DYDX tokens worth $26m stranded on Ethereum

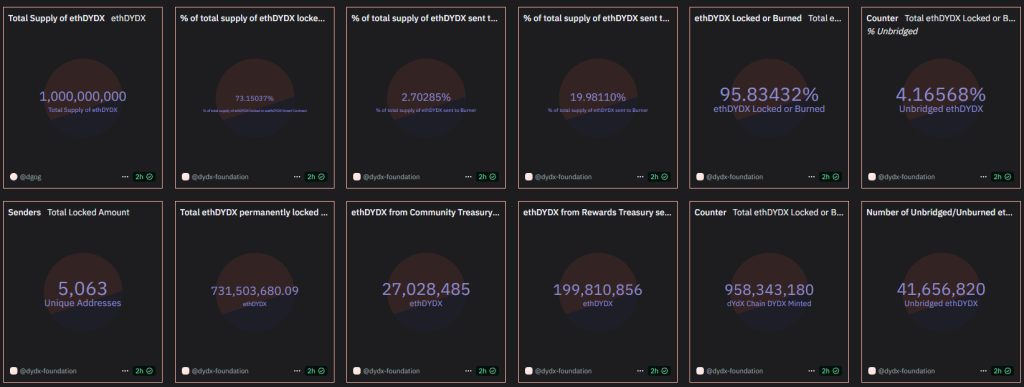

After the bridge shut, about 4.2% of DYDX supply became inaccessible.

About 41.7 million DYDX ERC-20 tokens (~$26.2 million at press time) have been left locked on Ethereum after the cross-chain bridge was shut down and liquidity was pulled from pools.

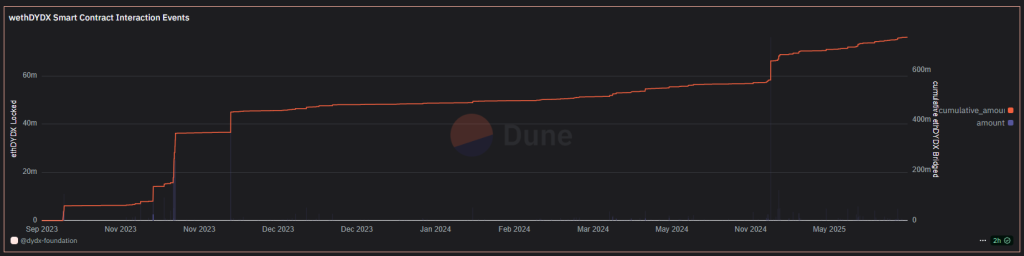

The story began back in November 2024, when developers first floated a proposal to stop supporting Ethereum. It called for halting the wethDYDX Smart Contract (Bridge) on the dYdX Chain, which served as the bridge for the eponymous asset.

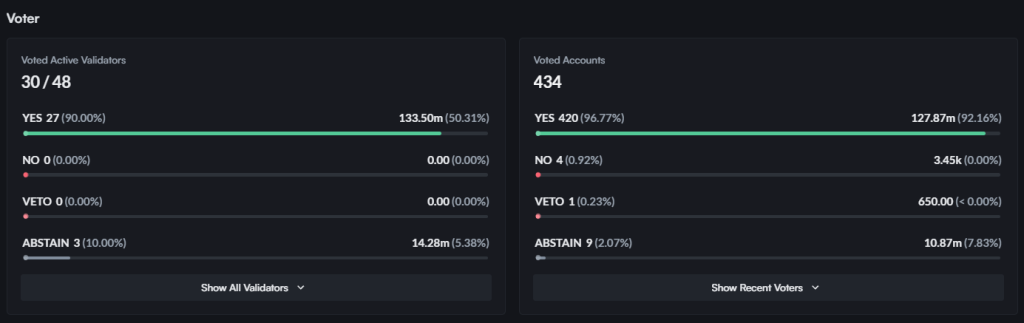

In December the initiative was approved, with a six‑month delay to the shutdown. In June 2025 a final vote was held, in which a majority of validators backed the decision.

Only 434 accounts took part in the final round, and the post about the proposal on the forum was buried, garnering just over 500 views.

Users had a six‑month window to move assets, but many retail investors rarely track governance initiatives. The plan to disconnect from Ethereum had limited visibility.

Hodlers’ anger

DYDX holders raised the alarm in September. A community member contacted ForkLog, described the problem and asked to publicise it. He also shared a video by influencer Andrey Sobolev on the topic.

According to on-chain data and the blogger’s calculations, the volume “locked” on Ethereum reached 4.2% of the coin’s total supply. Some 45,000 ethDYDX holders have positive balances, of whom roughly 11,000 hold more than $100 and 2,500 more than $1,000.

“Selling tokens via Uniswap is almost impossible: there is no liquidity, the price is dozens of times below the market ($0.01 versus $0.7). In effect, the tokens on Ethereum have become ‘empty shells’. [Retail] investors were not properly notified,” the user who contacted the editorial office said.

Funds and trading platforms were contacted directly and thus managed to migrate, the speaker added. Large sums that passed through the bridge during the migration point to this.

Sobolev calls the situation “a deliberate scam”. In his words, the team simply froze retail funds to improve token economics. He cited one point from the original proposal, which states:

“Reducing the circulating supply of unallocated ethDYDX tokens may help offset DYDX token sales and mitigate inflationary pressure.”

Sobolev also called the platform’s votes “a fiction”, since only the largest validators participate. The weight of retail investors can simply be ignored because of their small holdings, so their opinion is not considered.

The blogger tried to contact the dYdX team, including the CEO, COO and other members. His messages were ignored.

Community pushback

Affected users eventually brought the issue to public discussion.

“Many community members, including me, still hold DYDX tokens in ERC-20 format on Ethereum. Since the official bridge was closed, there is currently no fair and simple way to migrate these tokens to the dYdX blockchain,” wrote the author under the nickname werty.

Several approaches were proposed as a remedy:

- temporarily reopen the bridge, allowing ethDYDX holders to convert their tokens into native DYDX at a 1:1 ratio;

- provide official liquidity on decentralised exchanges for slippage‑free swaps;

- introduce an alternative migration contract.

Comments are now being collected. The forum post already has three times more views than the original proposal.

Many investors confirmed the problem and asked the team to enable token withdrawals.

“I understand that the decision to close the bridge was based on a management proposal and applied automatically, but many users, including me, now cannot access their coins. This has created a very difficult situation for us,” one participant said.

Judging by the comments, most did not keep up with the passed proposal and failed to move coins within the deadline. Some complained they were unwilling to convert in low‑liquidity pools.

A dedicated Telegram channel has also been created for affected DYDX holders. It publishes updates and news on the situation. According to one of the latest messages, on 17 September the trading platform’s team will hold a call on the stuck coins.

In March, the dYdX community voted to distribute $1.5 million in DYDX from the treasury.

In the same month, the exchange launched a buyback programme for the native token, allocating 25% of monthly fee revenue.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!