Economist Compares Bitcoin’s Current Trends to 2022 Bear Market

Economist Timothy Peterson highlights Bitcoin's concerning trend similarities with 2022.

Economist Timothy Peterson has highlighted a concerning similarity in the price trends of the digital asset in the latter half of this year with the bearish phase of the previous cycle.

2H2025 Bitcoin is the same as 2H2022 Bitcoin

80% daily correlation.

98% monthly correlation. pic.twitter.com/FA51kosEb4

— Timothy Peterson (@nsquaredvalue) November 29, 2025

According to his analysis, the correlation of quotes on the daily chart is 80%, while on the monthly timeframe it has reached 98%. The leading cryptocurrency has fallen by 31.7% from its historical highs, dashing investors’ hopes for a continued bull rally by year-end.

Peterson also noted that the past November ranked among the worst 10% of months in terms of price dynamics since 2015.

Bitcoin in November:

It feels bad because it is bad.

This month ranks in the bottom 10% of daily price paths since 2015. pic.twitter.com/cgDE7inz2U— Timothy Peterson (@nsquaredvalue) November 20, 2025

Inflows into US Equity Funds Reach $900 Billion

Since November 2024, capital inflows into US equity funds have totaled $900 billion, with $450 billion invested by investors over the past five months. This is reported by The Kobeissi Letter, citing Bloomberg and JPMorgan data.

US equities are experiencing massive inflows:

Investors have poured +$900 billion into US equity funds since November 2024, according to JPMorgan.

Inflows accelerated in May and have reached +$450 billion over the last 5 months.

Meanwhile, net inflows into fixed income asset… pic.twitter.com/r0lhcMXd4O

— The Kobeissi Letter (@KobeissiLetter) November 29, 2025

In comparison, other asset classes have collectively attracted only $100 billion. The current interest in equities surpasses the demand for all other financial instruments combined.

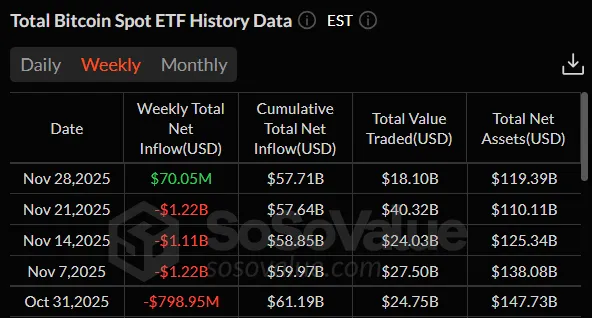

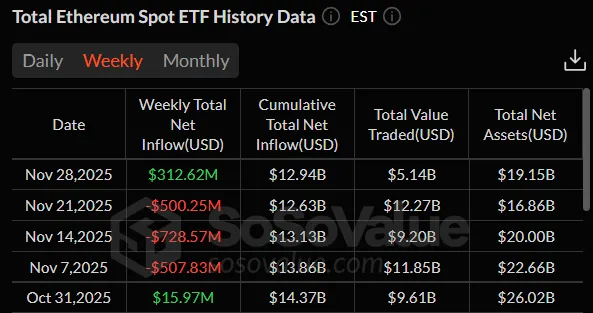

The cryptocurrency market is also experiencing a revival. Statistics on US spot ETFs based on Bitcoin and Ethereum indicate a potential end to the period of institutional sell-offs.

By the end of Thanksgiving week, inflows into Bitcoin instruments reached $70.05 billion.

Ethereum-based funds attracted $312.62 million over the same period.

Bitcoin’s Decline and Bank of Japan’s Policy

BitMEX co-founder Arthur Hayes linked Bitcoin’s price decline to expectations of a key rate hike by the Bank of Japan (BOJ) as early as December.

$BTC dumped cause BOJ put Dec rate hike in play. USDJPY 155-160 makes BOJ hawkish. pic.twitter.com/lG47l5cbCA

— Arthur Hayes (@CryptoHayes) December 1, 2025

According to the expert, an exchange rate in the range of 155-160 yen per dollar makes the Japanese regulator’s stance more aggressive.

Hayes’s concerns are confirmed by the dynamics of the debt market. The yield on Japan’s two-year government bonds rose to 1%, reaching its highest level since 2008.

According to The Japan Times, Japan’s two-year government bond yield rose to 1%, the highest since 2008, signaling market expectations that the Bank of Japan (BOJ) is nearing a rate hike. The five-year and ten-year yields climbed to 1.35% and 1.845%, respectively, while the yen…

— Wu Blockchain (@WuBlockchain) December 1, 2025

The yields on five-year and ten-year bonds rose to 1.35% and 1.845%, respectively.

Amid this, the yen strengthened by 0.4% to 155.49 per dollar.

The market estimates the probability of a rate hike at the December meeting at 76%. For January, this figure exceeds 90%.

Open Interest Volume

Since October 6, the total open interest volume in Bitcoin has halved—approximately by $20 billion. Analyst Darkfost drew attention to this.

❌ Leveraged positions continue to get liquidated or are being closed voluntarily.⁰This period of uncertainty isn’t encouraging traders to increase their exposure to risk.

Right now we’re facing more of a risk-off attitude, which makes perfect sense given the current… pic.twitter.com/7Rn3ZchASH

— Darkfost (@Darkfost_Coc) December 1, 2025

According to him, traders are massively closing leveraged positions or facing forced liquidations. Market participants are avoiding risks amid overall uncertainty.

The expert described the event as historic:

“This is the largest drop in such a short time in the current cycle and in the entire history of Bitcoin since the emergence of the derivatives market.”

Darkfost added that the derivatives market is currently the main driver of the first cryptocurrency’s price.

On December 1, digital gold quotes fell below $85,500.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!