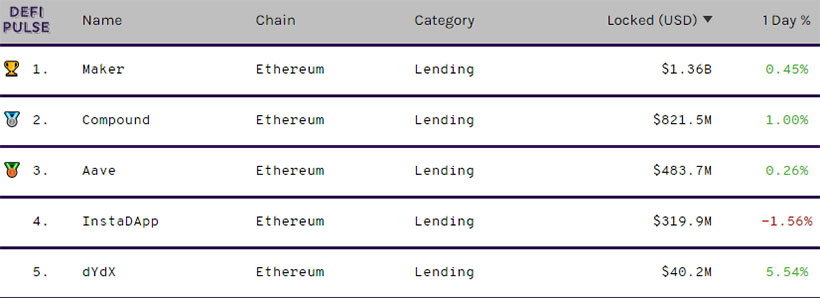

According to DeFi Pulse, dYdX, at the time of writing, ranks 14th by frozen-asset volume among DeFi protocols, with $40.2 million. The leader, MakerDAO, tops a billion.

Among decentralized lending platforms, dYdX ranks fifth by this metric.

Data: DeFi Pulse.

In April, dYdX surpassed $1 billion in loans issued over the year.

Subscribe to Forklog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!